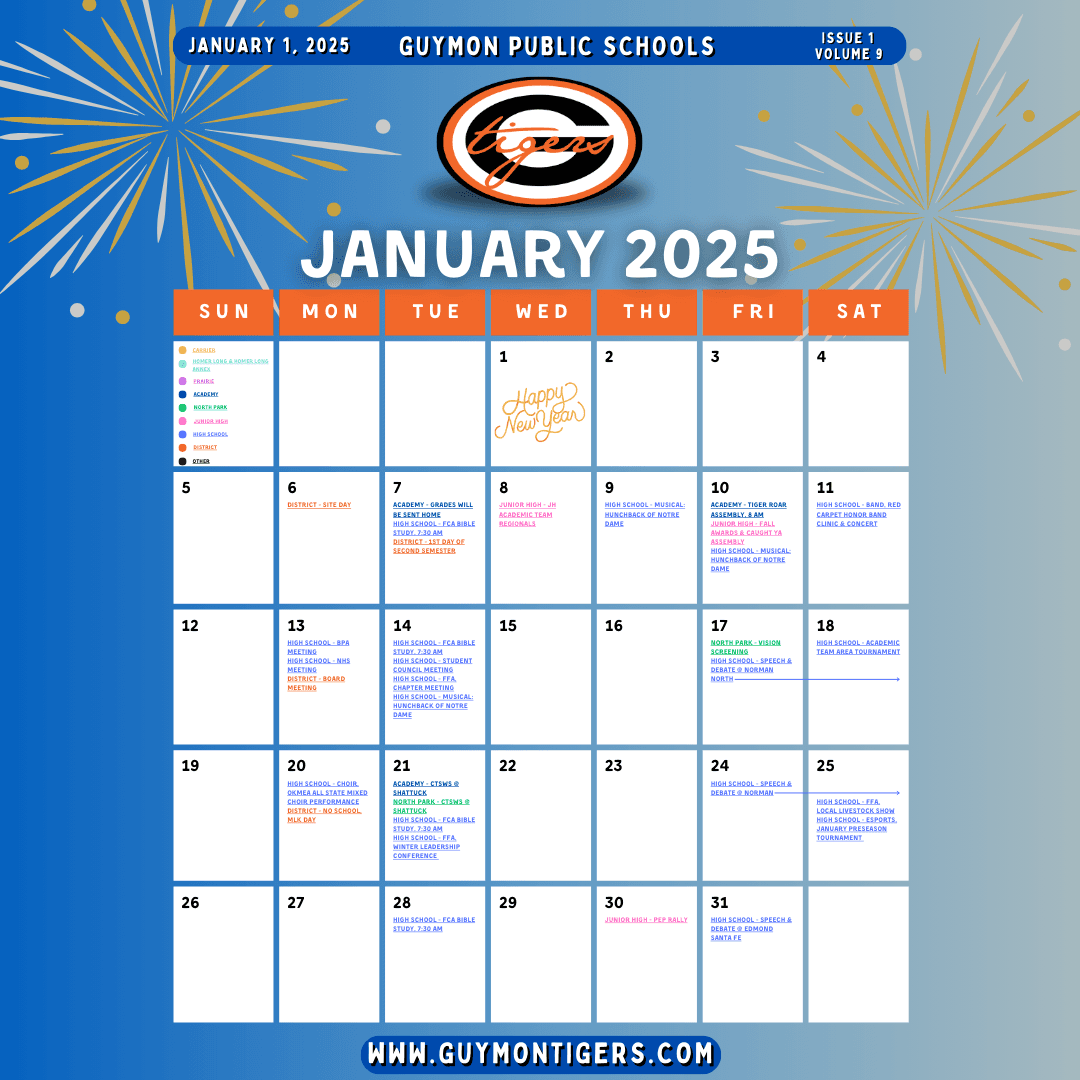

OSU Extension Offers Holiday Budgeting Advice for Texas County Families

OSU Extension released a consumer advice piece on December 1, 2025 that lays out practical budgeting and spending tips for families facing holiday expenses. The guidance matters to Texas County residents because it offers immediate cost saving tactics and longer term planning steps that can reduce household debt and ease pressure on local safety net services.

On December 1, 2025 OSU Extension published a consumer advice piece aimed at helping families manage holiday spending. The guidance collected low cost ideas for meaningful celebrations, methods to avoid overspending, and steps parents can take to teach children money management. While intended for Oklahomans statewide the recommendations are directly applicable to households in Texas County preparing for year end expenses.

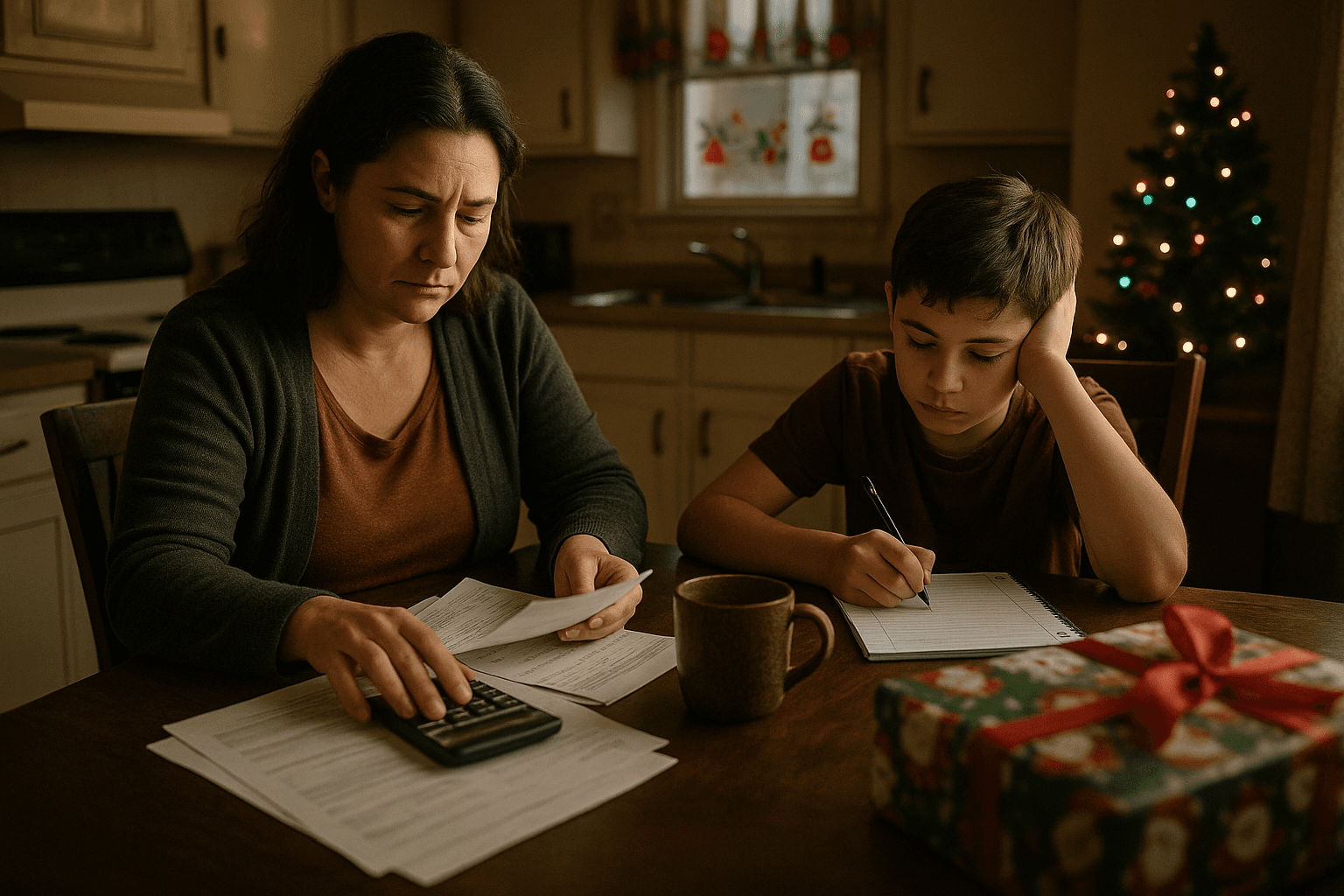

The guidance emphasized family time, potlucks, thrift store decorations, and homemade gifts as ways to preserve tradition without large expense. To prevent credit driven purchases the finance specialist recommended using cash or prepaid cards and avoiding buy now pay later plans that can spread costs into next year. The piece also outlined concrete ways to trim holiday expenses now and to begin planning for next year by setting aside modest monthly savings.

For Texas County residents the practical impact is twofold. In the near term families can adopt low cost celebration ideas that lower out of pocket spending and reduce reliance on high interest credit. Over the longer term establishing a monthly savings habit can diminish recurring financial stress and reduce demand for emergency assistance managed at the county level. Community level adoption of potlucks, shared decorations, and thrift store exchanges can also strengthen local social networks that provide informal economic support.

Institutionally the guidance highlights the role of extension services in financial education and in supporting household resilience. Local government and nonprofit planners may consider integrating these recommendations into outreach prior to the next holiday season. In policy terms widespread adoption of the advice could alter local budget pressures by reducing short term emergency aid needs and shifting conversation toward preventive household finance measures.

Texas County households looking for immediate application should consider peer run potlucks, community decoration swaps, and teaching children hands on money tasks this season. County officials and civic groups can amplify these low cost approaches to stretch limited budgets while building civic engagement and mutual aid across neighborhoods.