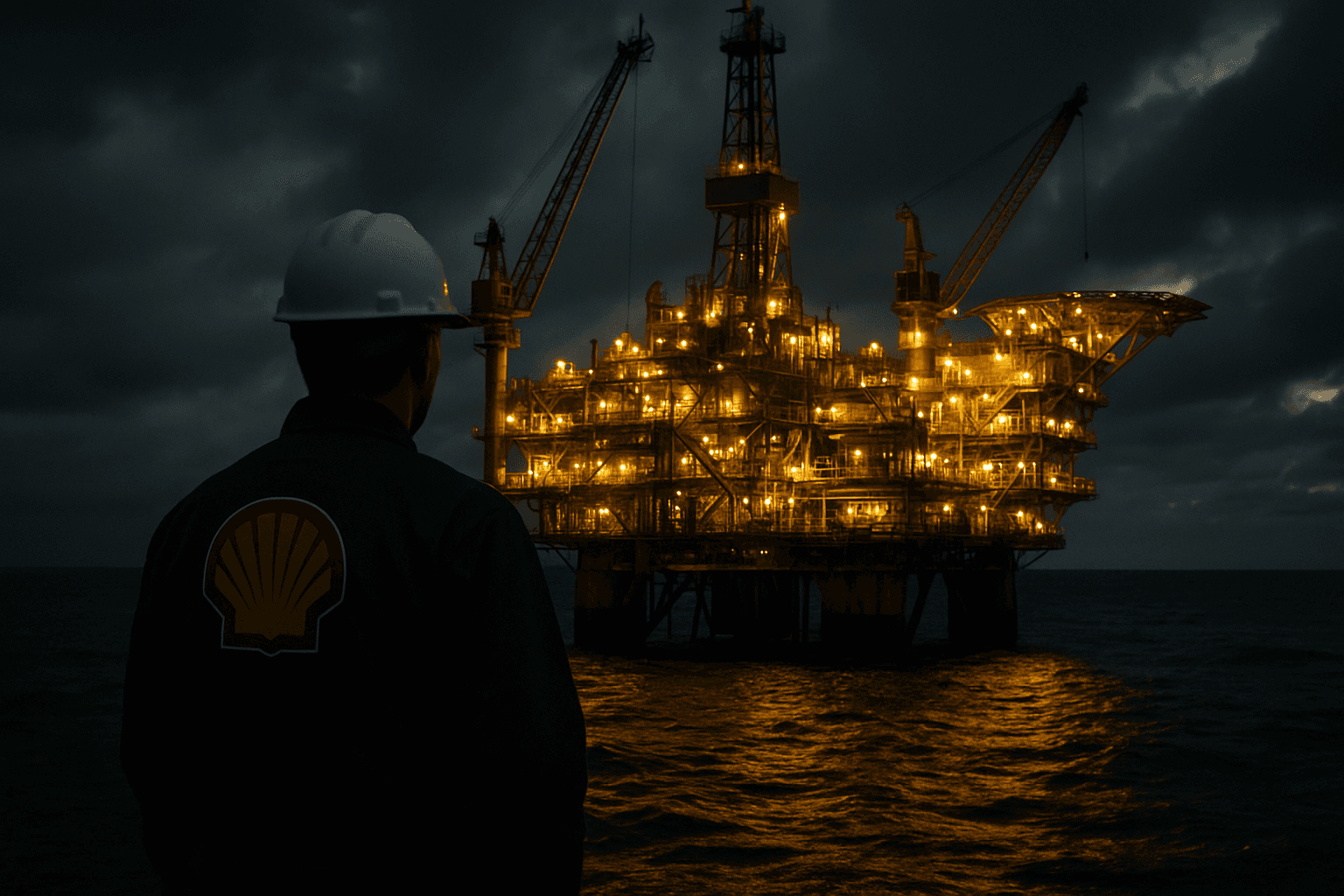

Shell in advanced talks to acquire LLOG, deal tops $3 billion

Shell entered advanced negotiations to buy LLOG Exploration Offshore for more than $3 billion, a move that would materially expand its U.S. Gulf of Mexico oil and gas footprint. The possible year end transaction underscores continued consolidation among majors and independents, with implications for production profiles, capital spending and regional investment patterns.

Shell was in advanced talks to acquire LLOG Exploration Offshore for a transaction valued at more than $3 billion, according to people familiar with the discussions. The conversations, which sources said were close as of December 9, 2025, indicated a deal could be struck by year end, though no agreement had been finalized and there was no guarantee a sale would occur. Shell declined to comment and LLOG did not respond to requests for comment.

The acquisition, if completed, would add a substantial privately held U.S. producer to Shells upstream portfolio in the Gulf of Mexico. LLOG, which operates deepwater and shelf assets and holds interests in producing fields and undeveloped prospects, has been a notable independent player in the region. For Shell, the deal would be a strategic bet on U.S. offshore production as it balances ongoing commitments to lower carbon investments with the need to sustain cash flow and returns to shareholders.

Market participants said the potential purchase fits a broader pattern of consolidation across the oil and gas sector, where major producers have been selectively buying high quality assets to improve margins and scale in core basins. The Gulf of Mexico remains a capital intensive but high quality basin for offshore oil and gas, offering long lived production and access to established infrastructure. Acquiring LLOG would increase Shells exposure to those long lived cash flows at a time when energy companies are under pressure to deliver near term returns while navigating the energy transition.

Financial implications for Shell would depend on the final price and financing approach. A transaction above $3 billion represents a meaningful but manageable addition to the balance sheet for a company of Shells size, and could be funded from cash on hand, divestment proceeds, or a mix of cash and debt. Analysts will be watching how the company integrates the assets, whether it accelerates investment in development projects, and how the purchase affects Shells capital allocation between oil and gas and cleaner energy businesses.

Regulatory and political considerations also figure. Offshore projects in the United States are subject to federal leasing, permitting and safety regimes, and any change in control can prompt scrutiny by regulators. In addition, the political environment around offshore drilling can influence long term investment economics, particularly given evolving climate policy priorities.

For the Gulf of Mexico, consolidation could alter competitive dynamics, with larger operators gaining scale and potential operational efficiencies. That could affect local service markets and regional employment, as well as government revenues tied to production. For investors, a completed deal would signal that majors continue to find value in acquiring developed and near term producing assets in the United States even as they publicly commit to longer term decarbonization goals.

As talks proceed, market observers will look for formal announcements, regulatory filings and detail on price and financing. Until then the parties caution that negotiations could yet stall and there is no certainty a transaction will be completed by the end of the year.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip