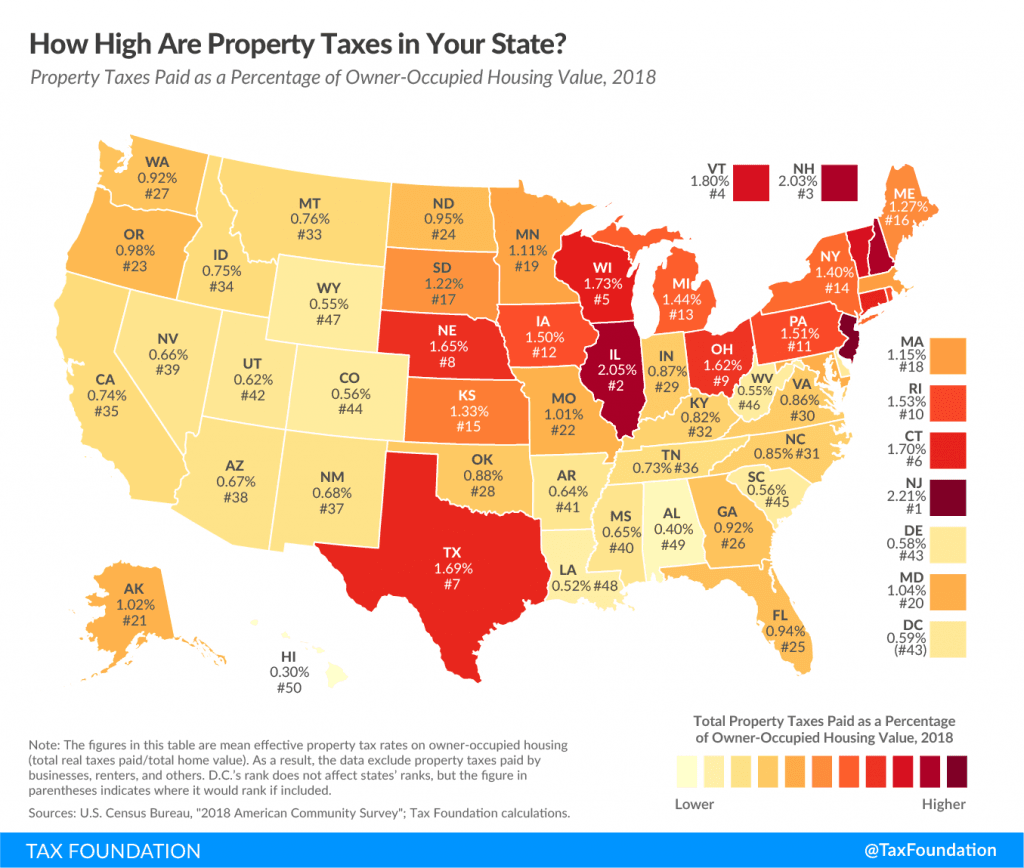

State study seeks property tax relief, could affect Wake County finances

On December 8, 2025 state lawmakers announced a bipartisan study to develop proposals aimed at easing property tax pressure on struggling homeowners. The effort matters to Wake County because cities and counties set local tax rates, and any state action that reduces homeowner liability could create budgetary tradeoffs for schools, public safety, and other services.

State legislators on December 8 launched a bipartisan effort to study and craft changes intended to help homeowners facing rising property tax bills. The committee framed its early goals around reducing homeowner property tax pressure while avoiding deep cuts to locally funded services such as public schools and public safety. The announcement set in motion a conversation that could reach Wake County taxpayers and leaders during the 2026 legislative calendar.

Under North Carolina law cities and counties set property tax rates and collect the bulk of revenue that pays for schools, sheriff offices, fire departments, and other local functions. That limited role for Raleigh means the state study will focus on tools the legislature could deploy to aid homeowners without simply shifting burdens to municipalities and counties. Lawmakers and local officials have described a range of fiscal tradeoffs, including whether the state would need to provide backfill funding to compensate for any reduction in local property tax receipts.

For Wake County the downstream effects are concrete. If the legislature enacts measures that lower homeowner tax bills but do not replace local revenue, county leaders could face pressure to trim budgets, draw down reserves, raise fees, or seek alternative revenue sources. That scenario could affect classroom resources, response times for emergency services, and local investment plans. Conversely, state assistance to offset local losses would place added demands on the state budget and compete with other priorities at the state level.

The announcement comes against the backdrop of recent state tax changes and a crowded 2026 legislative calendar. Lawmakers indicated the study would inform proposals to be debated next year, leaving residents and local officials months to weigh impacts and offer input. Wake County commissioners and municipal leaders will need to assess any draft proposals for their fiscal implications and plan outreach to constituents who may experience changes to their property tax bills.

Residents should monitor Wake County commission meetings and the unfolding legislative process in Raleigh. Any substantive proposals that emerge in 2026 will require careful balancing of homeowner relief with the need to sustain schools, public safety, and other essential local services.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip