Morgan Stanley Says U.S. Stocks Will Lead Global Markets in 2026

Morgan Stanley told investors it expects U.S. equities to outperform global peers next year, driven by accelerating artificial intelligence related capital expenditures and a supportive policy backdrop. The bank raised targets for European equities and the S&P 500, and favored global equities over credit and government bonds, a stance with clear implications for portfolio flows and bond yields.

Morgan Stanley on Monday laid out a bullish tilt toward U.S. equities for 2026, saying American markets are likely to outperform as companies step up investment in artificial intelligence related projects and macro policy settings become more favorable. The Wall Street brokerage published a series of global economic and strategic outlook notes that also flagged preference for global equities over credit and government bonds.

"Risk assets are primed for a strong 2026, powered by micro fundamentals, accelerating AI capex, and a favorable policy backdrop," Morgan Stanley said in the notes. The firm said it expects "moderate" global economic growth and disinflation next year, while warning that uncertainty remains elevated and the range of outcomes is wide. "The U.S. is the swing factor," the bank added, underscoring the centrality of American activity to global market direction.

The bank raised its 2026 year end target for the MSCI Europe local currency index to 2,430 from 2,250, indicating expectations that European equities will be drawn into any broader U.S. led recovery despite persistent domestic fiscal challenges and intensifying competition from China. "We expect EU equities to be pulled into the slipstream of a broadening U.S. recovery in 2026, despite continued domestic fiscal challenges and structurally rising China competition," Morgan Stanley said.

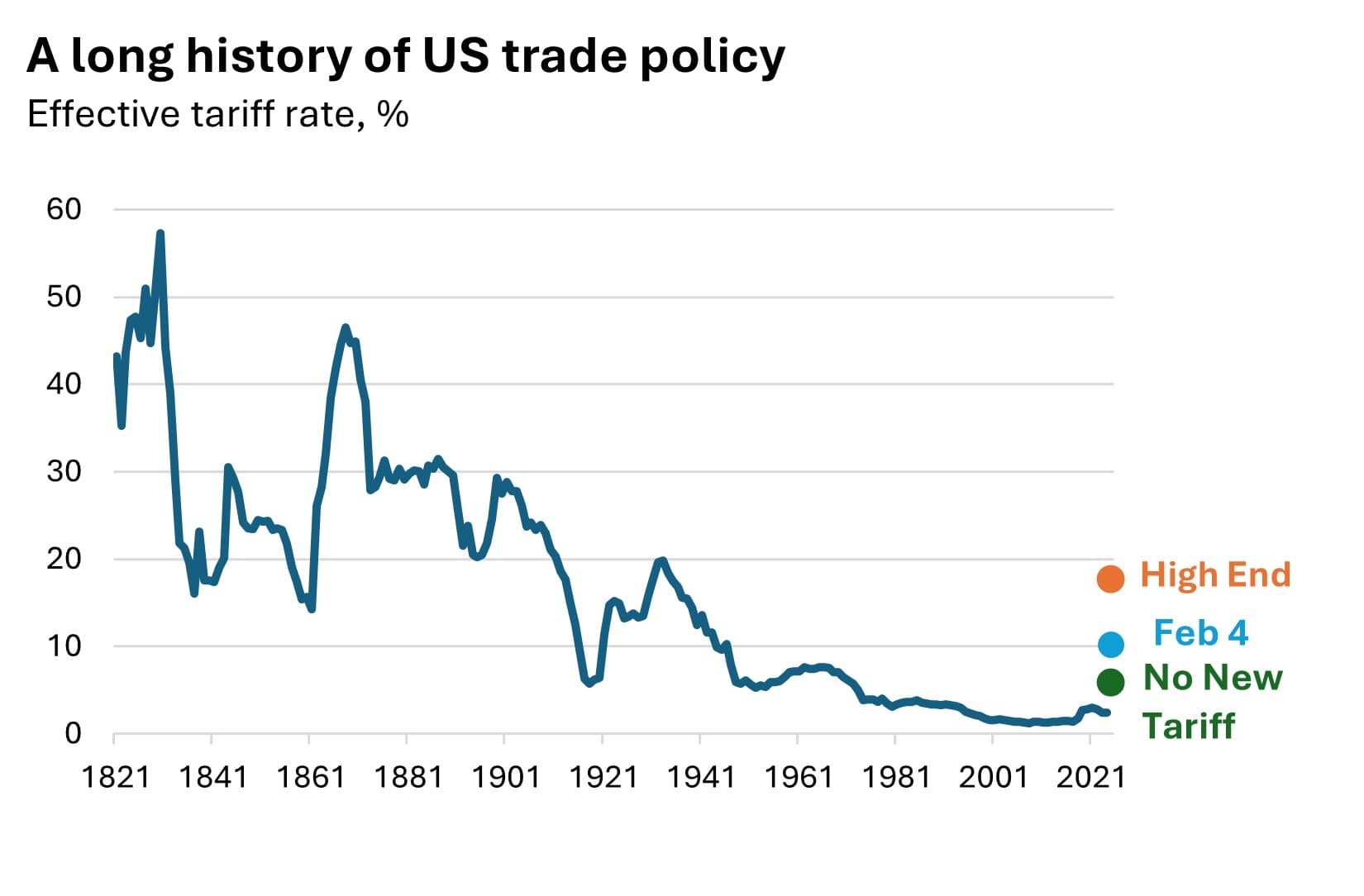

The outlook arrives after a volatile 2025 for global markets, driven in part by episodic tariff rhetoric from U.S. President Donald Trump. Morgan Stanley noted that most of the trade uncertainty had dissipated heading into 2026, creating conditions more conducive to corporate investment decisions and cross border equity flows.

For investors, the bank's stance suggests a reweighting toward equity exposures, particularly in sectors positioned to benefit from AI spending. Technology and software companies that provide AI infrastructure and services are logical beneficiaries, potentially reinforcing a concentration of returns in U.S. markets where such firms are most heavily represented. The preference for equities over credit and government bonds implies an expectation of limited returns from fixed income as equities capture risk premia tied to earnings upgrades and capital investment.

Policy implications are material. A favorable policy backdrop can mean a range of supportive elements, from tolerable central bank stances to fiscal initiatives that amplify corporate cash flows available for capex. Morgan Stanley’s view places a premium on U.S. policy and corporate behavior as determinants of global growth and market leadership.

The bank’s caution about a wide range of outcomes remains a reminder of downside risks. Geopolitical shocks, renewed trade frictions, or a sharper slowdown in China could still dent sentiment and corporate investment. Nonetheless, Morgan Stanley’s baseline paints 2026 as a year when microeconomic forces and strategic capital spending, especially on AI, could tilt the balance toward risk assets and toward U.S. markets in particular.

Investors and policymakers will be watching upcoming data on capex, corporate earnings, and inflation closely to test whether the expected reacceleration in AI related investment translates into the broader growth and equity gains Morgan Stanley envisages.