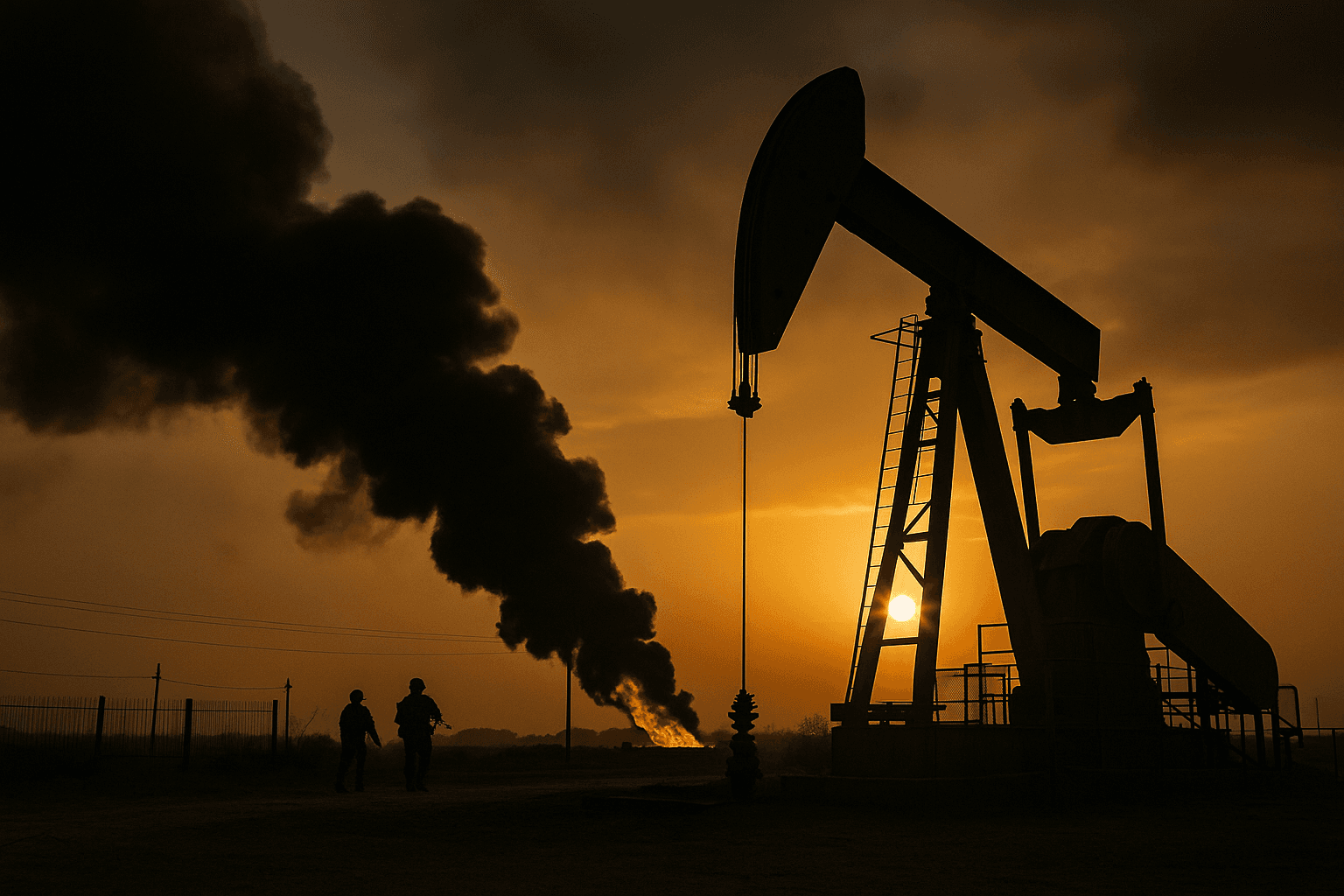

Oil Steadies, Supply Concerns Temper Gains as Diplomacy Looms

Oil markets held their ground as traders weighed a near term glut against the risk of supply disruption from the Russia Ukraine conflict, while watching a diplomatic process that could alter export flows. The balance between oversupply and geopolitical tail risks will shape prices, inflation readings, and energy sector returns in the coming weeks.

SINGAPORE, Dec 10, 2025 — Oil prices held steady after a recent pullback as investors balanced growing evidence of oversupply with the possibility of disruptions tied to the Russia Ukraine conflict. Brent crude and U.S. West Texas Intermediate futures traded with modest gains as markets awaited potential diplomatic developments and continued to monitor Russian seaborne exports, a variable that analysts say poses a persistent tail risk.

Market participants described the present environment as one of competing narratives. On one side, production and shipments from major suppliers have remained robust and demand growth has been uneven across regions, creating downward pressure on spot and futures markets. On the other side, any change in the conflict dynamics or in the flow of Russian crude at sea could tighten markets quickly, prompting sharp price moves.

Analysts said global markets are positioned for a near term glut even as they acknowledge the asymmetric risk posed by Russian supply. Traders are watching tanker routes and port activity closely for signs that export volumes might slow or accelerate. Changes in those flows would be transmitted rapidly through forward curves and prompt traders to reassess positions across both physical and paper markets.

The steady trading in oil comes amid a broader macroeconomic backdrop in which central banks are sensitive to energy price trajectories. Stable or falling oil prices can relieve headline inflationary pressure, reducing the pass through to consumer prices and potentially easing the immediate burden on monetary policy makers. Conversely, a sudden supply disruption that lifts oil prices would reinstate upside inflation risks and could alter rate path expectations.

For energy companies and commodity sensitive sectors, the current stalemate offers little certainty for capital spending plans. Producers face pressure from investors to preserve cash while also needing to respond quickly if prices move higher. Refiners and shipping firms likewise must navigate volatile margins that depend on both crude availability and demand for refined products.

Long term trends underline the complexity of the current market. Structural changes in energy demand driven by efficiency gains and the rise of alternative fuels are meeting a still resilient global oil supply system, including flexible shale production and continued flows from large exporters. That combination has contributed to the present spare capacity and downward price pressure, even as geopolitical flashpoints create episodic volatility.

Investors and policy makers will therefore be watching the outcome of diplomatic activity related to Ukraine closely, along with shipping data on Russian exports and weekly inventory reports. Those data points will determine whether the market moves decisively away from the current balance between oversupply and geopolitical risk, or whether prices remain anchored in a narrow trading range as participants await clearer signals.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip