Refinance Rates Hold Near 6.4 Percent, Curbing Homeowner Activity

National refinance rates have stabilized in the mid-to-high 6 percent range, with the average 30-year fixed refinance rate at 6.4 percent and little movement expected through the end of 2025. That environment narrows opportunities for savings and keeps monthly mortgage costs and lifetime interest burdens substantially higher than in the prior decade, with implications for housing demand and consumer spending.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

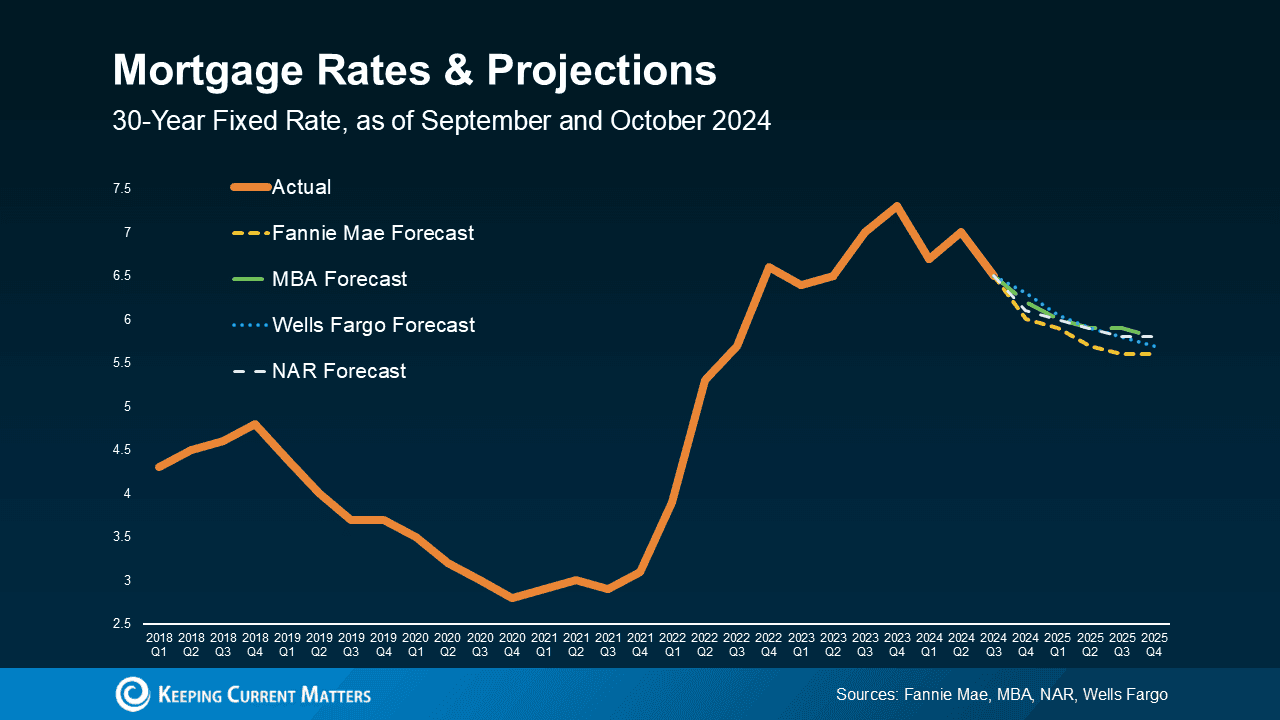

Mortgage refinance markets entered the final months of 2025 with rates stuck in the mid-to-high 6 percent range, and the average 30-year fixed refinance rate sits at 6.4 percent, according to Forbes Advisor data. The rate is reported as up 0.96 percentage points from the previous week, reflecting the sensitivity of mortgage pricing to short-term moves in Treasury yields and investor appetite for mortgage-backed securities. Lenders also continue to price refinance loans slightly above purchase loans, typically by 0.01 to 0.15 percentage points, narrowing the margin for borrowers weighing a cash-out or term-reduction refinance.

For many homeowners the arithmetic is stark. A 30-year, fixed-rate refinance at 6.4 percent on a $100,000 loan translates to a principal-and-interest payment of about $626 per month, excluding taxes and fees. Over three decades, the borrower would pay roughly $125,866 in interest, more than the original principal. Those figures underscore why refinancing is less attractive today than during the ultra-low-rate years earlier in the decade: the potential monthly and lifetime savings are reduced or erased unless borrowers are coming from significantly higher existing rates.

Market implications are predictable. With limited scope for immediate large savings, refinancing volumes are likely to remain subdued. Homeowners who locked in sub-4 percent rates in the recent past have little incentive to refinance. Remaining candidates include those with adjustable-rate mortgages approaching reset, borrowers seeking cash for renovations or debt consolidation, and households that can substantively shorten their loan term to capture long-run savings despite higher monthly payments. Lender competition for these marginal borrowers will focus more on fees, closing costs and tailored underwriting than on headline rate cuts.

From a broader economic perspective, sustained mid-to-high 6 percent refinance rates exert a cooling influence on the housing market. Higher borrowing costs reduce buyer affordability and can slow turnover, which in turn suppresses residential construction and related spending. For households with large mortgage balances, the higher interest burden can crowd out discretionary spending, tempering consumption growth even as labor markets remain uneven.

Policy context remains central to the outlook. Mortgage rates broadly track long-term Treasury yields and the Federal Reserve’s policy stance. Analysts who expect rates to remain elevated through year-end point to persistent inflation pressures and slower-than-anticipated easing in monetary policy. Any shift in that balance—unexpected disinflation or decisive Fed rate cuts—could still compress mortgage spreads and reopen refinancing opportunities.

For prospective refinancers, the current market emphasizes careful calculation: incremental rate differences, closing costs and remaining loan tenure must be weighed against modest prospective savings. As rates hold near 6.4 percent, the decision to refinance is increasingly a case-by-case financial calculation rather than an across-the-board cost-saving move.