Jail Costs Drive Slight Tax Increase in Coryell County Budget

County Judge Roger Miller said rising jail operations costs are now adding roughly an additional penny to the county tax rate compared with a few years ago, as officials propose increasing the jail budget from about $5.9 million in FY 2025 to $5.95 million for FY 2026. An expanded local facility has not eliminated out‑of‑county housing, and leaders warn that higher medical and food costs are putting new pressure on county finances while public safety remains the primary concern.

Coryell County leaders are proposing a modest increase in jail spending for the coming fiscal year amid continuing capacity and cost pressures that are beginning to show up on the local tax rate. County Judge Roger Miller said jail operations now account for roughly an additional penny on the tax rate compared with a few years ago as the budget for detention services moves from roughly $5.9 million in FY 2025 to about $5.95 million for FY 2026.

The budget shift arrives even after the county expanded its detention facility. County officials said that despite the additional capacity, Coryell County continues to place some inmates in out‑of‑county facilities. Local leaders attributed the need to house inmates outside the county in part to ongoing operational demands and rising costs for inmate medical care and food service, which have squeezed the detention budget.

Public safety officials and county leaders emphasized that maintaining public safety remains the top priority, and the proposed adjustment reflects an effort to keep jail operations functioning without reducing essential services. The proposed $50,000 increase is small in absolute terms but symbolic of broader fiscal pressures: everyday increases in medical and food costs for the incarcerated population are recurrent budget drivers that can ripple into county finances and tax assessments.

For Coryell County residents, the news means a small but tangible tax implication. Judge Miller characterized the impact as roughly an additional penny on the tax rate compared with previous years, a change that can affect household budgets and property tax bills. Local officials will need to balance the growing costs of detention operations with other county priorities and services when finalizing the budget.

Leaders also face the practical and fiscal consequences of continuing to use out‑of‑county housing even after investing in local capacity. Transporting and contracting with other jurisdictions can add administrative and logistical costs and complicate care continuity for detainees. County officials framed the proposed increase as a pragmatic step to ensure stability in operations while they monitor costs and capacity.

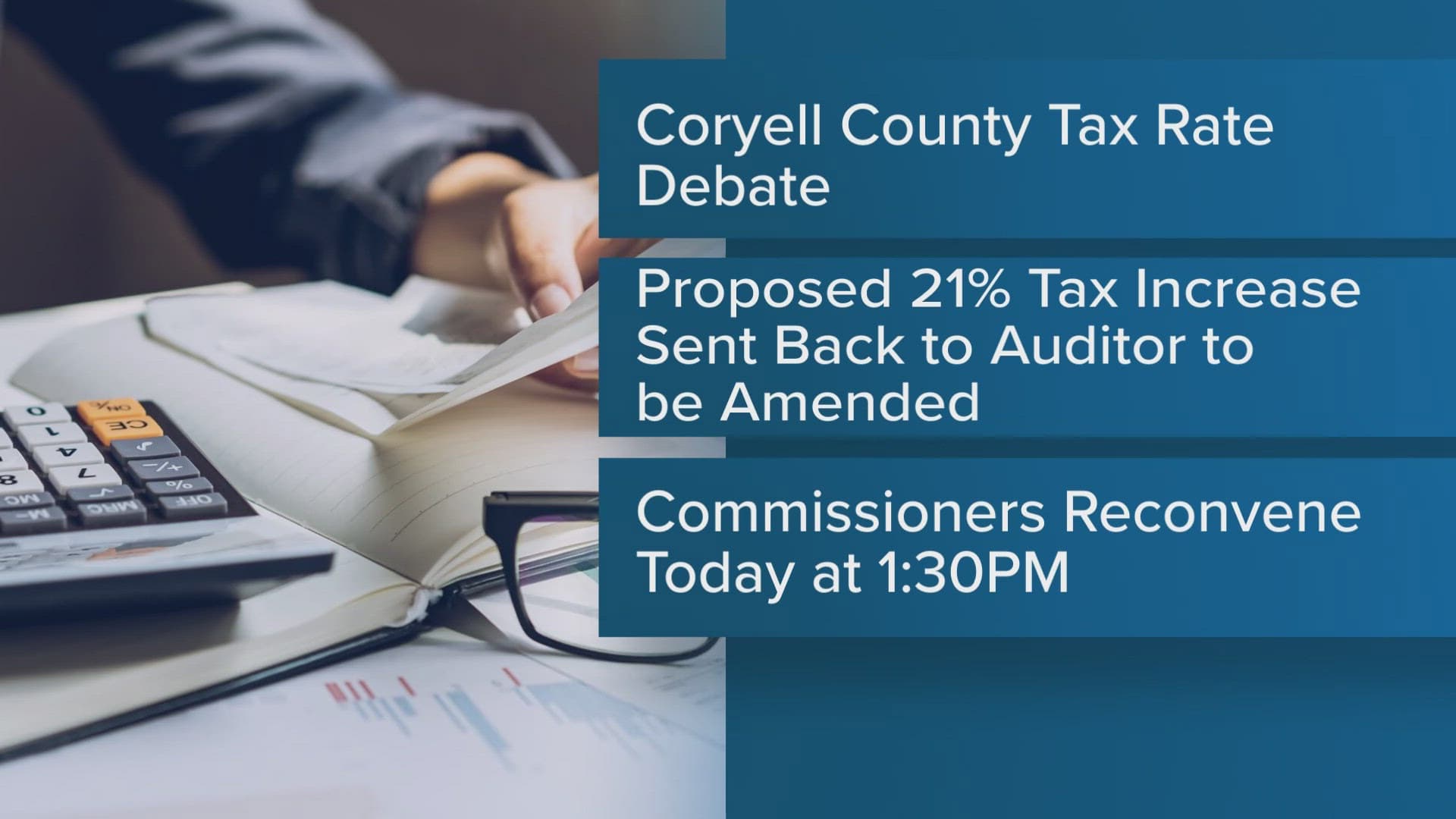

The proposed FY 2026 figures will be considered alongside other county budget items in upcoming hearings. Residents concerned about tax impacts and county spending will have opportunities to review the budget proposals and engage with commissioners as final decisions are made. The modest increase underscores the ongoing challenge for local governments to fund public safety in an environment of rising basic operational costs.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip