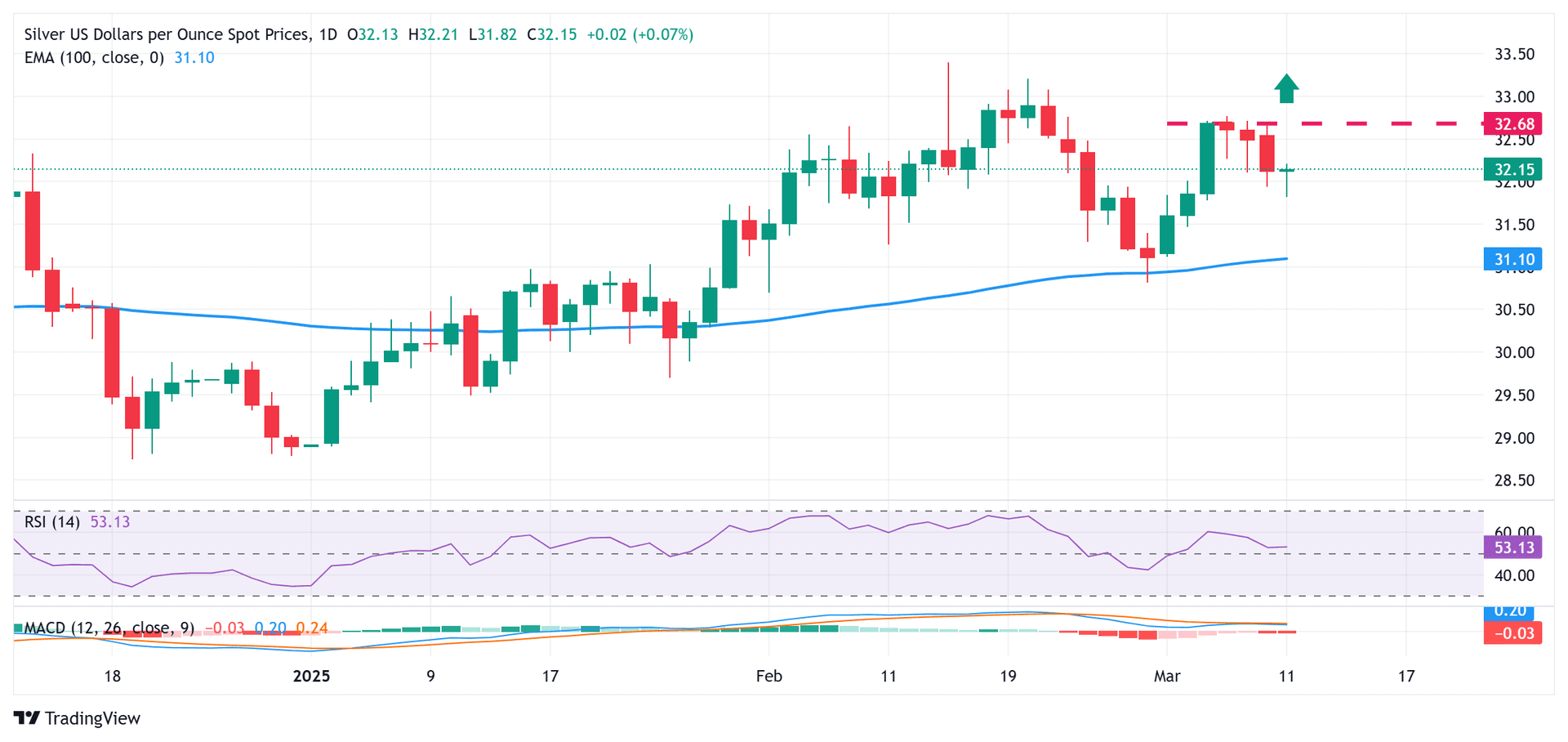

Silver Holds Above Fifty One Dollars as Fed Jitters Test Rally

Silver steadied above fifty one dollars on November seventeenth as investors dialed back expectations for a December Federal Reserve rate cut, strengthening the US dollar and testing gains posted earlier in 2025. The move highlights how quickly monetary policy shifts can reverse commodity rallies, with implications for miners, ETFs, and industrial consumers.

Silver prices remained resilient above fifty one dollars on Monday, but the short term outlook has been clouded by renewed Federal Reserve caution and a firmer US dollar. Traders have rapidly scaled back bets that the central bank will cut interest rates in December, a shift that has pressured precious metals which had benefited from an extended easing narrative earlier in 2025.

The XAG USD benchmark, a key gauge for global silver trading, held above the fifty one dollar mark after several sessions of volatility. The precious metals complex broadly felt the same headwinds that have weighed on gold, as rising real yields and a stronger dollar reduce the appeal of non yielding assets. Market positioning that had supported silver through much of the year has been vulnerable to even modest reappraisals of the Fed path.

The policy backdrop is central to the move. Throughout 2025 investors had priced in a higher probability of rate cuts, supporting asset classes that typically perform well when real yields are declining. That consensus shifted this week as Federal Reserve officials struck a more hawkish tone, prompting a reassessment of the timing and scale of any easing. The result was a reversal in December cut odds, and a prompt reaction in commodities priced in dollars.

For silver, the immediate consequence is an increased near term correlation with bond markets and the dollar. A firmer dollar raises the effective local currency cost for buyers outside the United States, damping demand from import dependent consumers and traders. Concurrently, higher real yields make the opportunity cost of holding silver more acute for investors and funds, pressuring ETF inflows and speculative positions.

Market participants will be watching a few indicators closely over the coming days. Dollar strength, US Treasury yields, and any additional signals from Federal Reserve speakers will likely drive intraday and short term direction for XAG USD. Liquidity conditions in silver futures and physical market spreads will also determine how sharply prices can move in response to shifts in risk appetite.

Beyond the immediate policy reaction, the longer term picture for silver remains shaped by its dual role as both an industrial metal and a monetary asset. Structural demand from sectors like renewable energy and electronics continues to underpin consumption trends, while supply dynamics have not produced a rapid increase in mine output. Those fundamentals could support higher prices if monetary policy eventually shifts back toward easing or if inflation pressures reemerge.

For now, however, the rally that carried silver into 2025 faces a credibility test. If Fed rhetoric remains hawkish and the dollar keeps its strength, silver may struggle to build sustained gains above current levels. Conversely, any renewal of rate cut expectations could quickly flip sentiment and revive the earlier momentum that lifted XAG USD into the fifty dollar range. The market will be taking its cues from central bankers and bond investors in the near term.