U.K. inflation slips to 3.6 percent, boosting chance of December rate cut

U.K. consumer price inflation eased to 3.6 percent in October from 3.8 percent in September, the Office for National Statistics reported, marking the first monthly decline since May. The softer reading reduced near term pressure on monetary policy, pushed up market odds of a Bank of England rate cut in December, and arrived just days before the government’s budget.

The Office for National Statistics said consumer price inflation fell to 3.6 percent in October, down from 3.8 percent in September, delivering the first monthly decline since May. Economists had expected a modest drop and the outcome was broadly in line with market forecasts, reducing short term pressure on the Bank of England as it weighs whether to begin easing policy in December.

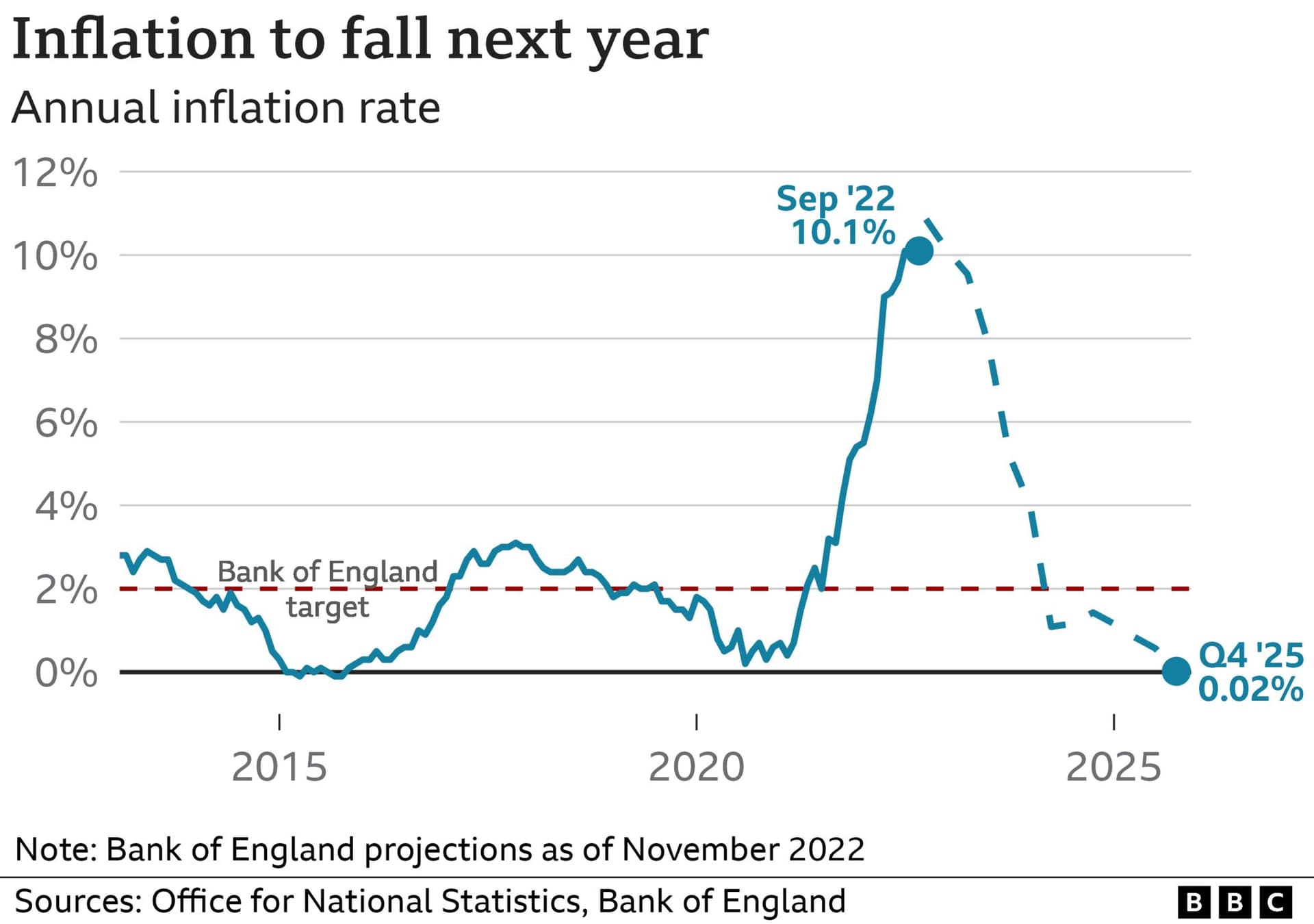

The ONS attributed much of the slowdown to lower household energy bills and cheaper hotel prices, which helped offset a rise in food inflation. At 3.6 percent the headline rate remains above the Bank of England’s 2 percent target, but the direction of travel has shifted from the sharp disinflation seen through 2024 and 2025. Inflation remains well below the double digit peaks recorded in 2022, underscoring the gradual normalization of price dynamics after the post pandemic shock.

Market reactions were immediate. Sterling weakened modestly and gilt yields fell after the data, reflecting higher odds among investors that the central bank will move to cut the Bank Rate next month. Traders and strategists have been watching a combination of slowing growth and continued disinflation as the key conditions that would permit a policy easing. The inflation reading arrives at a politically sensitive moment, with the government due to publish its budget later this week. Lower borrowing costs for the Treasury, implied by falling yields, could ease some fiscal pressure in the short term.

Analysts said the mix of easing energy driven components and sticky food prices creates a nuanced picture for policymakers. Lower energy costs are typically viewed as transitory in the inflation dialogue, while persistent food inflation tends to be more visible to households and can complicate the politics of both monetary and fiscal choices. For the Bank of England, that trade off is acute because cutting rates too soon risks reversing progress on headline inflation, whereas delaying cuts risks further weakening to an already slowing economy.

The economic backdrop has shown clear signs of cooling. Consumption and business investment have moderated from the stronger post pandemic rebound, and several indicators point to subdued demand growth heading into the end of the year. That slowing momentum, together with ongoing disinflation, is the central argument used by market participants who now expect a greater likelihood of policy easing in December.

Looking ahead, investors will focus on the Bank of England’s next decision and subsequent inflation prints to gauge whether the October decline is the start of a sustained trend or a temporary pause. The government budget will also be scrutinized for measures that could affect inflation or growth, particularly given the sensitivity of food prices and household energy costs to both international markets and domestic policy.

%3Amax_bytes(150000)%3Astrip_icc()%2FGettyImages-2184732381-bf69c62d628842e29b72bd5917851542.jpg&w=1920&q=75)