U.S. Container Imports Fall 7.8 Percent, China Demand Softens

U.S. container imports fell 7.8 percent in November, driven by a near 20 percent drop in volumes from China and one fewer day in the Thanksgiving month, Descartes Systems Group reported. The decline signals cooling goods demand as imports for the first 11 months of 2025 were roughly flat with 2024, with implications for freight markets, port revenues, and inflation dynamics.

U.S. seaports handled about 2.18 million twenty foot equivalent units in November, a decline of 7.8 percent from a year earlier, supply chain technology provider Descartes Systems Group reported on December 9. The fall reflected a normal seasonal easing, the calendar effect of one fewer day in the Thanksgiving month, and a marked pullback in imports from China, which dropped nearly 20 percent year on year and accounted for a large share of the overall decline.

Despite the year on year drop the November total was still the fourth strongest November on record, underscoring that volumes remain elevated relative to long run norms. For the first 11 months of 2025 aggregate import volumes were about flat compared with the same period in 2024, a slowdown from the robust growth observed earlier in the year. Descartes attributed the moderation to softer ordering by U.S. firms and the knock on effects of shifting trade patterns and tariffs.

The data add to mounting evidence that goods demand in the U.S. economy is cooling as the year closes. Economists track container volumes as a timely indicator of global goods trade and manufacturing activity because they capture orders, shipments and inventory cycles. A sustained pullback in imports tends to relieve upward pressure on goods prices, though services sector strength can keep overall inflation elevated.

Market participants said the combination of China specific weakness and a flattening of year to date imports will press on freight markets. Lower import volumes typically reduce short term congestion at ports and can weaken ocean freight rates, which rose sharply in previous years when supply shocks and surging demand strained capacity. For U.S. ports and terminal operators a moderation in volume growth has revenue implications, and it can temper demand for additional labor and equipment in peak season planning.

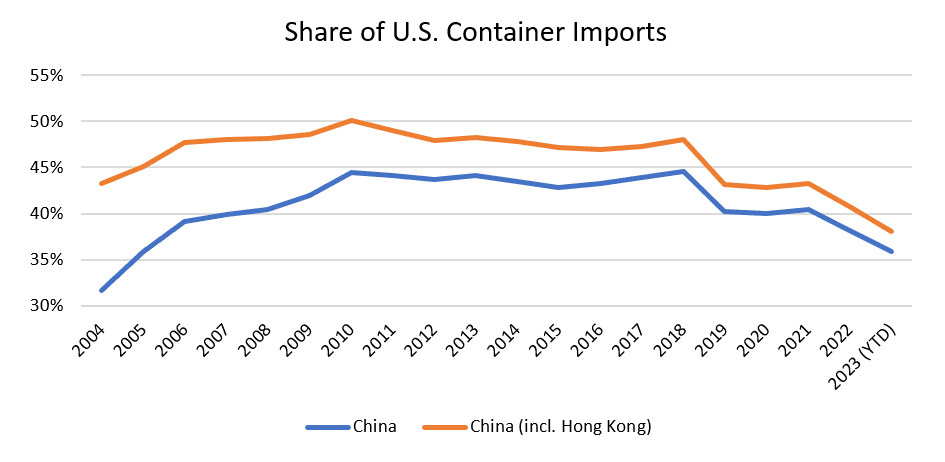

The near 20 percent decline in volumes from China points to both cyclical and structural forces. Cyclically, weaker Chinese factory orders and inventory rebalancing in global supply chains have reduced shipments. Structurally, companies are continuing to adjust sourcing strategies in response to tariffs and geopolitical disruption, shifting some flows away from China to alternative suppliers and nearshoring destinations. Those shifts can dampen growth in bilateral trade even as global trade stabilizes.

Retailers and inventory managers will be watching December shipments closely as they finalize holiday season receipts and plan replenishment for the first quarter. If import volumes remain subdued, businesses may delay additional orders until inventories fall to targeted levels, reinforcing the cooling trend.

The November figures underscore a transition from the catch up and restocking phase of 2023 and early 2024 to a more measured goods demand environment. For policymakers, freight and trade data of this sort provide a complementary lens on economic momentum and inflationary pressures as they evaluate the stance of fiscal and monetary policy heading into 2026.