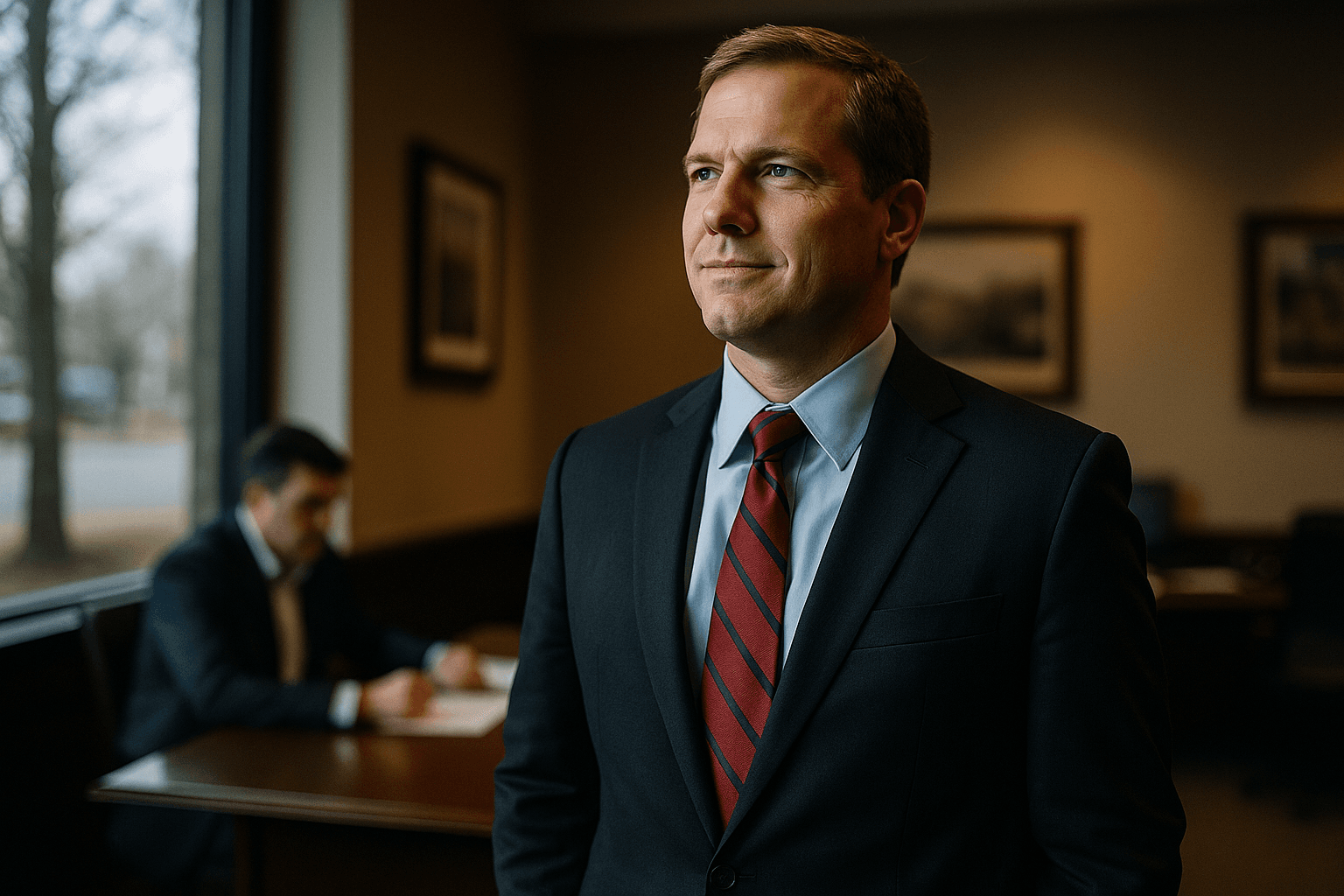

Local Banker Promoted, FNB Oxford Strengthens Commercial Lending Team

FNB Oxford promoted Oxford resident Luke Harris on December 12, 2025 to Senior Vice President, Senior Development Officer and Senior Lender, elevating a lender with 18 years of experience. The move centralizes commercial lending leadership in Lafayette County, potentially speeding decisions for local businesses and shaping credit management for the community.

FNB Oxford elevated Luke Harris to a senior lending role on December 12, 2025, naming him Senior Vice President, Senior Development Officer and Senior Lender. Harris brings 18 years of banking and lending experience to the role and will work closely with Michael Ferris, Senior Vice President and Chief Lending Officer, to lead Oxford market sales efforts and manage the bank's commercial loan portfolio.

Harris's background includes formal commercial lending training at the Southeastern School of Commercial Lending and the Graduate School of Banking at LSU. He is also an active member of First Presbyterian Church of Oxford and a graduate of Leadership Lafayette, linking his professional role to longstanding community ties. Those credentials position him to take on both relationship development and portfolio oversight responsibilities at a time when local businesses are weighing borrowing options for expansion, property acquisition and working capital needs.

For Lafayette County businesses the promotion matters because it concentrates local lending authority and client outreach in a lender with deep regional experience and community connections. A single senior lender responsible for market sales and portfolio management can shorten approval timelines for straightforward transactions, and can also serve as a clearer point of contact for small and medium sized firms seeking credit. The partnership with the chief lending officer suggests the bank intends to align Oxford market strategy with broader credit policy and risk management.

From a market perspective this appointment reflects wider banking sector priorities around experienced commercial lenders who combine technical training with local networks. For policymakers and local economic development officials, a predictable lending relationship at a community bank can support recruitment of new businesses and stabilization of existing employers. Over the longer term, maintaining seasoned lenders in Lafayette County supports continuity in underwriting standards and local knowledge that national institutions sometimes lack.

In the near term customers and business leaders can expect Harris to be a central figure in FNB Oxford's commercial outreach and loan decisions. His mix of formal training and community engagement will guide how the bank balances credit growth with portfolio quality in the Oxford market.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip