Maryland ACA Open Enrollment Ends Jan. 15 as Premiums Rise 13.4 Percent

Maryland's Affordable Care Act open enrollment runs through Jan. 15, with coverage for plans selected between Jan. 1 and Jan. 15 effective Feb. 1. Insurers are implementing average premium increases of about 13.4 percent for 2026 after federal premium tax credits expired, raising affordability concerns for Baltimore City families.

Marylanders have until Jan. 15 to sign up for 2026 coverage through the Affordable Care Act marketplace, and residents who enroll between Jan. 1 and Jan. 15 will have their coverage take effect on Feb. 1. Plans selected before Jan. 1 began on Jan. 1. Roughly 500,000 people in Maryland get health insurance through the marketplace, making this enrollment window critical for many households.

Insurers offering plans in the state's marketplace include CareFirst, UnitedHealthcare, Kaiser Permanente and Wellpoint/Anthem. For 2026, carriers are moving forward with premium increases averaging about 13.4 percent. State and market analysts attribute much of the increase to the expiration of federal premium tax credits in a recent budget measure, which reduced subsidies for many consumers and prompted carriers to raise rates to cover higher expected claims.

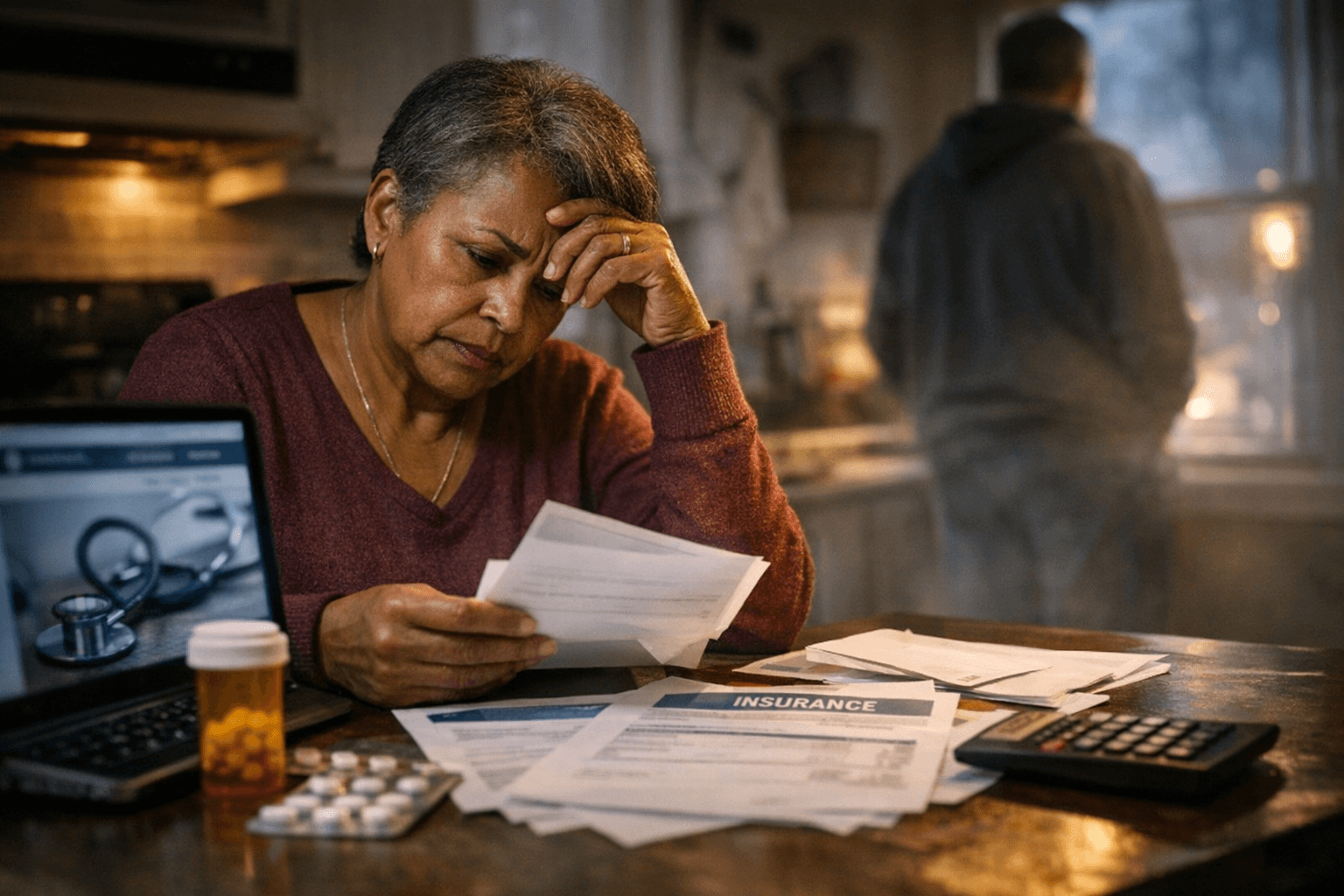

For Baltimore City residents, those shifts translate into difficult choices for families already juggling housing, food and transportation costs. Higher premiums and reduced subsidies increase the risk that people with chronic conditions, children and older adults delay care or skip needed medications. Local clinics, community health centers and emergency departments are likely to see the effects if more people go without coverage or choose plans with limited networks and higher out-of-pocket costs.

Enrollment remains available through the Maryland Health Connection website or by calling assistance lines, and people who need help selecting plans or finding subsidies are urged to act before Jan. 15 to secure February coverage. Community-based navigators and certified application counselors can help residents compare plan premiums, deductibles and provider networks and assess eligibility for any remaining financial help.

The policy shift in federal premium tax credits underscores larger equity issues: reductions in subsidies fall most heavily on low- and middle-income households and on communities already facing health disparities. Public health experts warn that increased uninsurance or underinsurance can worsen chronic disease outcomes and increase strain on safety-net providers.

Local policymakers and health advocates are watching closely as this enrollment period unfolds. For residents, the immediate priorities are clear: check eligibility, compare plans, and enroll before the deadline to avoid gaps in coverage. For the city and state, the coming months will test how health systems, community organizations and policymakers respond to rising costs and the needs of those most vulnerable to losing affordable care.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip