Oracle shows strong cloud momentum, flags much higher capital spending

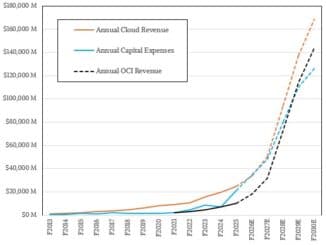

Oracle reported robust cloud contract growth and rising remaining performance obligations while warning that fiscal 2026 capital expenditures will be dramatically higher, prompting investors to rethink near term cash priorities in the AI investment cycle. The company kept its revenue target but faces pressure on free cash flow as aggressive data centre build outs drive quarterly capex well above operating cash flow.

Oracle delivered a quarter that underscored accelerating demand for cloud services while warning that the company will spend far more on infrastructure in the coming year. A Nasdaq summary of the company’s results for the quarter ended November 30, 2025 showed a substantial addition to remaining performance obligations and healthy operating profits, but management also raised fiscal 2026 capital spending expectations by roughly $15.0 billion compared with prior forecasts.

Management maintained full year fiscal 2026 revenue guidance at $67.0 billion, and reported that Oracle added $68.0 billion in remaining performance obligations during the fiscal second quarter that it expects can be monetized quickly. Based on that RPO increase, Oracle said it now anticipates roughly $4.0 billion of additional revenue in fiscal 2027. Those forward commitments help explain the company’s message that heavy near term investment is required to keep pace with cloud demand.

The quarter’s cash flow and spending figures highlight the tension driving investor reassessment. Cash and cash equivalents rose to $19.2 billion as of November 30, 2025 from $10.8 billion at the end of August, but operating cash flow for the quarter was only about $0.8 billion while capital expenditures totaled approximately $8.1 billion. Nasdaq linked that elevated quarterly capex to aggressive data centre build outs intended to expand capacity to support the stronger cloud contract momentum.

Profitability metrics were solid on both non GAAP and GAAP bases. Non GAAP operating income was $6.7 billion, up 10% year over year in US dollars and up 8% in constant currency, with a non GAAP operating margin of 42%. On a GAAP basis operating income was $4.7 billion, up 12% year over year in US dollars and up 9% in constant currency, with a GAAP operating margin of 29%. Total non GAAP operating expenses for the quarter were $9.3 billion, up 17% year over year in US dollars and up 16% in constant currency. Cloud and software expenses rose 45% year over year to $3.99 billion, reflecting the investments behind the data centre expansion.

Oracle’s earnings guidance assumes a non GAAP effective tax rate of about 20.8 percent. The company also emphasized that the added RPO can be monetized quickly, a key part of the argument that the capex is a forward looking investment that will generate revenue as capacity comes online.

Investors and analysts are weighing the trade offs. The pace of capital deployment underscores a broader industry dilemma in the AI era, where cloud providers and enterprise software firms must balance rapid infrastructure scaling with near term cash conversion and free cash flow. Oracle’s near term cash conversion will be under close scrutiny given the gap between operating cash flow and capex this quarter.

For Oracle, the move is a bet that accelerating cloud demand and the monetization of added contracts will justify the expense. For shareholders, the test will be whether the additional capacity delivers the projected revenue lift in fiscal 2027 and beyond while preserving the company’s long term profitability and cash generation.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip