Jumbo Mortgage Rates Jump, 30 Year Loans Rise To 6.74 Percent

Jumbo mortgage rates spiked sharply today, pushing the average 30 year jumbo rate to 6.74 percent and raising borrowing costs for high balance home buyers. The move intensifies affordability pressure in expensive markets, while 15 year fixed rates remain near 5.45 percent with an APR edging higher.

Lenders raised the average interest rate on 30 year fixed rate jumbo mortgages by 0.81 percentage point this week, bringing the rate to 6.74 percent on November 17, 2025. The climb affects loans that exceed the 2025 conforming limit of $806,500 in most areas, increasing monthly carrying costs for buyers of higher priced homes and shrinking the pool of cost effective refinancing options.

A borrower facing today’s 6.74 percent rate on a 30 year jumbo mortgage would pay roughly $648 per month in principal and interest for each $100,000 borrowed, and the data set provided indicates total interest of $133,567 per $100,000 over the life of the loan. The combination of higher rates and large principal balances means prospective buyers in high cost metros will see materially higher monthly payments compared with earlier this year when rates were substantially lower.

By contrast, the 15 year fixed rate remains listed at 5.45 percent with an annual percentage rate of 5.5 percent. The published monthly payment on a 15 year loan at that rate is about $815 per $100,000 borrowed, and total interest over the life of such a loan is shown as approximately $47,085. The APR for the 15 year product ticked up from 5.49 percent a week earlier. One set of rate notes indicates the 15 year figure rose 0.09 percentage point from the prior week, while another line reports it unchanged at 5.45 percent, underscoring some short term variation across data sources.

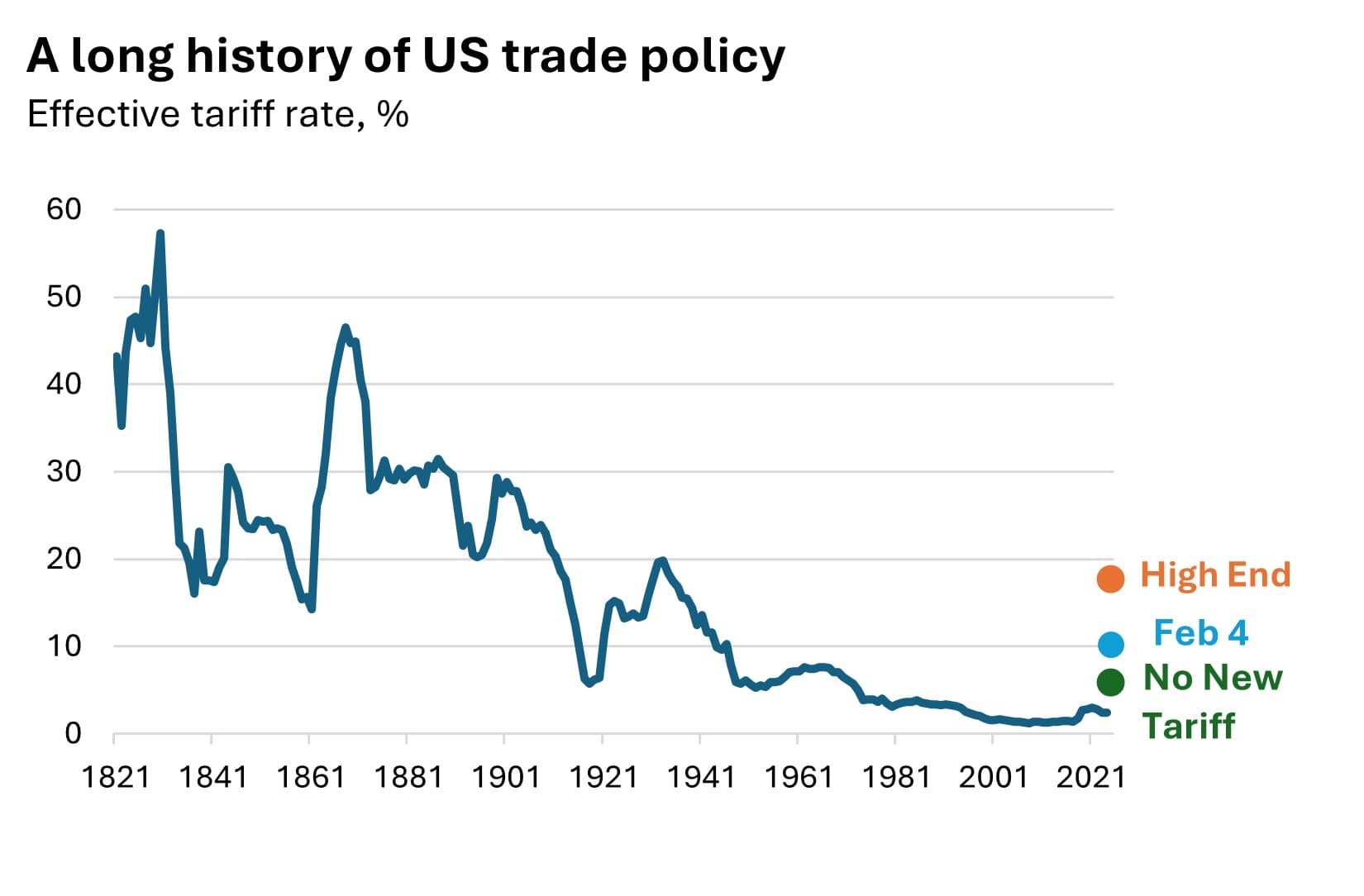

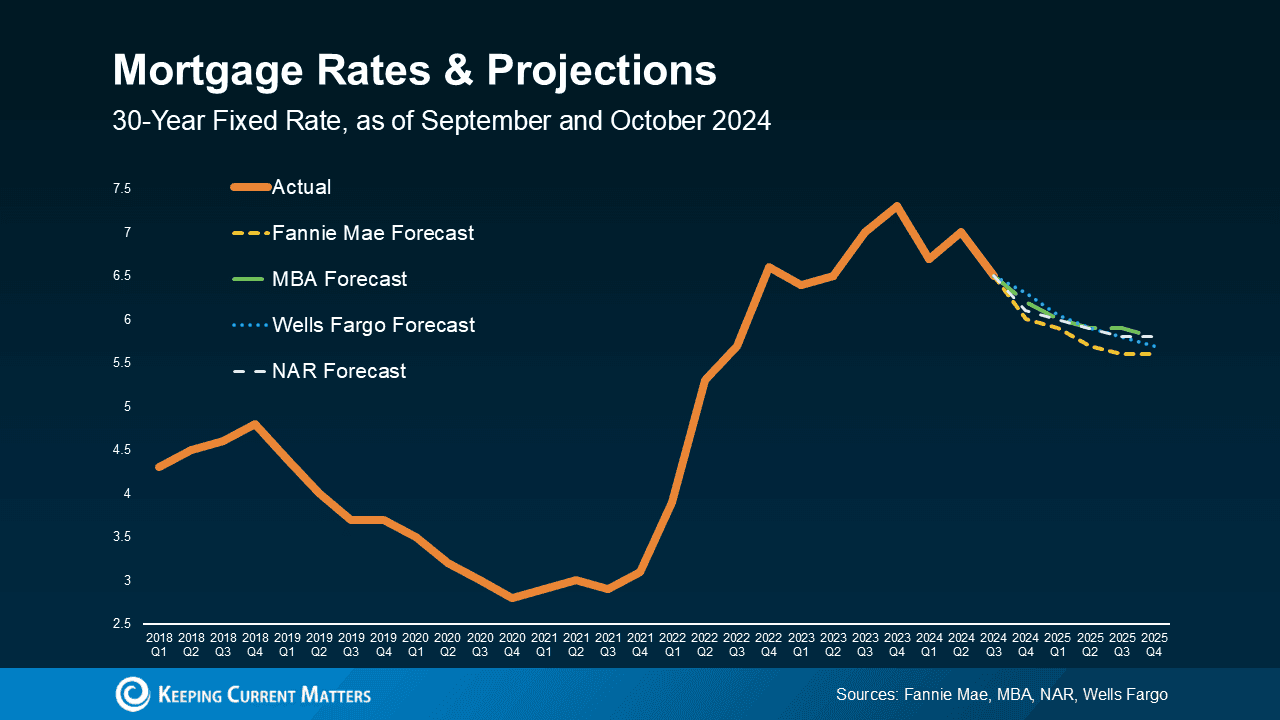

The immediate market implication is a widening affordability gap for buyers at the upper end of the market, where jumbo loans dominate. Mortgage rate moves are typically driven by longer term Treasury yields, investor demand for mortgage backed securities, and expectations about Federal Reserve policy and inflation. Higher benchmark yields over recent months have pressured mortgage pricing, lifting rates off the pandemic era lows and restoring borrowing costs to a more historically normal range.

For consumers the practical steps to shore up access to lower mortgage costs remain conventional and clear. Lenders favor borrowers with strong credit profiles, with good to excellent credit defined as scores between 670 and 850. Debt to income ratios below 43 percent continue to be a common underwriting threshold, indicating a borrower is less likely to be stretched by the monthly payment. Those who can shorten loan terms, increase down payments, or shop across multiple lenders may still secure comparatively better pricing.

Over the longer term the rise in jumbo rates highlights a structural reality in the housing market. Even as national home price growth has slowed in many regions, high end markets remain sensitive to changes in borrowing costs, and persistent elevation in rates can constrain demand at the top of the market. Policymakers and market participants will be watching incoming inflation readings and Federal Reserve guidance for signs of whether the recent uptick in longer term yields will prove transitory or the start of a more sustained reset in mortgage pricing.