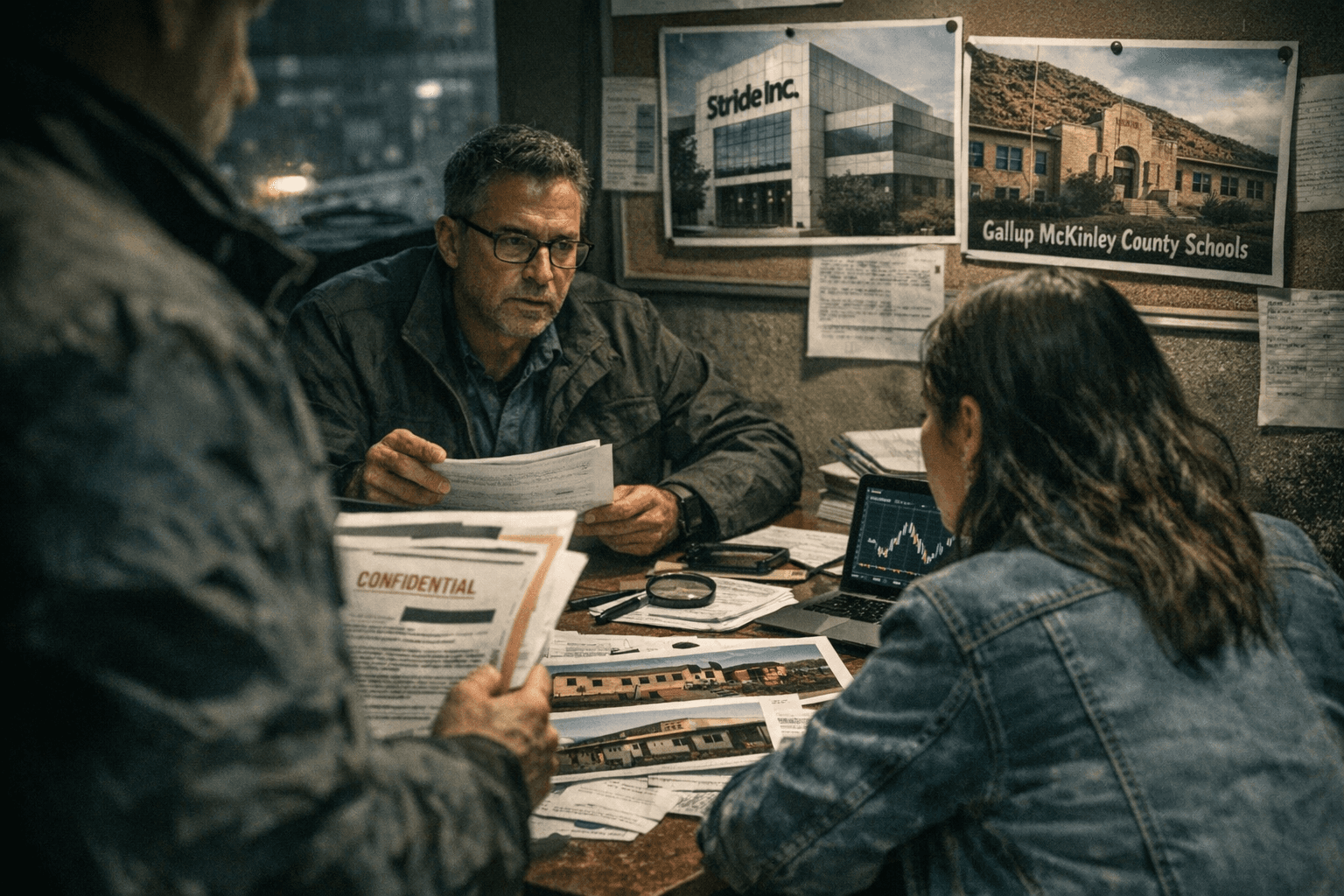

Investigation Links Stride Inc, Gallup McKinley School Allegations to Securities Claims

On December 19, 2025 plaintiff side law firm Johnson Fistel announced an investigation into Stride Inc, ticker NYSE LRN, over possible securities law violations tied to reports and litigation referencing Gallup McKinley County Schools. The inquiry highlights local allegations that have already affected markets and signals potential legal and financial fallout for investors and the county school system.

Plaintiff side firm Johnson Fistel said on December 19 that it was investigating Stride Inc for possible securities law violations related to litigation and reporting that directly reference Gallup McKinley County Schools. The notice focuses on a 2025 complaint filed by Gallup McKinley County Schools, which alleged deceptive practices including retaining "ghost students" and broader compliance failures. The firm urged shareholders who purchased Stride stock during the class period to contact it and outlined the nature of potential claims as "misrepresentations to investors, failure to disclose material facts."

The announcement follows earlier market moves and regulatory attention tied to the GMCS complaint, which the law firm said had previously caused market reactions and prompted scrutiny of Stride disclosures. Investors were reminded that law firm investigations often precede formal litigation or settlement negotiations and that there may be filing deadlines and procedural steps for affected shareholders. Johnson Fistel described the scope of its review as examining whether public statements and filings by Stride accurately reflected material facts tied to the GMCS matter and investor risk.

For Gallup McKinley County Schools the legal dispute arrived at the center of a national debate over oversight, record keeping, and the contracting relationships between public districts and education technology providers. Local residents may see indirect effects if litigation reshapes Stride operations or contract negotiations with school districts. Changes in a public companys stock price can influence investment, philanthropic commitments, and vendor stability, particularly in smaller regional markets that rely on continuity in education services.

Economically, the case underscores broader trends in the education technology sector and securities litigation. Investors are increasingly focused on transparency around public school contracts, enrollment reporting, and compliance. For McKinley County the key questions now are how the allegations affect ongoing services and what steps local officials will take to ensure students and funding are protected while legal and market processes proceed.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip