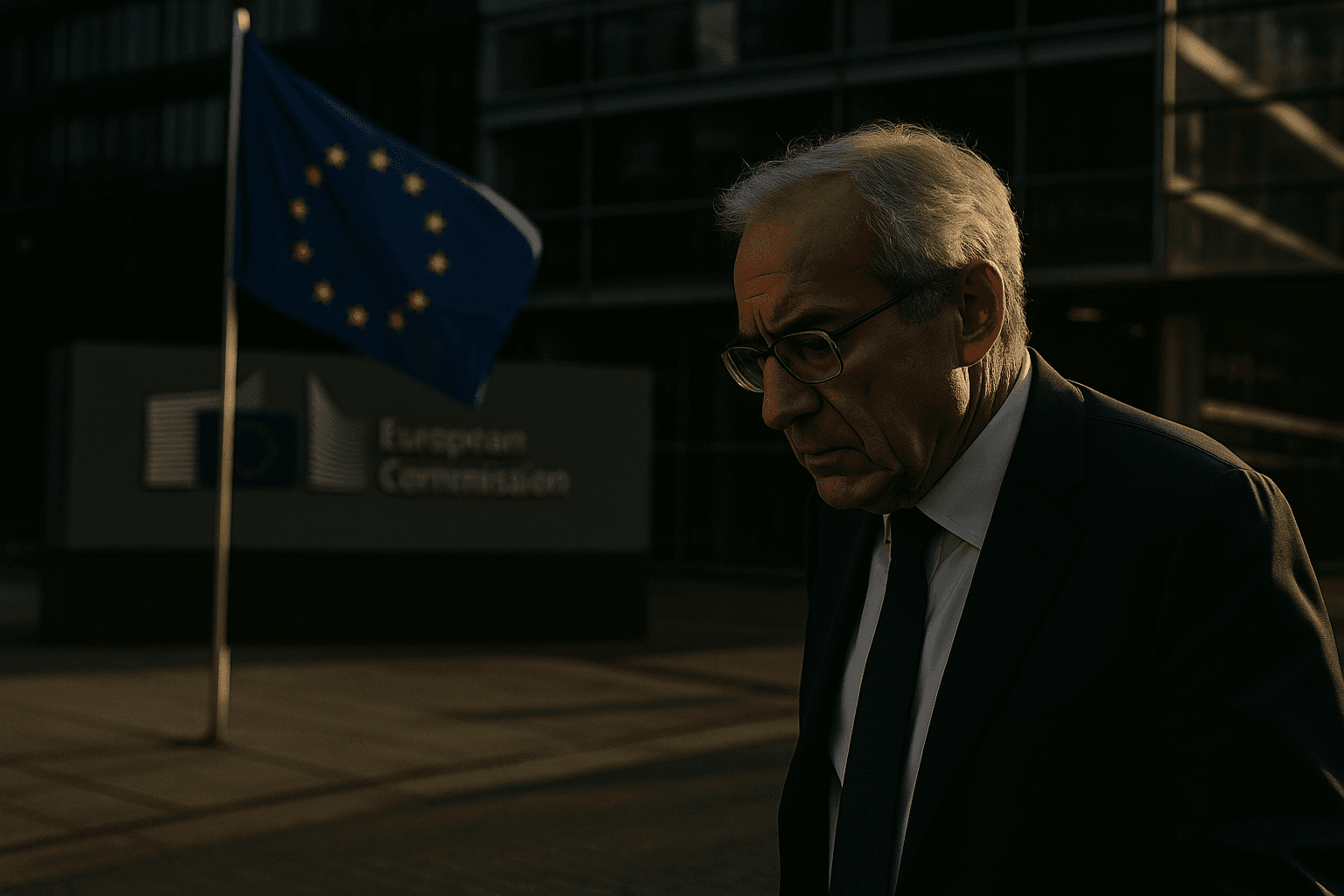

Vivendi makes final legal push to avert EU fine over Lagardère deal

Vivendi mounted a final defense on December 10 at a closed European Commission hearing, seeking to avoid a potential penalty after regulators accused the company of breaching merger procedure by closing its acquisition of publisher Lagardère before official clearance. The outcome matters for investors and dealmakers because the Commission could impose a fine of up to 10 percent of global revenue, and the decision is expected next year.

Vivendi presented its arguments to senior European Commission competition officials and French antitrust authorities on December 10 as it attempted to head off a potential fine linked to its takeover of Lagardère. The hearing was closed to the public and was attended by lawyers for Lagardère, reflecting the high stakes for both firms as regulators probe whether the acquisition breached the bloc's standstill obligation.

The Commission opened the infringement proceeding after the merger had already been cleared, a sequence that has intensified scrutiny of the procedural rules that govern EU merger reviews. At issue is whether Vivendi implemented the transaction or took steps to integrate the businesses before receiving final clearance, which would constitute a violation of the standstill requirement. If the Commission finds a breach, it can impose a fine of up to 10 percent of global revenue, a penalty that can be financially and reputationally consequential for large conglomerates.

Vivendi denied any procedural breach and used the hearing to lay out a last ditch legal defense to competition officials and national enforcers. The company argued that its conduct fell within the bounds of EU merger rules and sought to persuade regulators that sanctions were not warranted. Lagardère's legal team attended the session but public statements from the parties were not released.

The case highlights a broader regulatory trend in Europe in which competition authorities have signaled stricter enforcement of merger procedure and a willingness to pursue formal sanctions when firms are perceived to have flouted rules. For dealmakers, the potential for retrospective investigations adds an element of legal risk to transactions, particularly in sectors where concentration and media plurality raise sensitivity with regulators.

Market participants are watching the case for its potential to shape the compliance calculus for future mergers. A substantial fine would not only affect Vivendi's balance sheet, it would also serve as a deterrent to rapid postclosing integration when clearances are still pending. Legal specialists note that even the prospect of sanctions can increase deal costs, prompt longer hold separate arrangements, and influence the timing of integration steps to avoid regulatory exposure.

The Commission cleared the merger prior to launching the present investigation, a procedural twist that underscores the complexity of multi stage regulatory review in the EU. A formal decision on whether Vivendi breached the standstill obligation is expected next year. Companies facing adverse findings typically have the ability to appeal to the EU courts, a process that can extend for years and create prolonged uncertainty.

For media and publishing markets the case is also reputational. Regulators emphasize that adherence to merger rules preserves the integrity of the enforcement system. The Vivendi matter will be watched closely by executives, investors, and antitrust practitioners for signals about how rigorously procedural infractions will be punished going forward.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip