Robinhood Tops Q3 Expectations as Market Reprices Mixed Tech Results

Robinhood reported third-quarter results that beat analyst expectations but its shares slipped in after-hours trading, underscoring investor focus on forward guidance and profit quality rather than headline beats. The same session produced a split tape: Snap surged on an AI partnership and earnings beat, while Lucid and Lyft highlighted persistent profitability pressures despite operational gains.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Robinhood Markets beat Wall Street estimates for both earnings and revenue in its third quarter, but the brokerage’s stock fell in after-hours trading, illustrating how investors are parsing earnings for durability rather than one-off beats. The reaction reflects a broader theme in the current earnings season: top-line surprises are no longer sufficient to lift equities if companies offer cautious outlooks, show uneven unit economics, or face structural headwinds.

Also trading after hours, Snap rallied sharply—up as much as 25%—following an earnings beat and the announcement of a significant deal to integrate Perplexity’s conversational AI search into Snap’s products. The move underlines how AI partnerships are increasingly being priced into the valuations of consumer technology companies, with investors rewarding firms that can articulate potential revenue or engagement lifts from generative and conversational AI features.

Other notable results underscored the uneven state of corporate margins. Lucid delivered 47 percent more vehicles in the third quarter compared with the year-ago period, a clear operational improvement, but posted an adjusted loss per share of $2.65 versus the $2.29 loss per share analysts expected, highlighting persistent cost and scale challenges in the electric-vehicle sector. The gap between improving delivery trajectories and entrenched losses illustrates the capital intensity required to move from niche production to mass-market profitability.

Lyft’s quarter further emphasized the divide between growth in demand measures and bottom-line performance. The ride-hailing company reported third-quarter earnings per share of $0.11, missing the FactSet consensus of $0.24, even as bookings exceeded expectations. That pattern—bookings strength with disappointing EPS—suggests continued margin pressure from driver costs, promotions, or investments in new services, and it keeps the focus on whether mobility platforms can convert user-activity gains into sustainable profits.

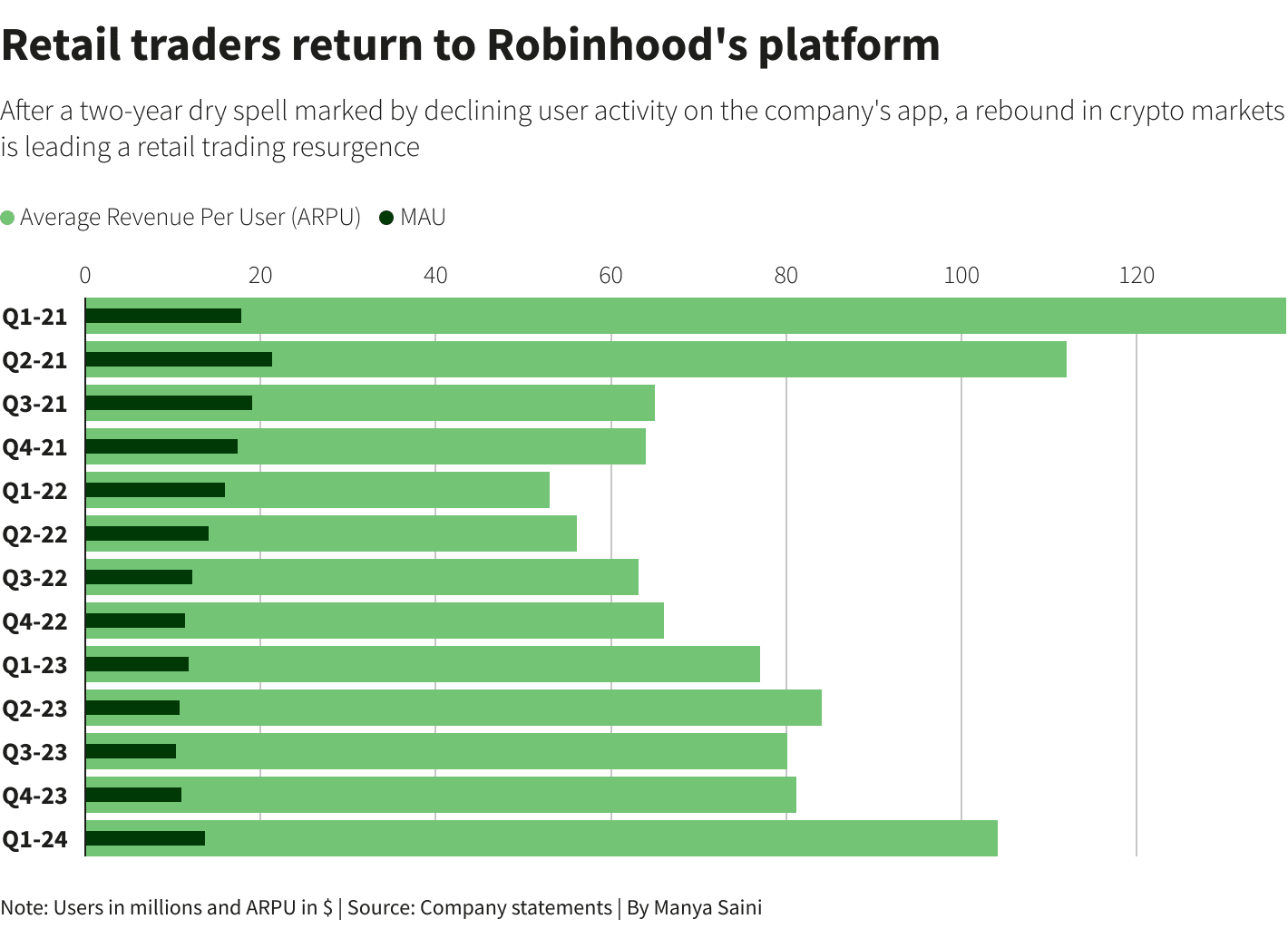

For Robinhood, the after-hours slip despite a beat points to investor sensitivity to guidance, chronic concerns about trading revenues tied to market volatility and interest rates, and the platform’s exposure to regulatory and competitive dynamics. Commission-free brokerage models have benefited from episodic trading activity and options flow, but they remain exposed to shifts in retail trading behavior and monetization mixes such as payments for order flow, margin interest, and subscription services. Investors are watching whether companies can diversify revenue streams and improve per-user monetization as macro volatility wanes.

Taken together, these quarterly releases show an equity market that is selectively rewarding tangible pathways to durable revenue and margin expansion—AI tie-ups and clear monetization roadmaps—while discounting firms that rely on operational momentum without credible near-term profitability. The divergence between beats and stock reactions underscores the elevated bar for corporate narratives in an environment where investors demand both growth and evidence of sustainable margins. As earnings season continues, the market will likely keep separating winners that can convert innovation into predictable cash flows from those still wrestling with capital intensity and unit-economics gaps.