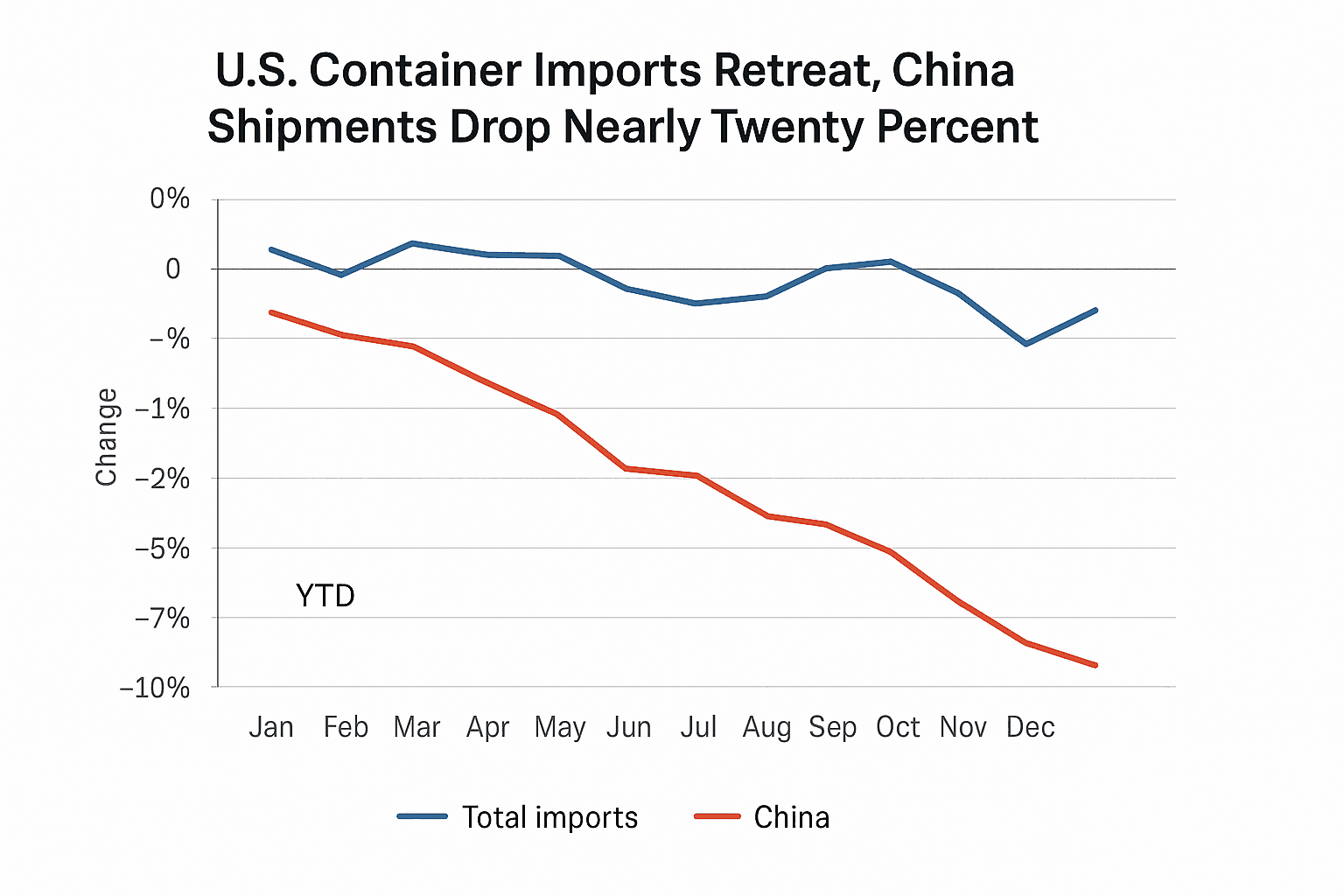

U.S. Container Imports Retreat, China Shipments Drop Nearly Twenty Percent

U.S. containerized imports fell 7.8 percent year over year in November 2025, a shift that signals cooling demand for consumer goods and strains for ports and logistics firms. The decline was driven largely by a near 20 percent fall in imports from China, and analysts warn uncertainty over tariff policy and high retail inventories could prolong weakness into early 2026.

Descartes Systems Group reports today that U.S. containerized imports fell 7.8 percent year over year in November 2025, totaling 2,183,048 twenty foot equivalent units. Imports from China were particularly weak, down about 19.7 percent, a major driver of the overall decline. Despite the drop, Descartes noted that November was still the fourth strongest November on record, underscoring that volumes remain elevated in absolute terms even as growth slows.

For the first 11 months of 2025, U.S. container volumes were only 0.1 percent above the same period in 2024, a sharp deceleration from stronger growth earlier in the year. The slowdown reflects a mix of factors that industry analysts and trade groups identify as temporary and structural. Timing effects played a role in November, with one fewer shipping day compared with the prior year, which compressed monthly throughput. Beyond calendar mechanics, many U.S. retailers entered the holiday season with well stocked inventories after aggressive restocking in previous quarters, reducing the need for new import shipments.

Trade policy uncertainty also emerged as a central concern. Changes in tariff policy and the possibility of further adjustments are prompting importers to delay or reroute orders rather than commit to large shipments. That caution can suppress near term import demand and complicate forecasting for carriers and terminals that plan capacity months in advance.

The November decline carries immediate market implications. Lower cargo volumes typically pressure spot freight rates and container lease rates, squeezing margins for ocean carriers that have benefited from elevated pricing in prior years. Ports and terminal operators may see slower gate volumes and lower revenue from stevedoring and ancillary services, with knock on effects for trucking and rail providers that move containers inland. For shippers and retailers, decreased import flows can reduce congestion and demurrage costs but also make supply chains more sensitive to future demand spikes because inventories are already high.

Macro economic implications are modest but noteworthy. Softer goods imports can dampen goods price inflation by easing supply constraints and reducing upward pressure on freight costs. That dynamic could interact with the broader inflation picture as policymakers assess whether price pressures are sustained. If import weakness persists into early 2026, the pattern could signal a rebalancing from goods to services consumption that has been underway since the pandemic era.

Looking ahead, the trajectory of imports will hinge on how quickly tariff policy uncertainty is resolved and on seasonal restocking cycles in the first quarter. If importers remain cautious, weaker cargo demand could extend into early 2026 and further erode year over year growth rates. For now, the data point to an import market moving from the white hot levels seen in recent years toward a more normalized, but still high, run rate.