Stocks Rally as Fed Injects Liquidity, Markets Watch Path to Rate Cuts

U.S. equities climbed on December 10 as the Federal Reserve stepped into money markets to ease year end funding strains, lifting the S&P 500 close to its all time high and driving gains in the Dow while the Nasdaq delivered a mixed performance. Investors welcomed the liquidity relief, but attention quickly shifted to whether the move alters the timing and pace of future rate cuts.

Markets advanced on December 10 after the Federal Reserve intervened in short term funding markets with Treasury bill purchases intended to ease pressure ahead of year end. The action provided obvious near term relief for cash markets, supporting risk assets as the benchmark S&P 500 rose toward its record level and the Dow posted a solid gain while the Nasdaq was mixed.

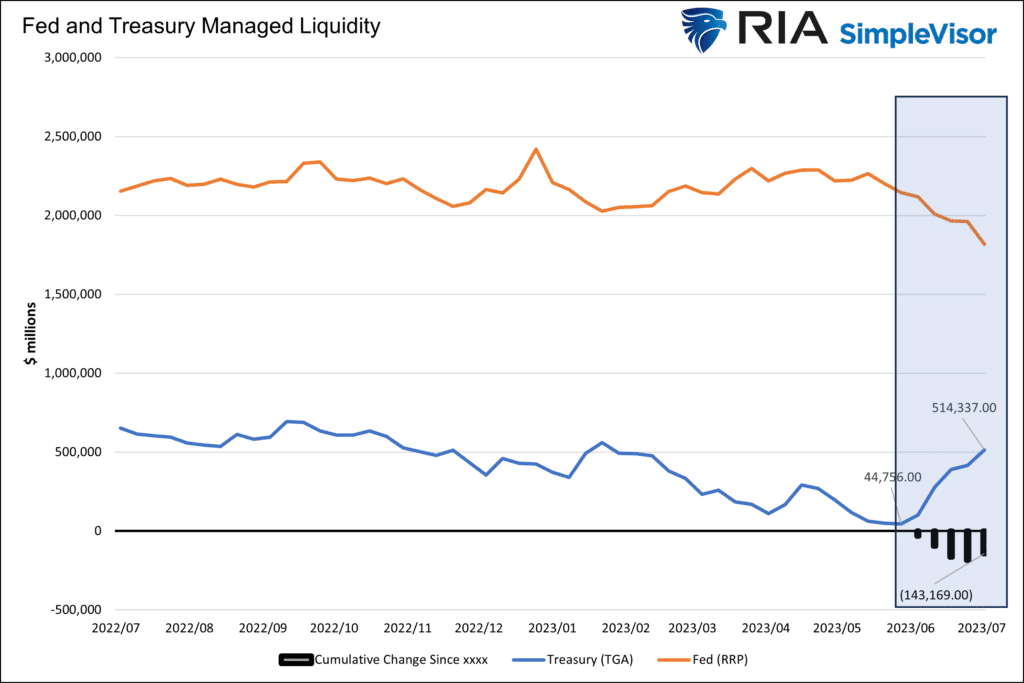

The Fed move targeted the acute strains that surface at quarter and year ends when demand for settlement cash typically spikes. By buying Treasury bills the central bank injected temporary reserves into the banking system and eased tensions in money markets that had pushed short term funding rates sharply higher in recent weeks. The step reduced the immediate need for forced asset sales and helped restore a more orderly pricing environment across short dated instruments.

Market participants interpreted the liquidity support as a pragmatic response to seasonal frictions rather than a shift in the Fed's long term policy stance. Traders and strategists focused on the further signals the central bank might provide about the timing of interest rate cuts. With inflation still above target in many measures and the labor market showing resilience, investors are parsing whether the liquidity intervention leaves the policy rate path unchanged or nudges policymakers toward a slower cadence of easing.

The liquidity move had clear market implications. Lowered stress in cash markets supported equities by narrowing funding cost margins for leveraged investors and market makers. That in turn helped equities climb closer to previous highs as buyers returned to staples of the market that had been sidelined during volatile sessions. At the same time, the mixed performance of the Nasdaq reflected uneven investor appetite for higher multiple growth names when the outlook for eventual rate cuts remains uncertain.

Despite the relief, short term funding dynamics remain a focus for both policymakers and market participants. The underlying drivers of recent strains are structural and calendar related. The combination of sustained Treasury issuance to finance fiscal deficits and regulatory and balance sheet management by banks leaves year end eyes on liquidity conditions each December. The Fed's purchases reduce immediate pressure but do not remove the structural tendency for funding rates to spike when cash demand outstrips supply.

Looking ahead, the market will take cues from future Fed communications and data on inflation and employment. If the central bank signals that the liquidity support was a one off, traders may again price in a higher probability of unchanged policy or delayed cuts. If officials indicate a willingness to deploy similar tools as needed, that could lower tail risks for short dated funding markets and bolster risk assets.

For investors the lesson is two sided. The Fed's intervention calmed an acute stress episode and buoyed the market in the short term. At the same time it underscored how sensitive asset prices remain to shifts in money market functioning and to evolving expectations about the Fed's path on rates.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip