New Mexico Records ACA Enrollment Rise as State Offsets Subsidies

BeWell reported a record more than 80,400 New Mexicans enrolled for ACA medical or dental coverage for 2026 as the state moved to replace expired federal premium tax credits. Hidalgo County residents may see continued access to marketplace plans, but statewide premium increases averaging 35.7% mean many households will still face higher costs.

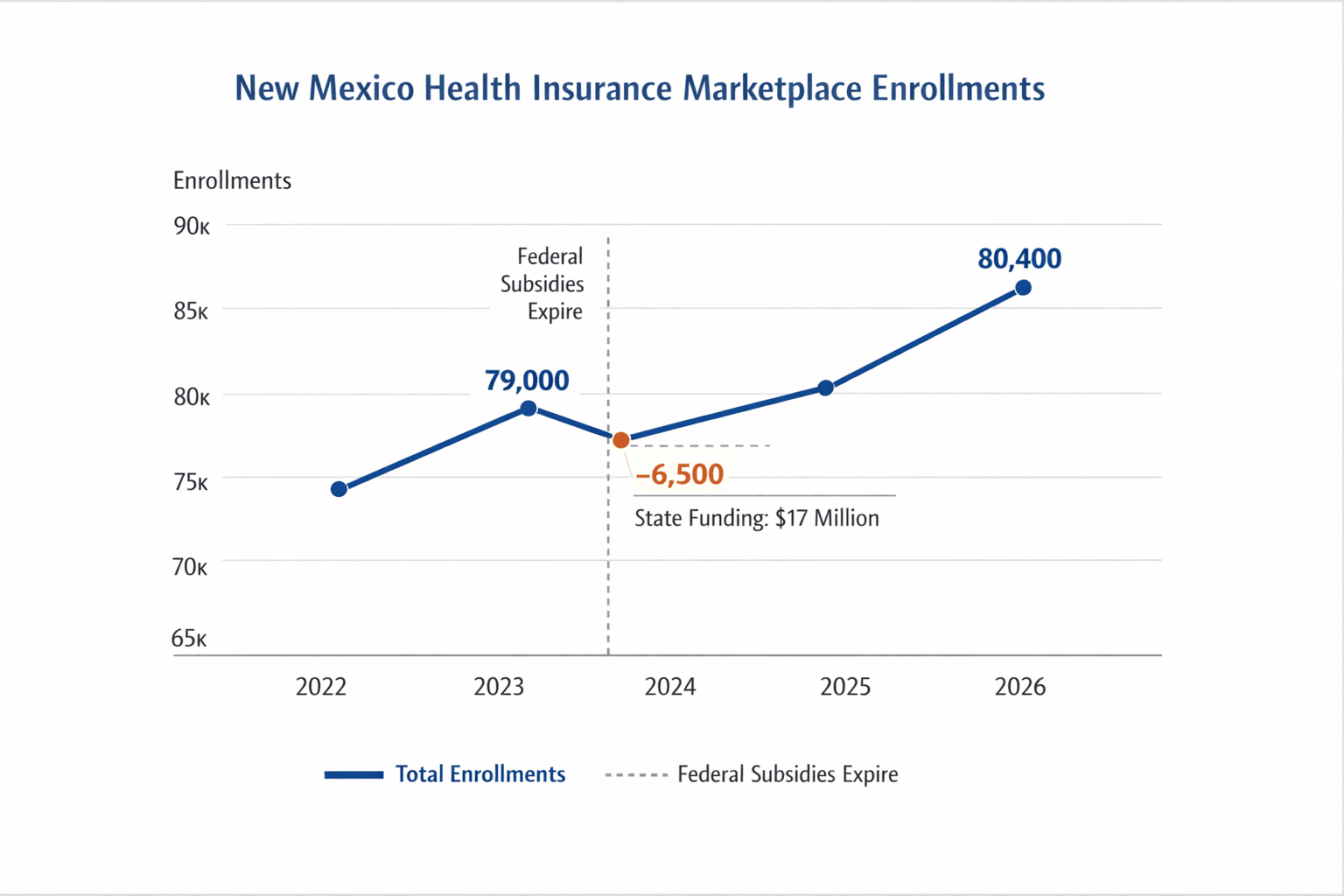

New Mexico’s health insurance marketplace reached a record enrollment this winter as state lawmakers moved to plug a gap left by expiring federal subsidies. BeWell reported more than 80,400 people had enrolled for medical or dental coverage for 2026 as of Dec. 30, surpassing last year’s nearly 79,000 and marking the third consecutive year of record sign-ups.

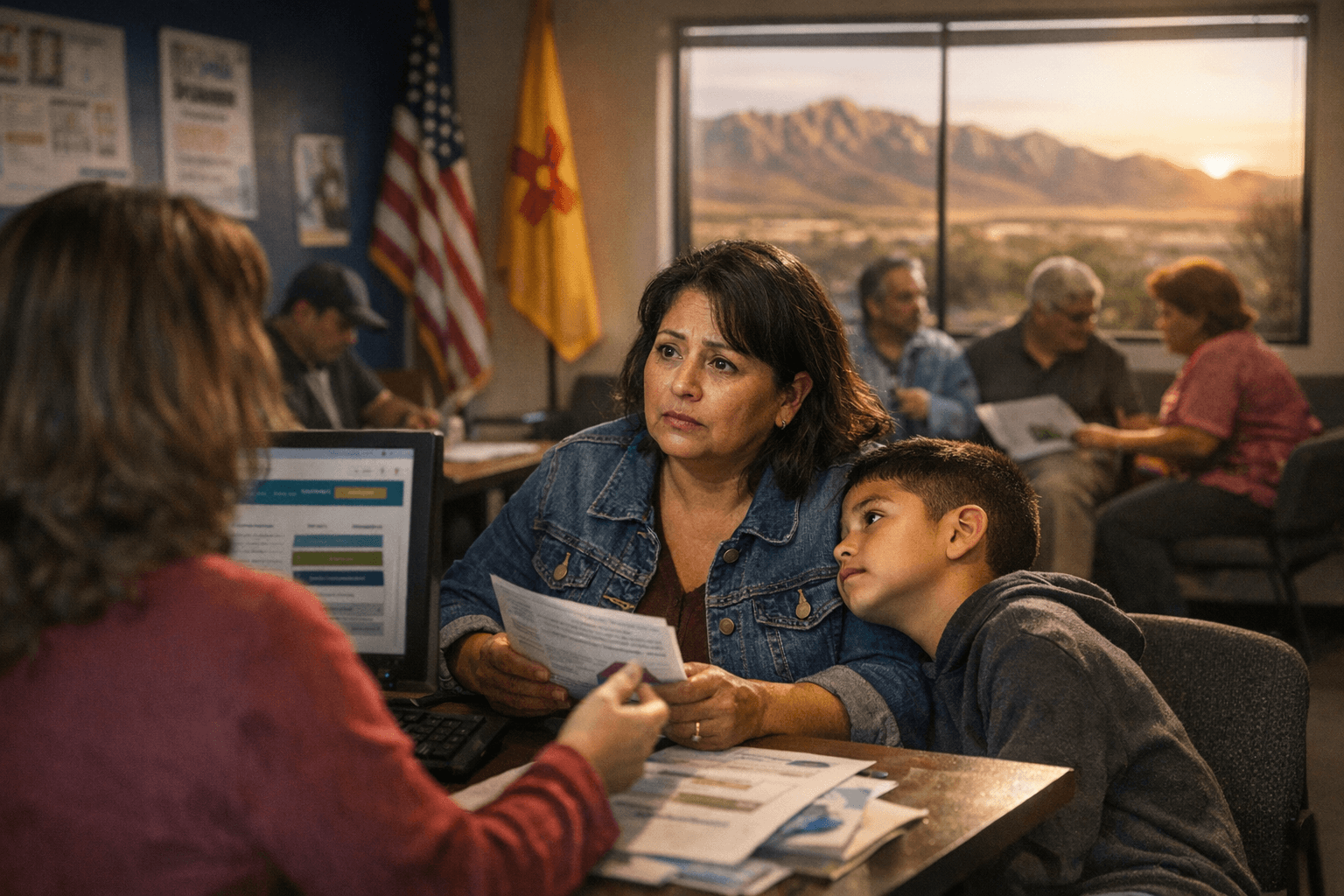

The surge in sign-ups came amid a federal policy shift: pandemic-era tax credits that reduced premiums for higher-income households were not renewed by Congress, raising concerns about affordability. In an October emergency session, lawmakers passed House Bill 2 with bipartisan support to cover the lost federal assistance for one fiscal year, using $17 million from the state’s Health Care Affordability Fund. Lawmakers said the aid will replace the federal premium assistance previously received by roughly 6,500 New Mexicans.

“That’s why we stepped up as a state during the special session to ensure marketplace insurance remains affordable for families across New Mexico,” House Majority Leader Reena Szczepanski, D‑Santa Fe and a co‑sponsor of the bill, said when lawmakers acted.

Despite the temporary state assistance, New Mexicans will face steep rate increases next year. The state Office of the Superintendent of Insurance projected ACA premiums to rise by an average of 35.7%, citing higher medical and prescription drug costs and strong demand for health care services. Around 43% of 2026 enrollees will pay $10 or less per month after subsidies, and the average net premium per enrollee is about $147 per month.

BeWell officials credited subsidies with supporting enrollment while acknowledging uncertainty at the federal level. Alex Sanchez, BeWell’s chief experience officer, said, “We know that subsidies work. It would be the most ideal situation for the federal (tax credits) to be continued, but we are also lucky to live in New Mexico, where this commitment to affordable and reliable health insurance has ensured that people can continue to sign up.”

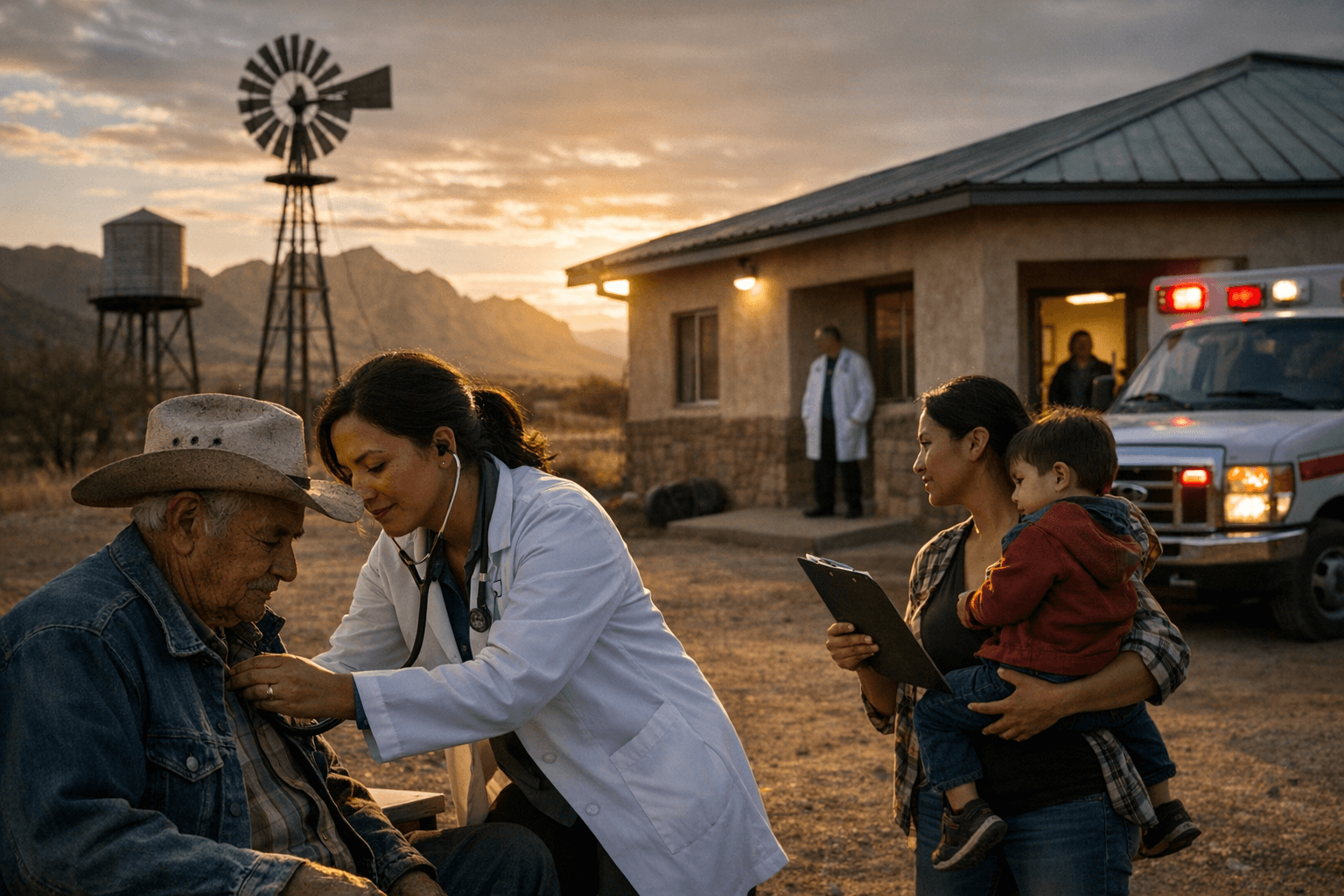

For Hidalgo County residents, the developments carry mixed implications. The marketplace serves many middle‑class households who do not qualify for Medicaid or Medicare and who rely on employer or individual plans - groups that include small business owners, employees and the self‑employed. Higher premiums could strain household budgets and local small businesses that provide or rely on individual coverage. At the same time, the state’s stopgap funding and the fact that many enrollees will pay minimal net premiums offer a buffer for vulnerable families.

Enrollment windows have closed for coverage starting Jan. 1, but New Mexicans still have until Jan. 15 to enroll for coverage beginning Feb. 1 through BeWell. Marketplace advisers can assist with plan selection and with Medicaid or Medicare placement. As BeWell officials put it, “I think that at the end of the day, what we are seeing is people need health care,” reflecting the practical urgency behind policy decisions and the real impact on families across counties like Hidalgo.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip