UMC and Polar to Explore U.S. 8 inch Chip Manufacturing

Taiwan’s United Microelectronics Corp signed a memorandum of understanding with U.S. based Polar Semiconductor to study production of 8 inch wafers at Polar’s Minnesota facility, a move aimed at strengthening domestic supply for a range of industries. The collaboration could boost resilience for mature node chips used across automotive, data center, consumer electronics and defense markets, as global tensions prompt more onshore investment.

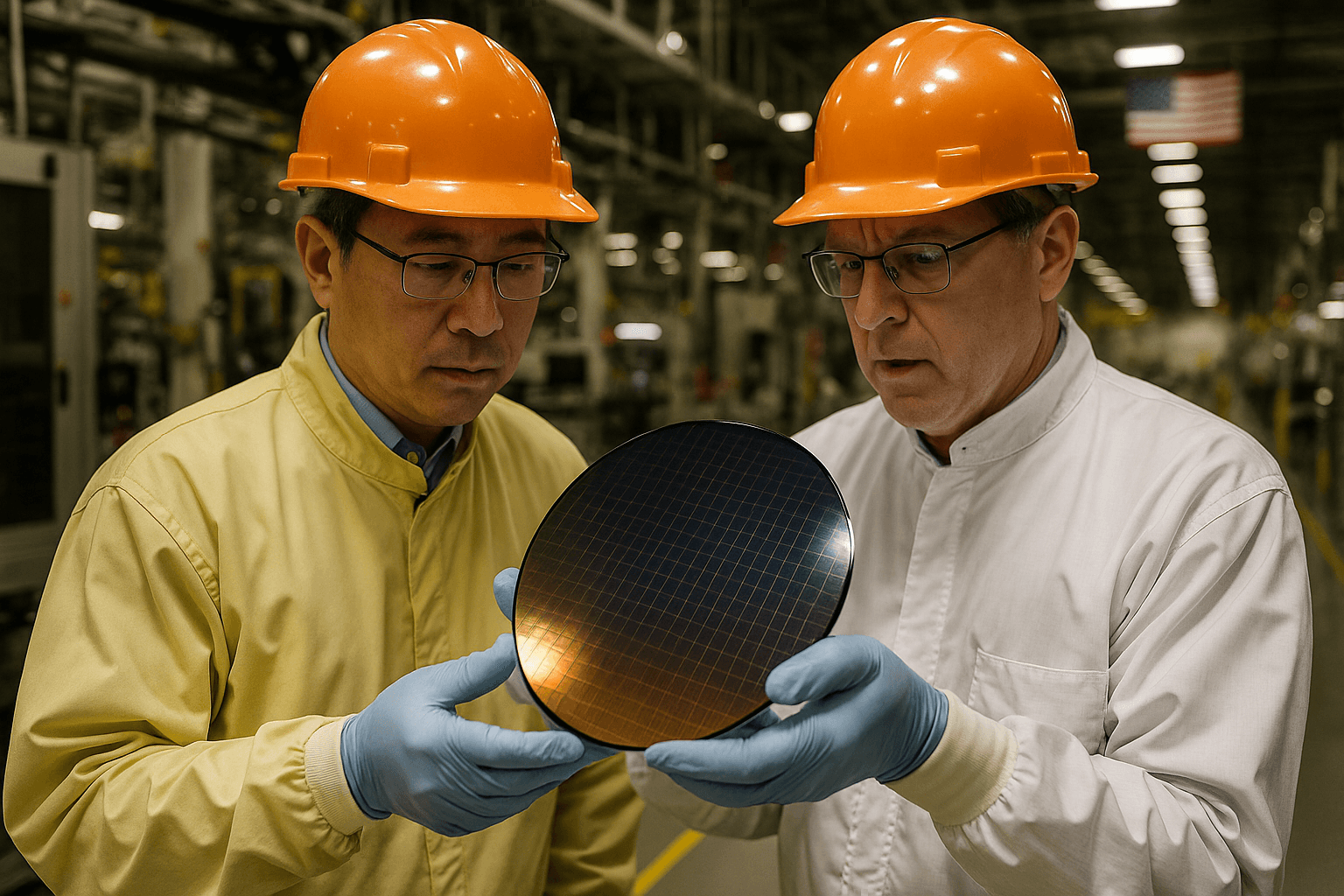

United Microelectronics Corp, Taiwan’s second largest contract chipmaker, signed a memorandum of understanding on December 4 with U.S. based Polar Semiconductor to explore manufacturing of 8 inch wafers at Polar’s Minnesota facility. The agreement will focus on identifying specific products that could be made domestically for customers in automotive, data center, consumer electronics and defense markets.

The pact comes as demand for mature node semiconductors continues to outstrip available capacity, and as companies and governments seek to reduce reliance on long global supply chains for chips embedded in a wide array of devices. Eight inch wafers, used to produce chips on older process technologies, underpin many automotive control systems, industrial controllers, sensors and power management components. Those parts are not typically made on the newest fabrication processes but are critical to modern vehicles, infrastructure and military systems.

The MOU is exploratory rather than a final investment decision, intended to map potential product lines, capacity needs and the technical adjustments required to set up or expand production at Polar’s Minnesota site. UMC brings experience in contract manufacturing across a range of nodes, and Polar is positioned as a domestic manufacturing partner with existing facilities in the United States. Together the companies will evaluate which chips could be reshored to ensure more reliable access for the sectors cited.

Industry analysts and policymakers have highlighted that bolstering 8 inch capacity is now a strategic priority, because many embedded and industrial applications rely on mature node devices that cannot easily be substituted or redesigned. Building or upgrading domestic capacity for these chips addresses both commercial risks, such as supply disruption, and national security concerns linked to defense supply chains.

The collaboration also reflects a broader wave of investment aimed at diversifying and strengthening semiconductor production within the United States. Over the past several years companies and governments have prioritized expanding fabrication capacity across a range of process nodes to reduce vulnerability to geopolitical friction and to shorten the logistics chains that can delay critical components.

If the feasibility work proceeds to implementation, production at Polar’s Minnesota facility could supply automakers, data centers, electronics manufacturers and defense contractors with chips manufactured on U.S. soil. That would alter sourcing patterns for parts commonly produced in Taiwan, Japan and other Asian markets, and could spur additional announcements as supply chain planners and customers seek secure alternatives.

For now, the memorandum sets a cooperative framework and signals intent. The two companies will continue technical and commercial assessments before deciding on the scale and timing of any capital investments or production shifts. Observers will watch closely for further details on targeted products, planned capacity and any timeline for bringing new or upgraded 8 inch production online in the United States.