Notice to creditors begins probate for local estate, signals implications for County

A notice to creditors has been filed for the estate of Garney Murl Mathis, noting that Letters of Testamentary were issued on December 2, 2025, and opening a window for claims against the estate. The development matters for local creditors, heirs, and small businesses because probate can affect asset transfers, debt repayment, and short term cash flows in Decatur County.

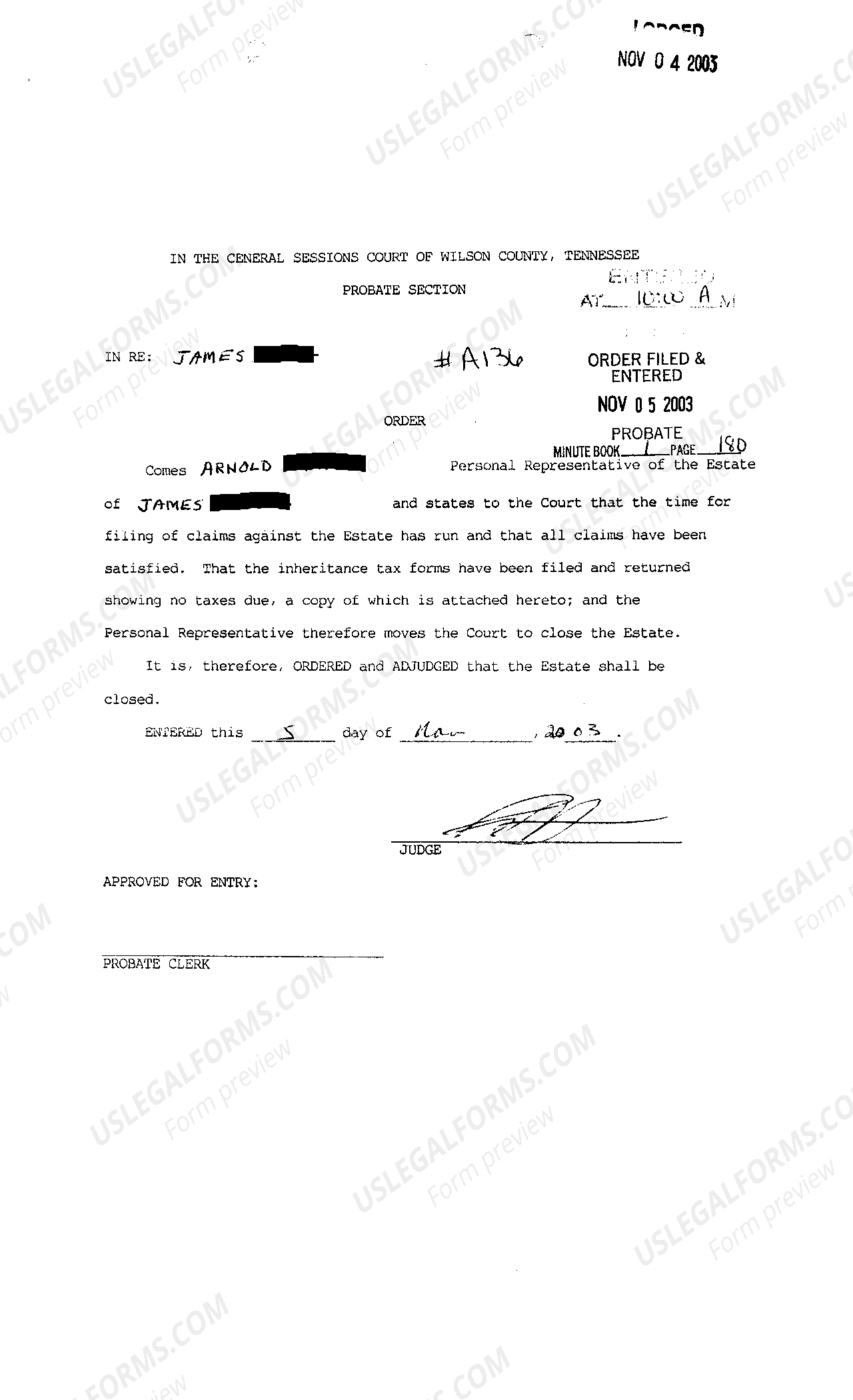

A formal notice to creditors has been published in connection with the estate of Garney Murl Mathis as the county moves into probate administration. The notice states in part, "Notice is hereby given that on the 2nd day of December, 2025, Letters of Testamentary, in respect of the Estate of Garney Murl Mathis ..." and cites statutory authority under Chapter No. 886, Public Acts of Tennessee 1939 as amended, Sections 30 2 306 of the Tennessee Code Annotated.

Letters of Testamentary authorize an executor or personal representative to manage the estate s affairs, receive assets, pay debts, and oversee distribution to heirs. The notice formally triggers the period in which creditors are expected to present claims under Tennessee law. That process establishes the timeline for resolving outstanding obligations and for settling administration matters that affect ownership of property and financial obligations within the county.

For local residents the immediate impact is practical. Vendors, contractors, medical providers, lenders and other local creditors who extended credit to the decedent should review their records and, if owed money, prepare to submit claims as required by probate procedures. Heirs and potential beneficiaries should be aware that estate administration may delay transfers of real property and other assets while claims are adjudicated and liabilities are settled.

From an economic perspective, probate cases can temporarily reduce liquidity for families and for local firms that are creditors of the estate. If significant assets are tied up, spending by heirs may fall in the short term and property tax receipts or real estate transactions may be postponed until title can be cleared. Over the longer term the completion of probate restores clear title and can lead to renewed property market activity and finalization of tax obligations.

If you believe you have a claim against the estate, confirm the claim requirements and deadlines in the notice and contact the probate court or the estate s representative named in the notice for filing instructions. Prompt action preserves legal rights and helps the county resolve outstanding obligations efficiently.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip.jpg&w=1920&q=75)