Wall Street Awaits Nvidia Results, Tests AI Hardware Investment Thesis

Investors are watching Nvidia's quarterly report on Wednesday as a pivotal check on the AI hardware boom, with analysts flagging a wide revenue range for the firm's data center business and options markets pricing in large post-earnings swings. The outcome could reshape valuations across chipmakers and global tech, while influencing expectations for Federal Reserve rate cuts and the outlook for bond markets.

Wall Street is entering a tense session as Nvidia releases quarterly results and commentary on Wednesday, a disclosure that market participants view as a central test of the artificial intelligence hardware investment thesis that drove a dramatic run for tech stocks earlier this year. After a sharp run up through much of 2025, U.S. equities have pulled back in November and traders say Nvidia's numbers could either reassure sellers or trigger a deeper retreat.

Analysts compiling estimates ahead of the report have suggested a broad range for Nvidia's data center revenue, from the high teens of billions to the mid 50s of billions in quarterly sales, underscoring both the scale of the business and the uncertainty investors face. Options markets are signaling sizeable implied volatility around the print, with traders positioning for large post-earnings moves that could ripple through related equities.

The stakes extend well beyond one company. Market strategists note that Nvidia's results will be read as a proxy for the sustainability of AI-driven spending across cloud providers and corporate IT budgets. A strong beat and robust guidance would bolster the case for continued investment in AI accelerators and could prop up valuations for other chipmakers that have benefited from the AI narrative. Conversely a miss or cautious outlook would revive concerns about valuation excess in a sector that has become highly concentrated, potentially prompting broader correction across global technology stocks.

Geo economic risks are also in investors' minds. Ongoing export control measures affecting high end chip shipments to China remain a key risk factor for semiconductor supply chains and revenue visibility. Nvidia's disclosure on geographic revenue exposure, channel inventories and any references to regulatory frictions will be closely parsed for indications of how export rules are altering demand dynamics and pricing power.

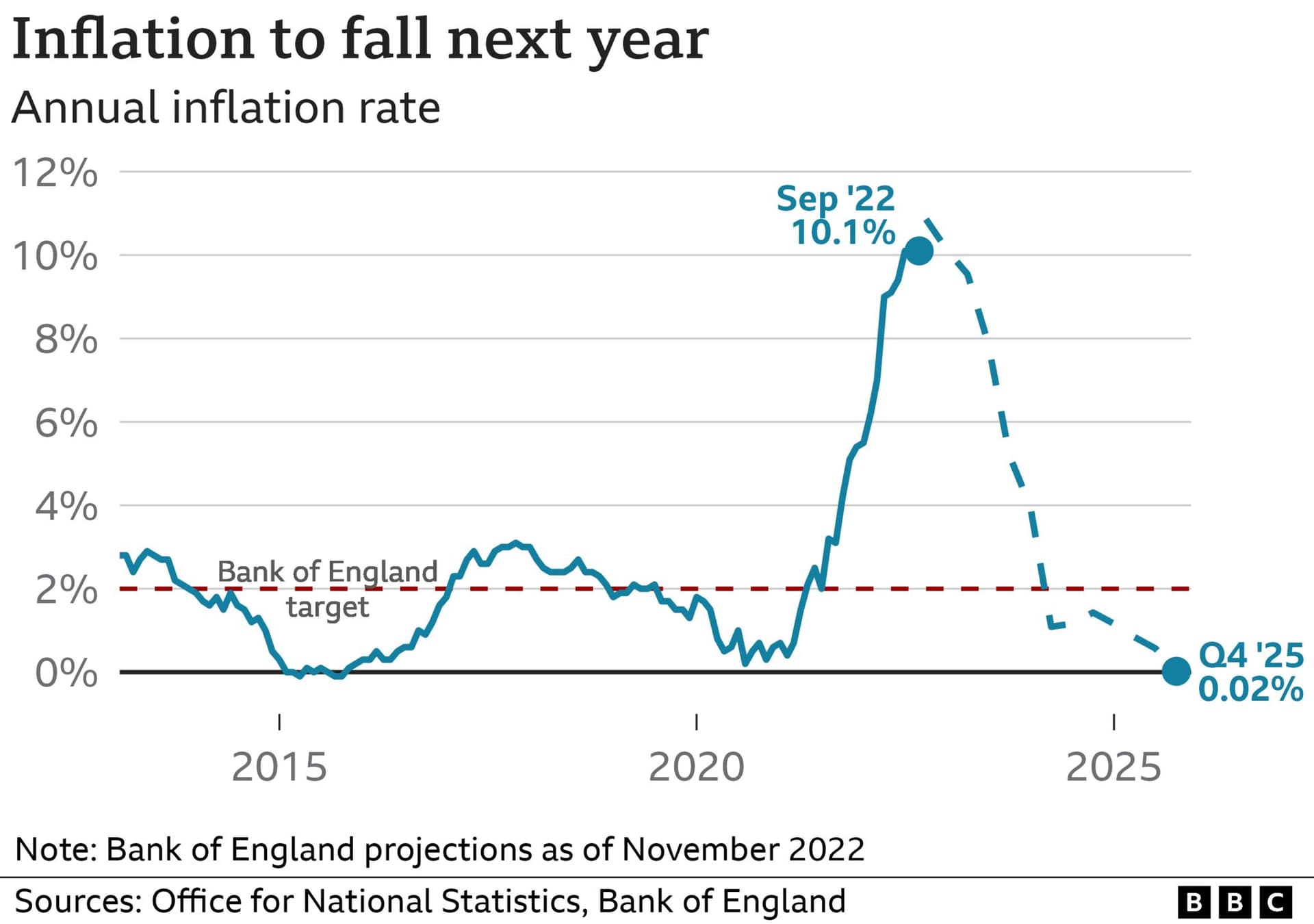

Fixed income markets are watching as well. Traders have been recalibrating the timing for Federal Reserve rate cuts this year, and a strong Nvidia result that signals accelerating tech and cloud spending could reinforce concerns about persistent demand driven inflation, potentially delaying expectations for easing monetary policy. A disappointment could have the opposite effect, sending investors toward safe havens and compressing yields. In either case, the report has the potential to change the risk reward calculus for both equities and bonds.

Longer term, Nvidia's report will feed into debates over the structural impact of AI on productivity and corporate investment. The combination of concentrated market leadership, rapid capital spending on AI infrastructure and geopolitical supply constraints creates a high reward but high risk investment environment. For now, the market's mood is one of cautious waiting, with a single earnings release capable of catalyzing substantial repositioning across portfolios and asset classes. Investors will be watching revenue detail for data center operations, commentary on demand trends and any guidance that sheds light on the durability of AI driven growth.

%3Amax_bytes(150000)%3Astrip_icc()%2FGettyImages-2184732381-bf69c62d628842e29b72bd5917851542.jpg&w=1920&q=75)