Shutdown Forces Delay of U.S. Third Quarter GDP Advance Estimate

The Bureau of Economic Analysis postponed its scheduled release of the third quarter advance GDP estimate after a record federal government shutdown disrupted agency data publication. The move tightens the economic calendar ahead of the Federal Reserve’s December meeting, raising uncertainty for investors and policymakers who rely on timely growth and inflation readings.

The Bureau of Economic Analysis announced on November 25, 2025 that it would postpone the planned release of the advance estimate of third quarter GDP after a recent, record federal government shutdown interrupted the normal flow of source data. The agency said other products that depend on those inputs, including county level GDP, income statistics and the Personal Income and Outlays report for September, will also be rescheduled.

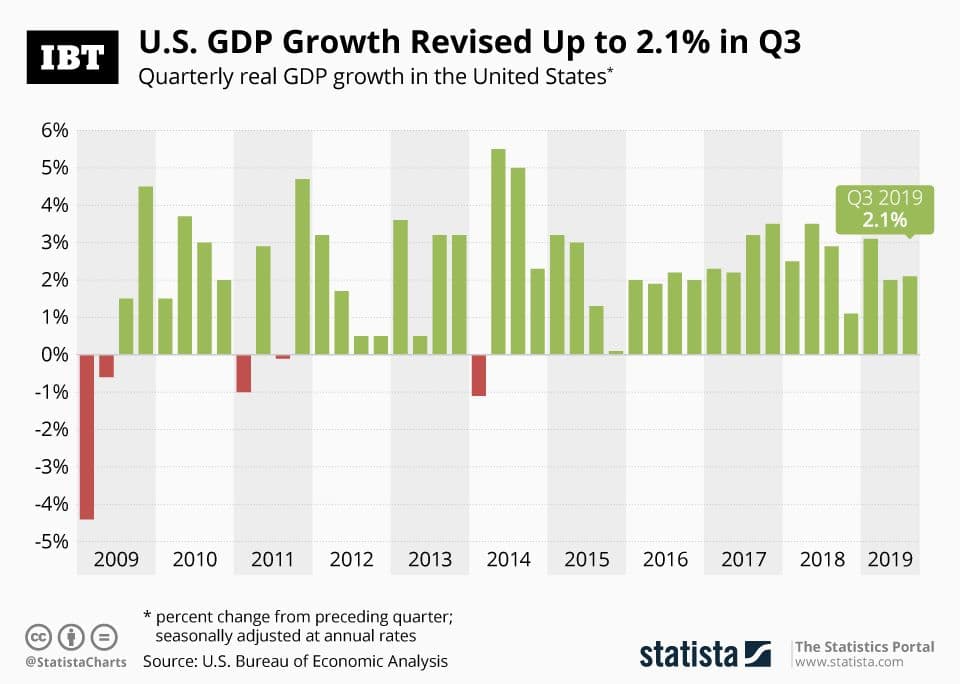

The advance GDP estimate is the first comprehensive snapshot of quarterly economic activity and normally arrives about a month after the quarter ends. It feeds directly into market expectations and policymaker assessments of the growth trajectory. Personal Income and Outlays contains the personal consumption expenditures price index, the Federal Reserve’s preferred inflation gauge, so the delay removes a key piece of information used to calibrate monetary policy.

Economists noted the practical consequences. Without the advance GDP figure and the September Personal Income and Outlays data, headline growth rates and the latest PCE inflation numbers will be absent from the regular end of month data flow, compressing the calendar of releases that the Fed, investors and corporate planners use to update models and forecasts. The Fed’s December meeting is widely expected to be the next major policy decision point, and officials rely on a combination of payrolls numbers, CPI and PCE readings, and GDP estimates to assess the balance between growth and inflation.

The government shutdown that precipitated the postponements was unusually disruptive, interfering with the capacity of statistical agencies to process surveys and compile source documents. The effect is to increase near term uncertainty about the pace of growth and the recent trend in household spending. Analysts will need to defer revisions to third quarter GDP and any reassessments of the economic slowdown or resilience until the BEA and other agencies can rebuild the schedule of releases.

There is precedent for such fallout. Partial government closures in the past disrupted the timely publication of data, prompting temporary gaps and required catch up once funding resumed. The current interruption adds another variable for market participants weighing the outlook for interest rates and risk assets. In the absence of official numbers, traders and analysts tend to lean more heavily on private high frequency indicators such as consumer card spending, mobility measures and real time payroll trackers, which can substitute imperfectly for comprehensive source data.

Beyond the immediate market noise, the episode underscores a longer term risk to economic management. Recurrent interruptions in data availability could erode the reliability of the statistical record, complicate policy calibration and raise the cost of uncertainty for businesses making investment and hiring decisions. Policymakers faced with an uneven flow of official information may either delay decisions or act more conservatively, both of which carry economic trade offs.

The BEA did not provide a new timetable for the rescheduled releases on November 25. Economists and investors will watch for announcements over the coming days, and will adjust forecasts for third quarter growth and core inflation once the advanced estimates and related income reports are restored to the calendar.