EU Lowers 2026 Growth Forecast, Cites Higher Than Forecast U.S. Tariffs

The European Commission says the eurozone economy has outperformed expectations so far this year, prompting an upgrade to this year’s growth outlook to 1.3 percent. The commission warns that higher than forecast U.S. tariffs will shave growth next year and leaves its 2026 forecast marginally lower at 1.2 percent, a development that complicates policy choices in Brussels and Frankfurt.

The European Commission says eurozone growth has been stronger than expected through the first three quarters of 2025, powered by rising private consumption and renewed investment. In its twice yearly economic outlook published on November 17, the commission raised its forecast for growth this year to 1.3 percent, while nudging down its projection for 2026 to 1.2 percent, citing trade policy developments and a challenging global environment.

Commission economists pointed to resilient domestic demand as the main driver of the unexpected momentum, with household spending sustaining activity even as external headwinds have grown. Investment, particularly in equipment and business services, has contributed to a broadening of that momentum across member states. The report does not provide new quarterly breakdowns beyond noting that output in the first three quarters exceeded earlier projections.

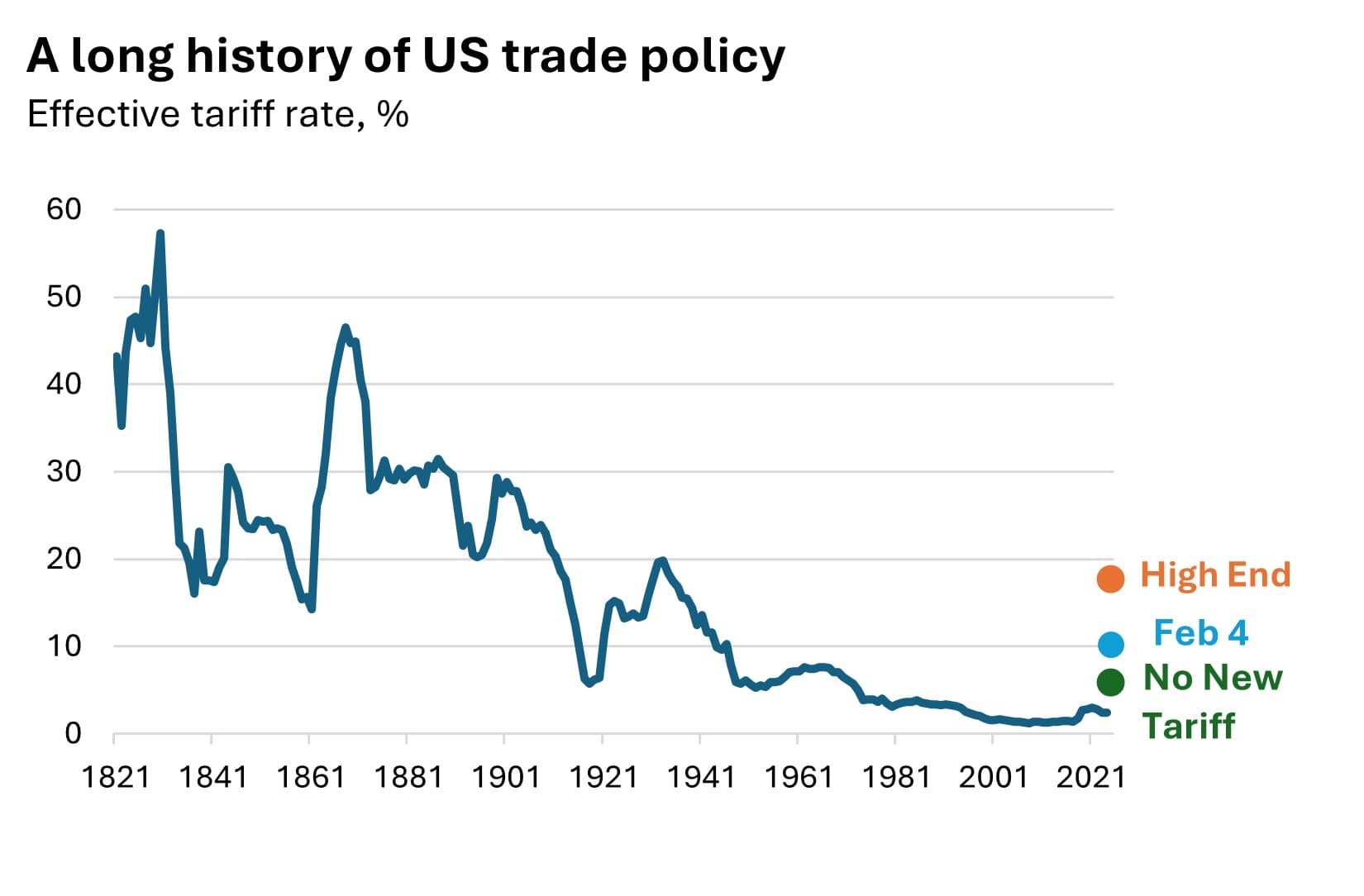

The revision for 2026 reflects a new and specific external shock. Tighter than anticipated tariffs imposed by the United States are expected to reduce eurozone exports, raise costs for firms that rely on U.S. intermediate inputs, and increase uncertainty for cross border investment decisions. The commission frames these tariff moves as a material downside risk, and says they are likely to weigh on growth next year through trade channels and slower global demand.

The downgrade is marginal in numerical terms, but it carries outsized policy significance. A drop from 1.3 percent to 1.2 percent is small in isolation, yet it arrives at a sensitive juncture for European policymakers who are balancing a still elevated inflation backdrop against signs of cooling activity. The commission emphasizes that risks are tilted to the downside, a warning that limits room for complacency among finance ministers who must set budgets for 2026 and for the European Central Bank as it assesses its interest rate path.

Market implications are immediate and multifaceted. Slower foreign demand and higher input costs could depress corporate profit growth, prompt downward revisions to earnings forecasts, and increase volatility in equity markets. Currency markets may respond to a dimmer external outlook for the bloc, adding pressure on the euro. Bond markets will watch for any shift in inflation expectations and for signals from the ECB that it might re calibrate policy if growth weakens more than anticipated.

Looking further ahead, the episode underscores a broader trend toward greater policy uncertainty in international trade and the enduring vulnerability of open economies to exogenous shocks. For the eurozone, the commission’s prognosis strengthens the case for targeted fiscal buffers that can be deployed to support investment in productivity enhancing projects, while central banks weigh how to navigate between taming inflation and sustaining the recovery. The commission’s cautious tone signals that the near term outlook will remain contingent on developments beyond Europe’s borders.