Mortgage Refinance Rates Stall in Mid‑High 6% Range, Buyers Face Higher Costs

Average refinance rates remain anchored in the mid‑to‑high 6 percent range, keeping monthly payments and lifetime interest burdens elevated for homeowners considering refinancing. With the national 30‑year refinance rate at 6.4%—nearly a full percentage point higher than last week—borrowers face tighter windows for savings and a marketplace where lender pricing and fees matter more than ever.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

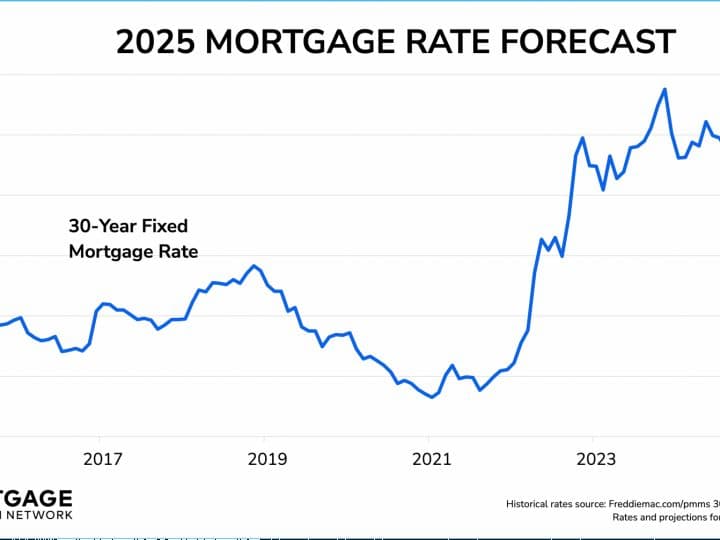

Mortgage refinance rates have settled into a narrow band around mid‑to‑high 6 percent for most of 2025, and that pattern shows little sign of breaking before year‑end. Forbes Advisor reports the national average for a 30‑year fixed‑rate refinance at 6.4%, a jump of 0.96 percentage points from a week earlier and a mark that keeps borrowing costs substantially above the era of ultra‑low rates seen earlier in the decade.

The immediate arithmetic for homeowners is stark. A borrower refinancing a 30‑year, fixed‑rate mortgage for $100,000 at 6.4% would pay roughly $626 per month in principal and interest, excluding taxes and fees, and will incur about $125,866 in total interest over the life of the loan according to the Forbes Advisor mortgage calculator. Those sums frame the tradeoffs that surface when homeowners assess refinancing: modest monthly savings can be overwhelmed by high lifetime interest and upfront closing costs unless the new rate substantially undercuts the original mortgage.

Lender pricing practices add an additional wrinkle. Mortgage lenders typically charge slightly higher rates on refinance loans than on purchase mortgages—generally between 0.01 and 0.15 percentage points more, according to the market guidance in the advisor summary. That spread, though numerically small, can translate into hundreds of dollars annually and further reduce the payoff from a refinance particularly for borrowers with smaller principal balances or shorter remaining terms.

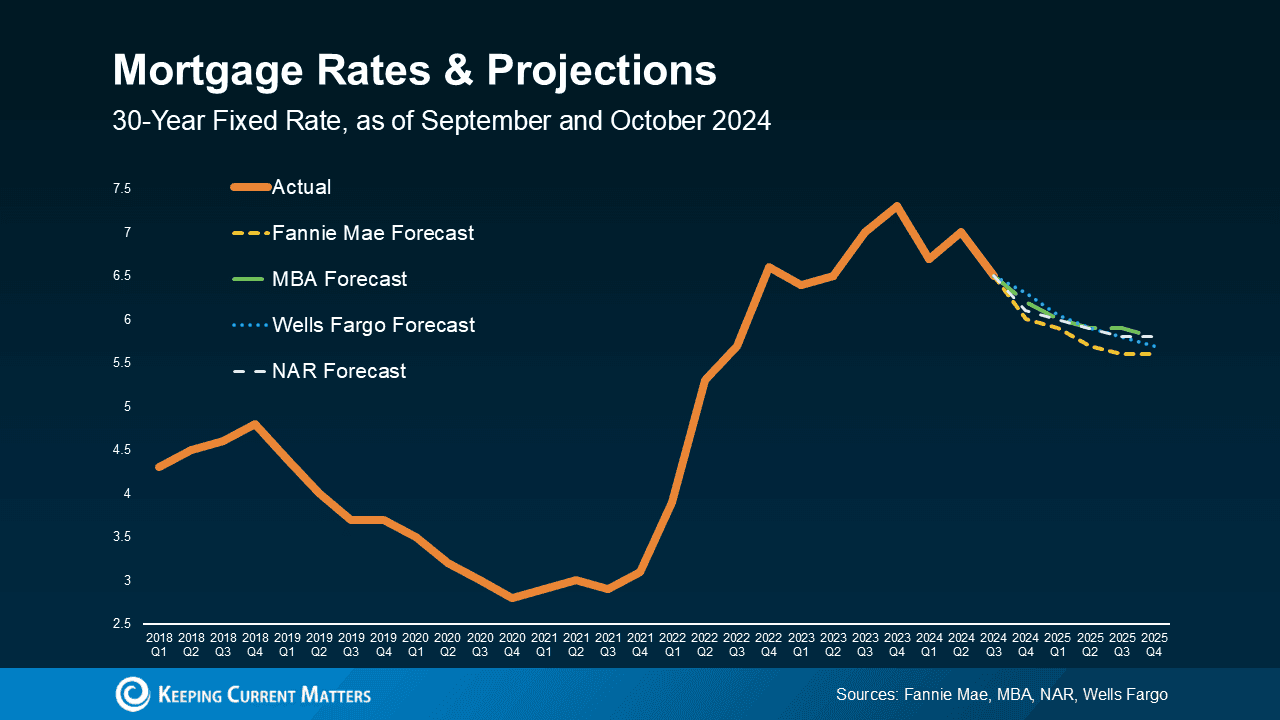

The persistent elevated level of mortgage rates reflects broader financial market conditions. Long‑term yields and mortgage spreads have remained higher than the lows of previous years as investors recalibrate expectations for economic growth, inflation and the trajectory of central bank policy. For the housing market, sustained mid‑6 percent refinance rates translate into reduced refinance activity compared with the boom years of cheap credit, while also tempering homeowner mobility because existing low‑rate mortgages become more valuable and harder to replace affordably.

For consumers, the immediate implications are concrete: the window for refinancing into a materially lower rate has narrowed, increasing the importance of timing, fee comparisons and loan term decisions. Homeowners who locked in lower rates in prior years face little incentive to refinance unless they need to change loan duration, tap equity at a favorable cost, or consolidate higher‑interest debt. Prospective refinancers should weigh the monthly savings against closing costs and the likely payback period, and compare offers across multiple lenders to capture the small but meaningful differences in pricing.

As the calendar moves toward year‑end, market participants expect the mid‑to‑high‑6 percent band to persist, limiting the potential for widespread refinancing-driven relief for households. That environment will keep refinancing a targeted strategy for select borrowers rather than a broad remedy for mortgage cost reduction.