Treasury Says FinCEN Notified Businesses in Minnesota Fraud Probe Involving Pandemic Aid

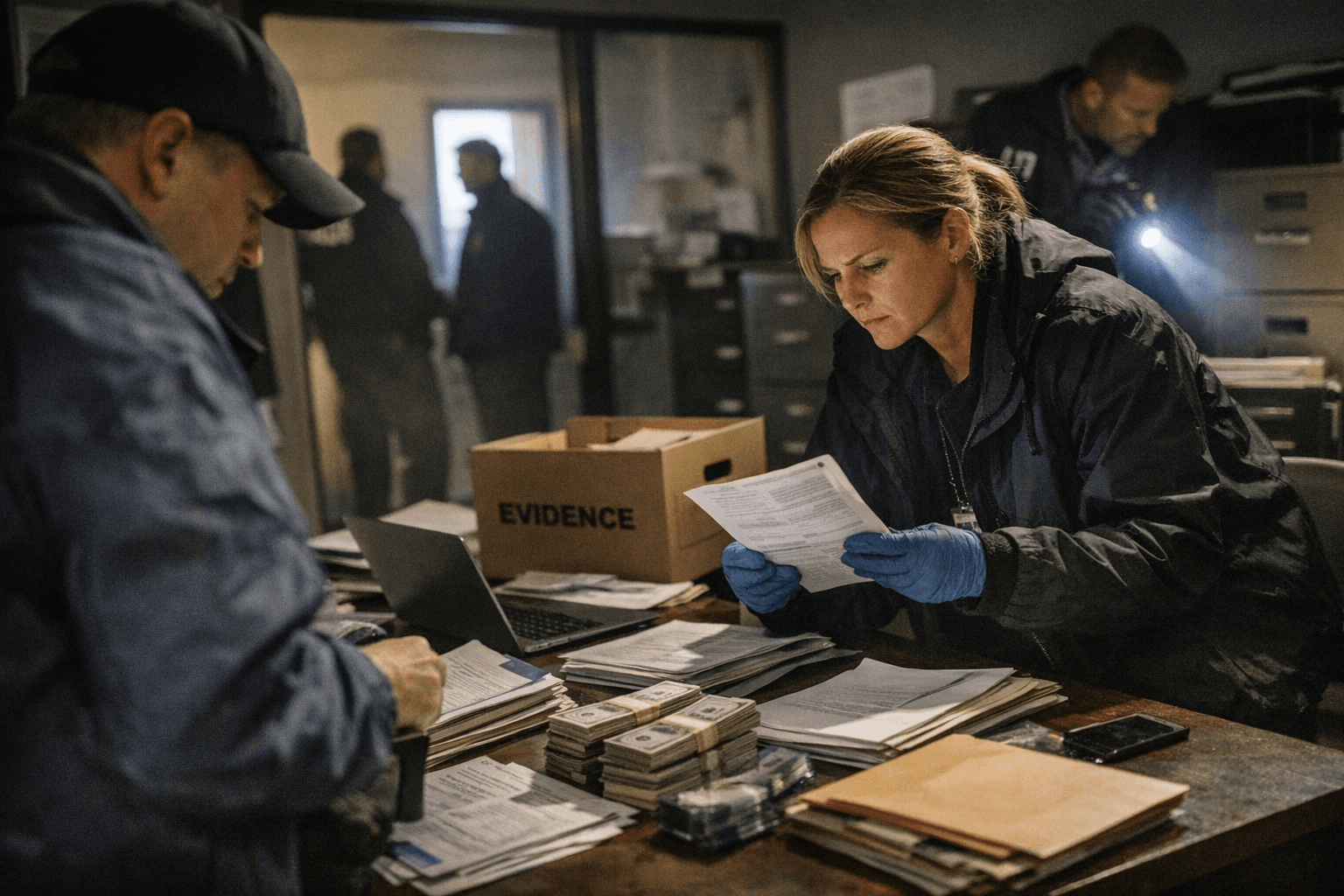

Treasury Secretary Scott Bessent said Jan. 9, 2026 that FinCEN has notified some businesses they are under investigation in an alleged Minnesota fraud scheme involving pandemic-era incentives and social services funds. The disclosure raises urgent questions about accountability for emergency aid, the protection of vulnerable communities, and how recent changes to corporate-beneficial ownership reporting may affect transparency.

Treasury Secretary Scott Bessent told reporters on Jan. 9, 2026 that the Financial Crimes Enforcement Network has notified some businesses they are under investigation in connection with an alleged fraud scheme in Minnesota involving pandemic-era incentives and social services funds. The Treasury statement did not identify the businesses, say how many were notified, or specify the precise allegations, whether charges have been filed, or which investigative agencies are leading the inquiry.

The announcement comes amid regulatory changes at FinCEN that have reshaped how beneficial ownership information, or BOI, is collected and used. In March 2025 the Treasury issued an announcement referenced by FinCEN, and on March 21, 2025 FinCEN said it would issue an interim final rule removing the requirement for U.S. companies and U.S. persons to report BOI under the Corporate Transparency Act. The interim final rule was published on March 26, 2025, and FinCEN has posted related materials on its BOI resource page, including a press release and alerts outlining new deadlines for foreign companies.

FinCEN’s public materials also show targeted flexibility and warnings tied to BOI procedures. The agency issued notices providing BOI reporting relief to victims of Hurricanes Debby and Francine, and it posted an alert warning that fraudsters are attempting to solicit BOI through scams aimed at those who may be subject to Corporate Transparency Act reporting requirements.

Officials did not say whether the BOI rule changes or the fraud-alert notices are related to the Minnesota investigation. The lack of specific information about targets, the number of businesses notified, alleged victims or investigative timelines leaves open critical questions about scale, intent and potential harm to communities that relied on pandemic-era incentive programs and social services.

Public health and social service advocates say alleged diversion of emergency funds can cause measurable harm. Pandemic-era incentives and social services were designed to shore up low-income households, stabilize housing and sustain community health services during a public health emergency. When those funds are misused, the consequence is not only lost money but reduced access to care, food insecurity and strains on local clinics and social workers that serve marginalized populations.

The uncertainty also raises policy questions about transparency and enforcement. Beneficial ownership reporting was intended to make it harder for bad actors to hide behind shell companies and to help law enforcement trace illicit flows. Changes that narrow BOI coverage for U.S. entities could complicate future investigations if investigators lose a consistent source of ownership information, though agency statements do not assert that outcome in this case.

FinCEN’s fraud alert underscores another risk: attempts to harvest sensitive ownership data from legitimate filers through deceptive solicitations. For communities and small businesses already stretched by the pandemic, such scams can compound financial vulnerability and undermine confidence in reporting systems meant to protect them.

Treasury’s disclosure signals the start of what officials must make transparent if accountability is to be credible: who is implicated, who suffered harm, and how recovered assets will be redirected to rebuild services. Federal and state authorities, including the U.S. attorney’s office in Minnesota and state law enforcement, have not been quoted in the Treasury materials. For communities dependent on pandemic and social service supports, the stakes of that transparency are fundamentally about health equity and trust in public institutions.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip