Silver Nears $48.74 as Market Awaits Shutdown Outcome and Fed Direction

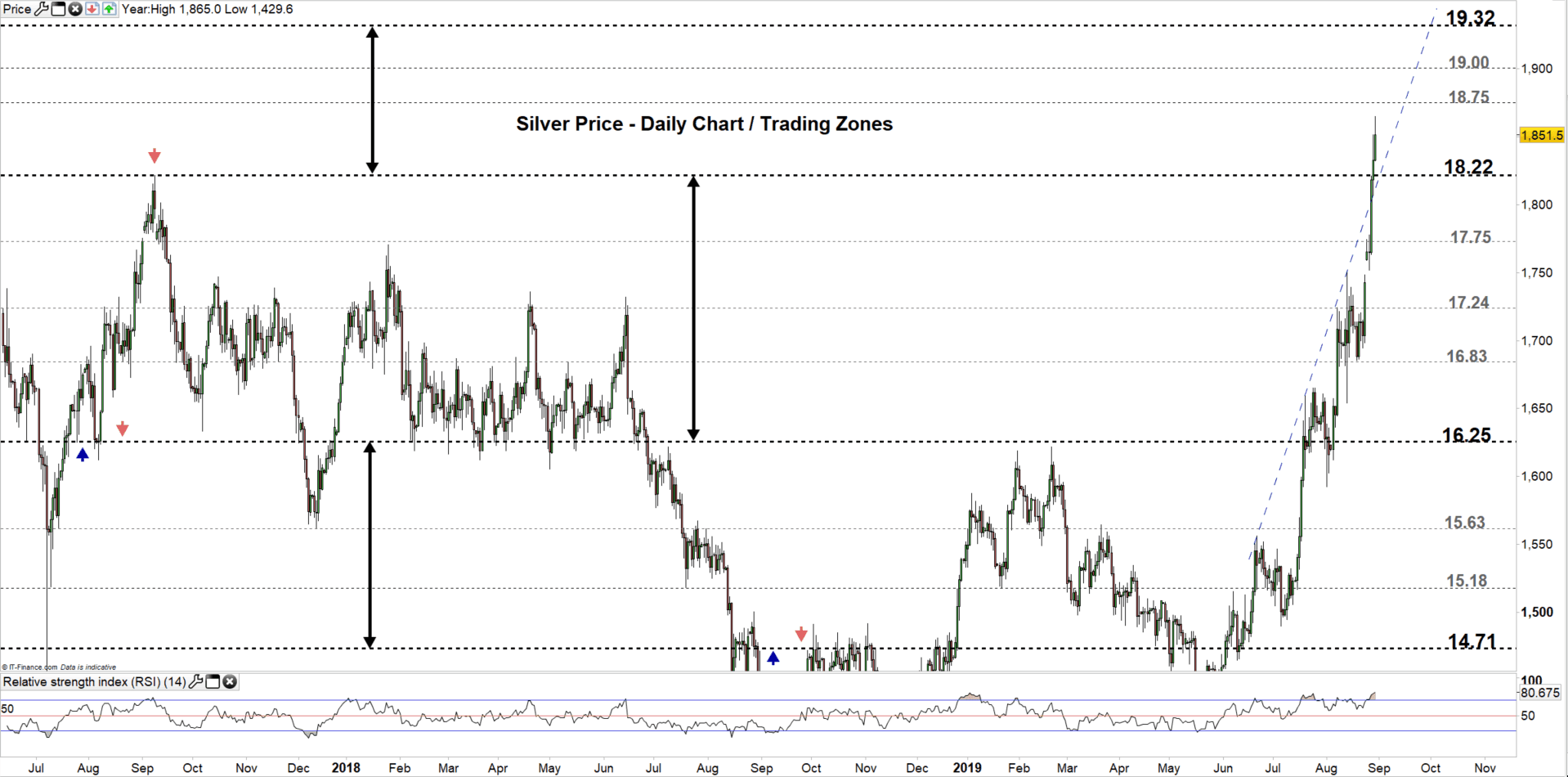

Silver traded with a constructive bias on November 7, 2025, hovering around $48.74 per ounce as a steadier gold, a range‑bound dollar and benign U.S. yields left the market poised for headline-driven moves. Traders are watching U.S. shutdown developments, shifts in rate‑cut expectations and micro signs of physical tightness — factors that could push silver toward $49–$50 or back under $48.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Spot silver edged toward $48.74 per ounce on Friday, supported by a calmer gold complex, a dollar that has remained range‑bound and U.S. Treasury yields that have shown little directional pressure. With macro variables relatively muted, market participants said the metal’s path for the session hinged on political headlines and evolving expectations about the Federal Reserve’s next moves.

The silver market has been trading with heightened headline sensitivity. Analysts and traders described the U.S. government shutdown risk as a key near‑term catalyst: renewed fiscal uncertainty could lift safe‑haven demand for precious metals, while a rapid resolution would likely remove that upside. At the same time, any changes in the probability of Fed rate cuts—already being monitored closely by markets—would alter real yield dynamics and the relative attractiveness of non‑yielding assets like silver.

Microstructure factors are also in focus. Observers noted that ETF issuance, reported physical premiums and dealer inventories can amplify price swings when headline drivers break the stalemate. Market commentary published with the price update suggested that fresh signs of tightness in physical markets could quickly propel silver into the $49–$50 range, whereas easing premiums or a sudden rise in yields could drag prices back toward the $48 handle.

The broader financial backdrop offered a mixed signal. With the dollar trading sideways and the 10‑year Treasury yield described as still‑benign, the immediate tailwinds for bullion have been modest but supportive. In that environment, flows into or out of silver exchange‑traded products and shifts in industrial demand or manufacturing data could matter more than usual for short‑term price moves.

An item of adjacent market relevance on Friday came from Affirm Holdings, which reported continued momentum in the asset‑backed securities market after extending a five‑year agreement with Amazon. The payments firm cited growth in merchant‑funded 0% APR loans, higher transaction frequency, and expansion of direct‑to‑consumer offerings such as the Affirm card, while reiterating a 4% target for revenue less transaction‑cost take rates. Market participants interpreted the update as a sign of durable capital‑market access for consumer finance players, a development that influences broader liquidity conditions even if its link to silver demand is indirect.

For traders and longer‑term investors, the immediate checklist remains anchored to macro indicators and physical market signals: daily moves in the dollar index and the 10‑year yield, intraday reports of ETF issuance or redemptions, and shifts in local physical premiums and dealer inventories. Until one of those vectors produces a clear directional impulse, prices are likely to oscillate around current levels, with episodes of volatility tied to headline news on the U.S. fiscal standoff or unexpected changes in Fed guidance.