Nokia stock in focus as TIM 5G win, Germany layoffs and Capital Markets Day converge

Nokia finds itself at the center of investor attention today after reports of layoffs in Germany and a significant commercial win with TIM coincided with the companys Capital Markets Day. At the same time financial markets are digesting Cboe's launch of futures and options on a new tech index that could redirect capital flows across the sector.

Nokia is under close scrutiny by investors and analysts as multiple developments come together on November 18, 2025. Coverage of reported layoffs in Germany, a three year commercial agreement with Italian operator TIM and the companys Capital Markets Day are all shaping the market conversation. The pattern of news is arriving as exchanges roll out new derivative products tied to concentrated technology names that may influence broader sector flows.

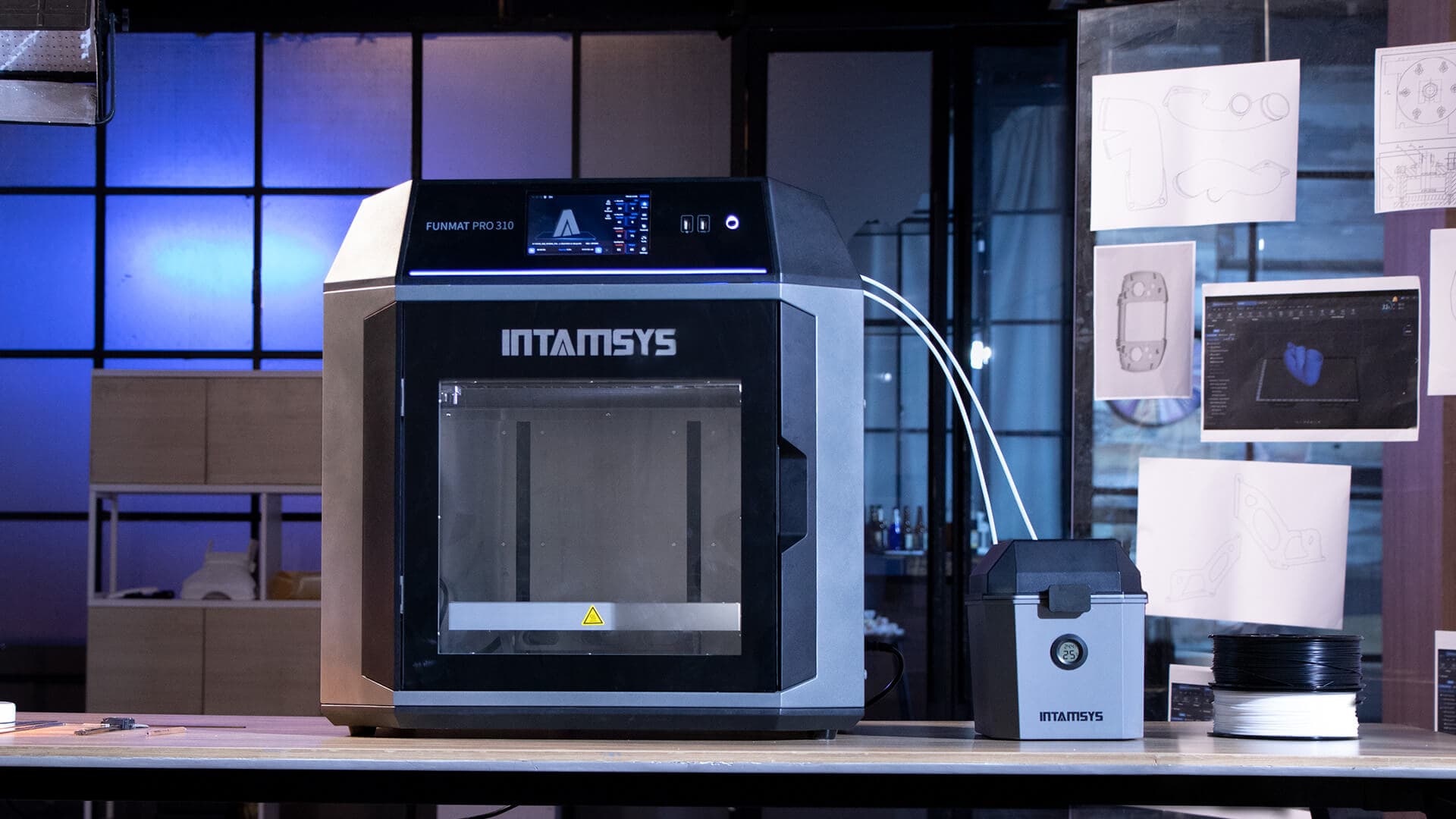

Media reports today said Nokia will expand and modernize 5G coverage and capacity for TIM under a multi year contract that the coverage called "Landmark". The agreement, described as lasting three years, follows a competitive tender in which Nokia is reported to have captured share in TIMs radio access network at the expense of Ericsson. The deal highlights deployment of Nokia products including AirScale RAN, Habrok 32 massive MIMO radios and Pandion multi band RRHs. Financial terms were not disclosed.

Those operational wins arrive as Nokia hosts its Capital Markets Day today, where management is expected to elaborate strategy and financial priorities. Pre event commentary has focused on three themes likely to dominate the presentations and investor questions. Market watchers are looking for clarity on growth in network infrastructure tied to artificial intelligence and data center demand, the transition of mobile networks to AI driven RAN architectures, and expanding opportunities among AI and cloud customers. Presentations and guidance delivered during the event will be closely parsed for capital allocation signals and margin trajectory.

The reported layoffs in Germany add a second layer of investor focus. While specifics were limited in media coverage, the reports have raised questions about cost discipline and the pace of restructuring in Europe as Nokia seeks to balance investment in growth platforms with margin improvement. For shareholders and bondholders looking for clarity, management commentary at the Capital Markets Day about workforce strategy and operating leverage will be material.

Broader market structure shifts also arrived today when Cboe Global Markets announced at 1:24 PM Eastern that it will launch futures and options on the new Cboe Magnificent 10 Index on December 8 subject to regulatory review. The MGTN Index, introduced on October 14, is an equal weighted benchmark targeting 10 large cap technology and growth stocks, including the Magnificent 7 plus AMD Broadcom and Palantir. The new contracts will be cash settled which reduces delivery risk compared with exchange traded funds or single stock options. Although Nokia is not a constituent of the index the new derivatives could alter liquidity and investor attention across the technology complex which in turn can influence relative demand for network equipment stocks.

Taken together the TIM commercial win, the Germany personnel reports and the companys Capital Markets Day create a compressed set of near term catalysts for Nokia. Investors will be watching for concrete guidance on execution, margins and capital allocation while market wide flows into tech derivatives add an external variable to how the stock is valued in the weeks ahead.