Moody’s Warns Drug Price Reforms Could Cripple Big PBM Finances

Moody’s Investors Service warned that pharmacy benefit managers face elevated credit risk if proposed drug pricing reforms and transparency measures advance, a development that could reshape negotiations across the pharmaceutical supply chain. Investors and policymakers should watch for narrower formularies and altered rebate dynamics, because those operational responses would directly affect PBM revenue models and corporate balance sheets.

Moody’s Investors Service issued a caution on December 13 that pharmacy benefit managers face heightened credit risk if a wave of legislative, regulatory and reimbursement changes aimed at lowering drug prices moves forward. In a statement cited by Moody’s analysts, Diana Lee, a Moody’s senior credit officer, said, “If any legislative and reimbursement proposals aimed at reining in drug prices take hold, we believe they would erode the value of the pharmacy benefit manager model.” The agency flagged transparency measures and broader political backlash over drug costs as the primary triggers for that deterioration.

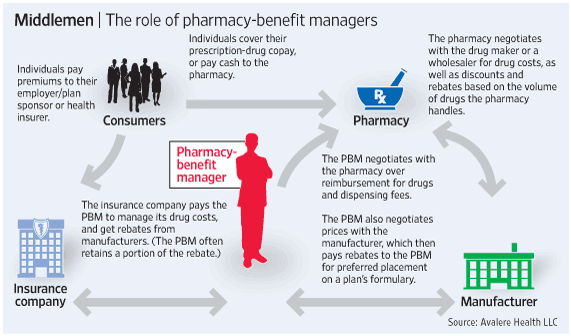

Moody’s explanation centers on how PBMs generate value today and how proposed changes could undercut those levers. The agency expects PBMs to respond to pricing pressure by excluding more products from the formularies they manage, a tactic that can deliver lower short term costs for client plans but that also shifts the way PBMs realize savings and manage utilization. That operational shift would likely affect contract terms, rebate flows and fee arrangements that underpin much of PBM revenue, the analysts said.

Moody’s singled out the largest, integrated PBMs as most exposed. The firms identified include CVS Health, referenced in source material as CVS Caremark, Express Scripts, noted in some accounts as Express Scripts Visit, and UnitedHealth Group. The agency emphasized that scale and integration make these firms particularly sensitive to changes that would reduce margins or rework manufacturer relationships.

The warning carries immediate implications for fixed income markets and corporate finance teams. Moody’s characterization of “elevated credit risk” signals that bond investors, rating analysts and issuers should revisit leverage assumptions, covenant headroom and liquidity plans should reforms become law. Rating agencies typically respond to sustained erosion in fundamental economics with negative outlooks or downgrades, and Moody’s advisory frames such moves as contingent on policy outcomes and PBM operational responses.

Beyond credit metrics, the shift toward narrower formularies would reshape market strategy across the supply chain. For manufacturers, reduced formulary access could translate into steeper price concessions or altered launch strategies. For payers and employers, formulary exclusions may lower premiums or outlays but raise questions about access and clinical choice. The interplay between transparency rules, rebate reforms and reimbursement changes will determine whether cost savings accrue to plan sponsors, patients or intermediaries.

Moody’s statement does not name specific bills or quantify potential rating actions, and the agency acknowledged that the magnitude of any credit impact would depend on the final policy design and industry responses. Nevertheless, the warning underscores a longer term trend: rising political and regulatory scrutiny of drug pricing is forcing a reappraisal of intermediary models that evolved under opaque rebate and contracting systems. For investors and policymakers, the immediate task is not predicting a single outcome, but stress testing PBM finances across a range of plausible reforms and monitoring early operational moves such as formulary tightening that would reveal how firms are adapting.

Know something we missed? Have a correction or additional information?

Submit a Tip