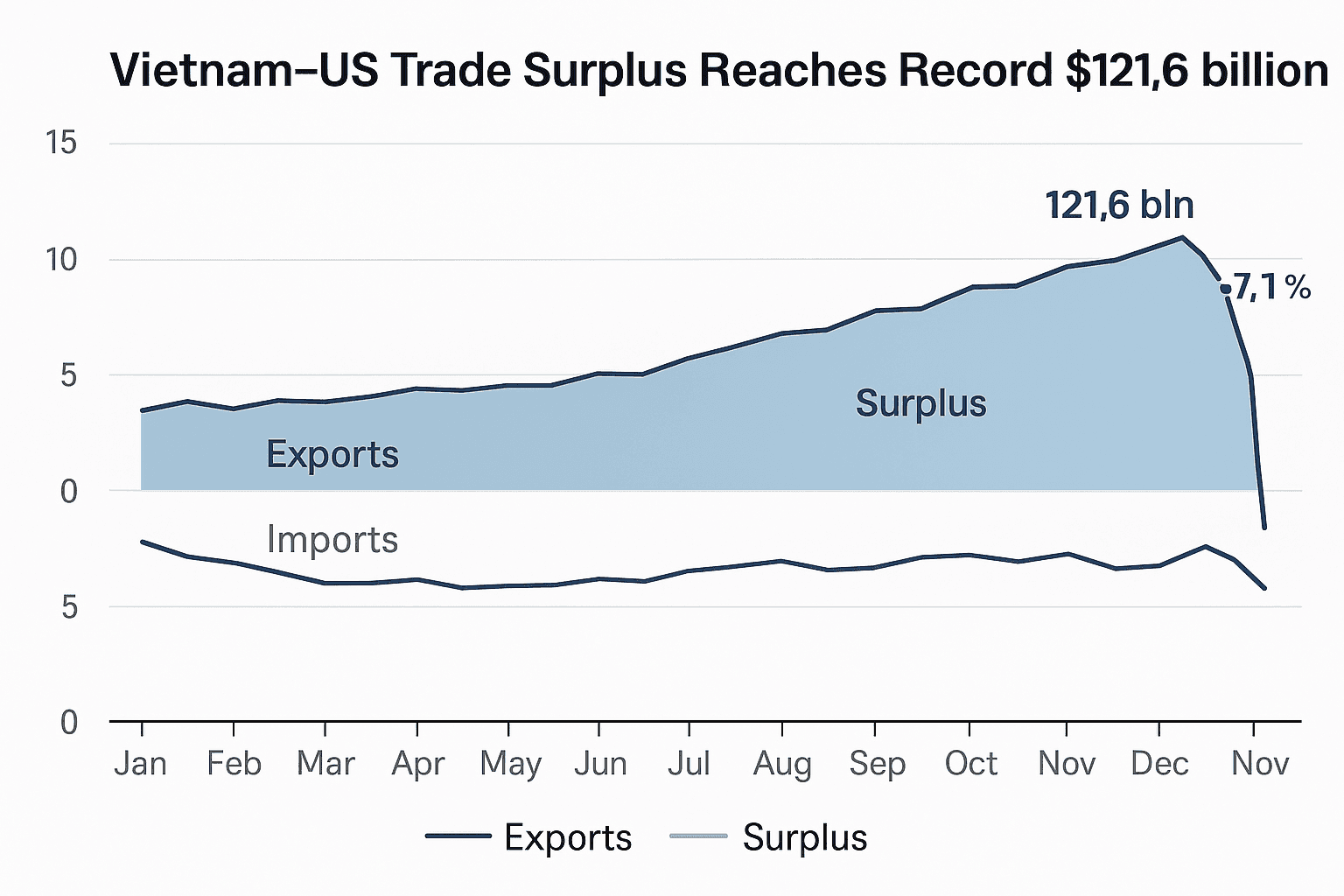

Vietnam United States trade surplus reaches record $121.6 billion

Vietnam posted a record bilateral trade surplus with the United States of $121.6 billion through November 2025, underscoring the resilience of its export machine despite U S tariffs introduced in August. November shipments fell 7.1 percent month on month, but strong manufacturing momentum, supply chain relocation, and foreign investment inflows have kept year to date flows at historically high levels, raising fresh questions about trade policy and economic balance.

Official data released on December 6 showed Vietnam's trade surplus with the United States climbed to $121.6 billion in the first 11 months of 2025, a record figure that highlights how deeply integrated the Southeast Asian economy has become in American supply chains. The headline comes even as Washington imposed tariffs in August on certain Vietnamese goods, a move intended to curb alleged unfair trade practices.

November exports to the United States eased, falling 7.1 percent month on month, according to the data. That slowdown, while notable, did little to blunt the year to date surge driven by continued strength in factory output and the reallocation of manufacturing away from China. Electronics assembly, mobile devices and components, textiles and apparel, and other consumer durable goods have remained principal sources of export growth, supported by foreign direct investment that has flowed into Vietnamese industrial parks and special economic zones.

The persistence of the surplus despite tariffs has two immediate implications. First, tariffs applied selectively have so far not reversed the broader trend of production relocation and investment that has underpinned export expansion. Second, the size of the bilateral imbalance is likely to sustain political pressure in Washington for further trade measures or tougher enforcement actions, even as U S companies and consumers continue to rely on competitively priced Vietnamese goods.

Trade officials in Hanoi are engaged in ongoing discussions with their counterparts in Washington to address the tensions, while seeking to protect the investment and jobs that fuels the export sector. Negotiations are likely to focus on product specific issues, verification of trade practices, and potential remedies designed to channel trade adjustment without disrupting the broader commercial relationship.

Market participants warn that sustained confrontation could have knock on effects. A protracted tariff escalation or broader restrictions could prompt multinationals to reconsider supply chain strategies, slow new capital projects, and raise costs for U S importers. Conversely, a negotiated settlement that resolves disputed practices while preserving market access would support continued investment and keep export led growth on track in Vietnam.

Long term, Vietnam’s role as a manufacturing hub for high volume consumer electronics and apparel is likely to persist, driven by competitive labor costs, a growing network of suppliers, and ongoing investment from multinational corporations diversifying production footprints. Policymakers in Hanoi face the task of balancing export growth with measures to avoid overconcentration in a single market and to upgrade the domestic value added of production.

Economically, the immediate challenge for Vietnam will be to sustain export momentum while managing external pressures and to use inflows to broaden industrial capabilities. For the United States, policymakers must weigh the short term political benefits of tariffs against the potential longer term costs to supply chain resilience and consumer prices. The record surplus through November crystallizes those tradeoffs.