AMD Prepared to Pay 15 Percent Fee on China AI Shipments

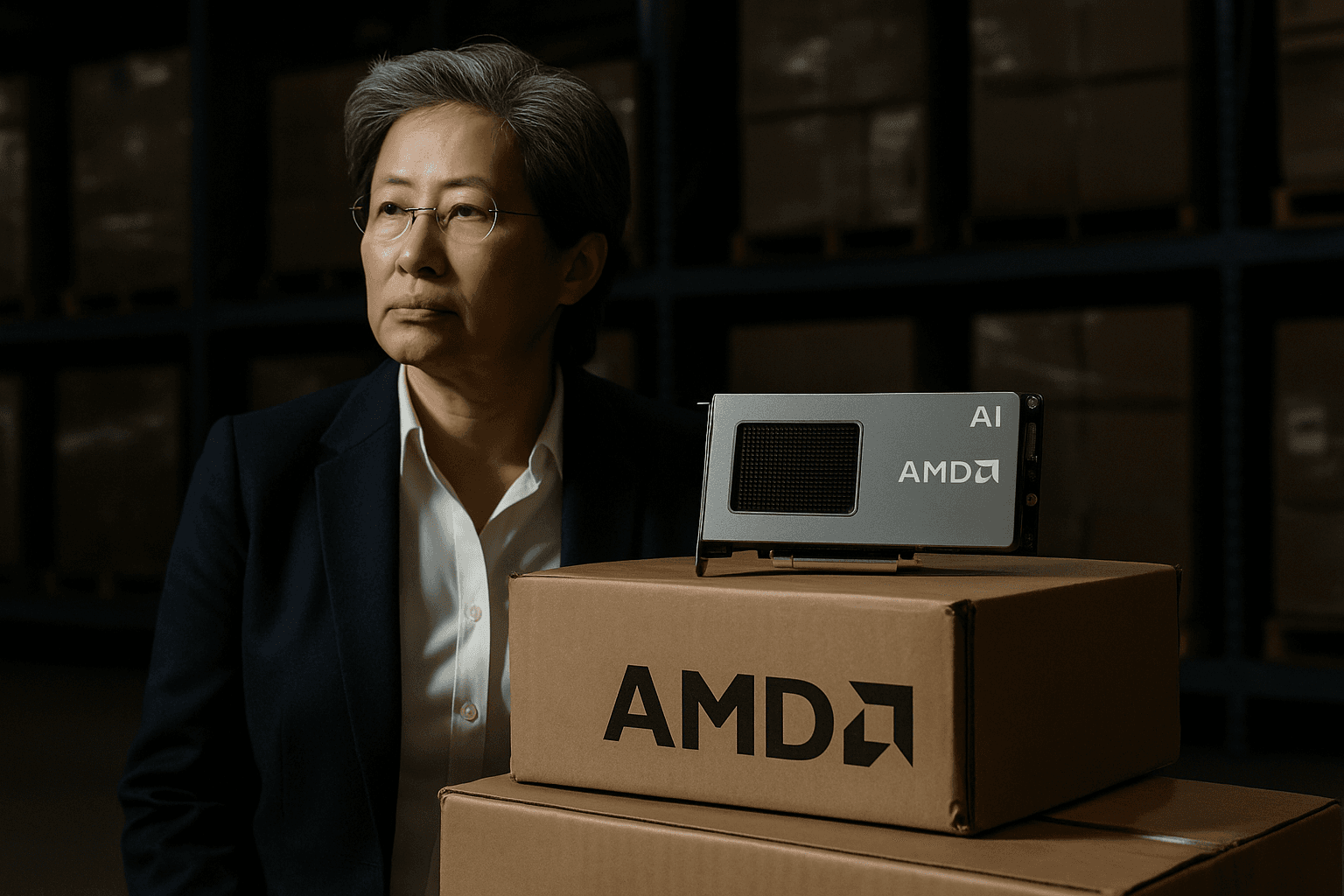

AMD chief executive Lisa Su said the company is prepared to accept a proposed 15 percent fee on exports of its MI class AI accelerators to China, a concession tied to recent U.S. licensing arrangements. The move highlights the fraught balance between national security controls and maintaining market access for leading chipmakers, a dynamic that could reshape investment, supply chains and policy debates in Washington.

At a technology conference on December 4, AMD chief executive Lisa Su said the company was prepared to pay a proposed 15 percent fee on shipments of MI class AI accelerators to China, a condition linked to U.S. licensing arrangements that have permitted some advanced chip exports under the current administration. The statement reflects an emerging commercial reality as firms weigh compliance with tighter controls and continued access to one of the largest markets for computing hardware.

The MI class devices are AMD branded data center accelerators designed for artificial intelligence workloads, used by cloud providers and enterprise customers for training and inference. Under recent U.S. policy changes, certain high performance chips may be exported under licenses that incorporate limits intended to reduce the risk that advanced computing power is used in ways that could harm U.S. national security. The proposed fee is part of those licensing terms, and Ms. Su indicated AMD would accept it as a price of doing business in China.

The comments come amid intense debate in Washington over export controls and the broader strategic competition with China. Lawmakers, regulators and industry groups are evaluating how to curb technology transfer without ceding the commercial advantages of U.S. semiconductor companies. Some in Congress have urged stricter measures, while executives have warned that severely constraining exports could push customers toward alternative suppliers and accelerate technology development outside the United States.

Markets reacted to the news with increased attention on semiconductor shares, reflecting investor concern about revenue exposure to China and the potential profit impact of new fees. For manufacturers, the choice is not purely financial. Accepting licensing fees preserves supply relationships and market share, but it also creates precedent for government conditioned access that could expand or tighten depending on geopolitical shifts and future legislation.

AMD’s stance illustrates the practical challenges firms face when policy and commerce collide. By agreeing to a 15 percent fee, the company signals a willingness to operate within the new regulatory framework rather than withdraw from a critical market. That calculus will matter for cloud operators and artificial intelligence developers in China who rely on advanced accelerators for computationally intensive projects, and for global customers who depend on an open supply of AI hardware.

Analysts say the move may prompt competitors to make similar calculations, potentially normalizing fees as part of export licensing. It may also spur closer scrutiny from lawmakers who want to ensure that licensing schemes do not inadvertently weaken U.S. strategic position. How Washington responds, whether through additional legislative action or regulatory fine tuning, will determine whether such fees remain a temporary mechanism or become a long term feature of technology trade.

As companies adapt, the broader implications reach beyond immediate sales figures. The evolution of export policy, corporate compliance and market responses will shape where advanced AI hardware is developed, sold and deployed, with consequences for innovation, national security and the global balance of technological power.