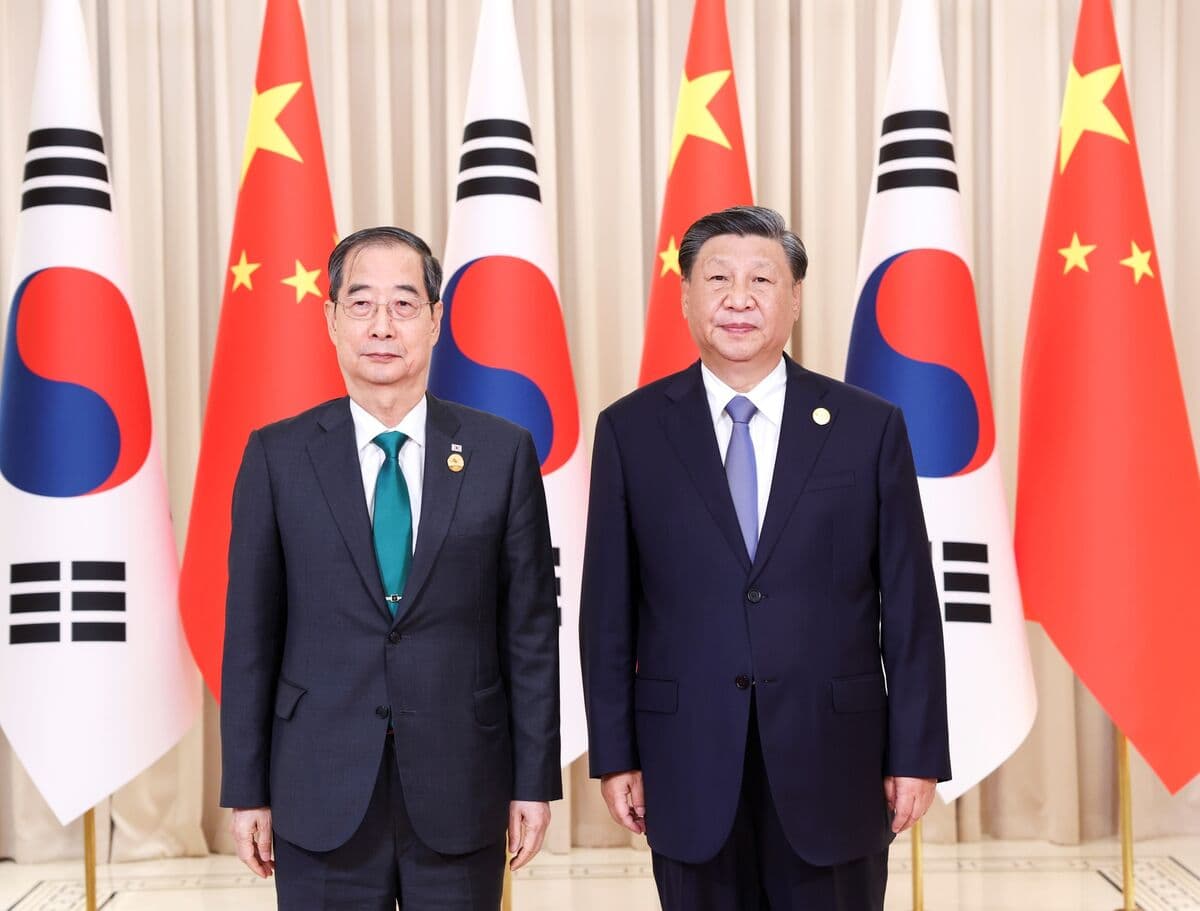

Xi and Lee Meet in Seoul to Recalibrate Economic and Strategic Ties

Chinese President Xi Jinping will meet South Korean President Lee Jae‑myung on the sidelines of the Asia‑Pacific Economic Cooperation summit, marking Xi’s first visit to South Korea in 11 years. The encounter signals both leaders’ intent to repair bilateral relations strained by Seoul’s closer alignment with Washington, with immediate implications for trade flows, investment patterns and regional supply chains.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Xi Jinping’s face‑to‑face meeting with President Lee Jae‑myung on Saturday in Busan comes at a delicate moment for East Asian geopolitics and global markets. The discussions, scheduled on the sidelines of the APEC summit and confirmed by Lee’s office, follow separate sessions both leaders held with U.S. President Donald Trump, during which Seoul and Washington finalized a trade and investment accord that will see Korean firms channel “billions of dollars” into the United States each year.

The summit provides a forum for Seoul to thread a narrow needle: preserve deep economic ties with China, South Korea’s largest trading partner, while maintaining an increasingly robust security and investment relationship with Washington. Trade with China accounts for roughly a quarter of South Korea’s total trade, and Korean exporters remain heavily integrated with Chinese supply chains for electronics, components and consumer goods. At the same time, Seoul has incrementally aligned with U.S. strategic priorities in recent years, from security cooperation to semiconductor policy.

Market participants will watch the meeting for signals on trade cooperation, investment facilitation and regulatory coordination. Global investors have been attentive to Korea’s balancing act: Korean chipmakers and automakers have moved to diversify production footprints after a period of heightened geopolitical risk. In recent years, major South Korean firms have committed tens of billions of dollars to build semiconductor fabrication plants and auto factories abroad, notably in the United States, as part of a “friendshoring” trend that reduces exposure to any single market.

Rebuilding Sino‑Korean ties could reduce near‑term business friction — easing non‑tariff barriers, restoring cross‑border tourism and stabilizing supply‑chain logistics — but it is unlikely to reverse the structural realignment toward the U.S. established by Seoul’s recent policy choices. The new U.S.–South Korea trade and investment framework underscores that shift: while it opens a channel for Korean capital to flow into U.S. semiconductor and other strategic sectors, it also codifies closer economic coordination with Washington that Beijing will monitor closely.

For policymakers, the meeting is an exercise in risk management. Beijing seeks to prevent further polarization in a region vital to its growth trajectory, while Seoul must weigh the economic costs of dependence on a single market against the security benefits of alliance. Economists note that restoring warmer government‑to‑government relations can have measurable economic effects: smoother customs procedures, resumed cultural exchanges and renewed investment dialogues can lift export growth and service-sector incomes that are sensitive to diplomatic climate.

Longer term, the encounter highlights a pattern in East Asian diplomacy: countries increasingly pursue hedging strategies that combine economic engagement with China and strategic alignment with the United States. The Saturday talks will not resolve those tensions, but they can set practical parameters for cooperation that matter to investors, exporters and consumers across the region.