Baidu’s Kunlunxin Plans Hong Kong IPO After Fresh Funding Boost

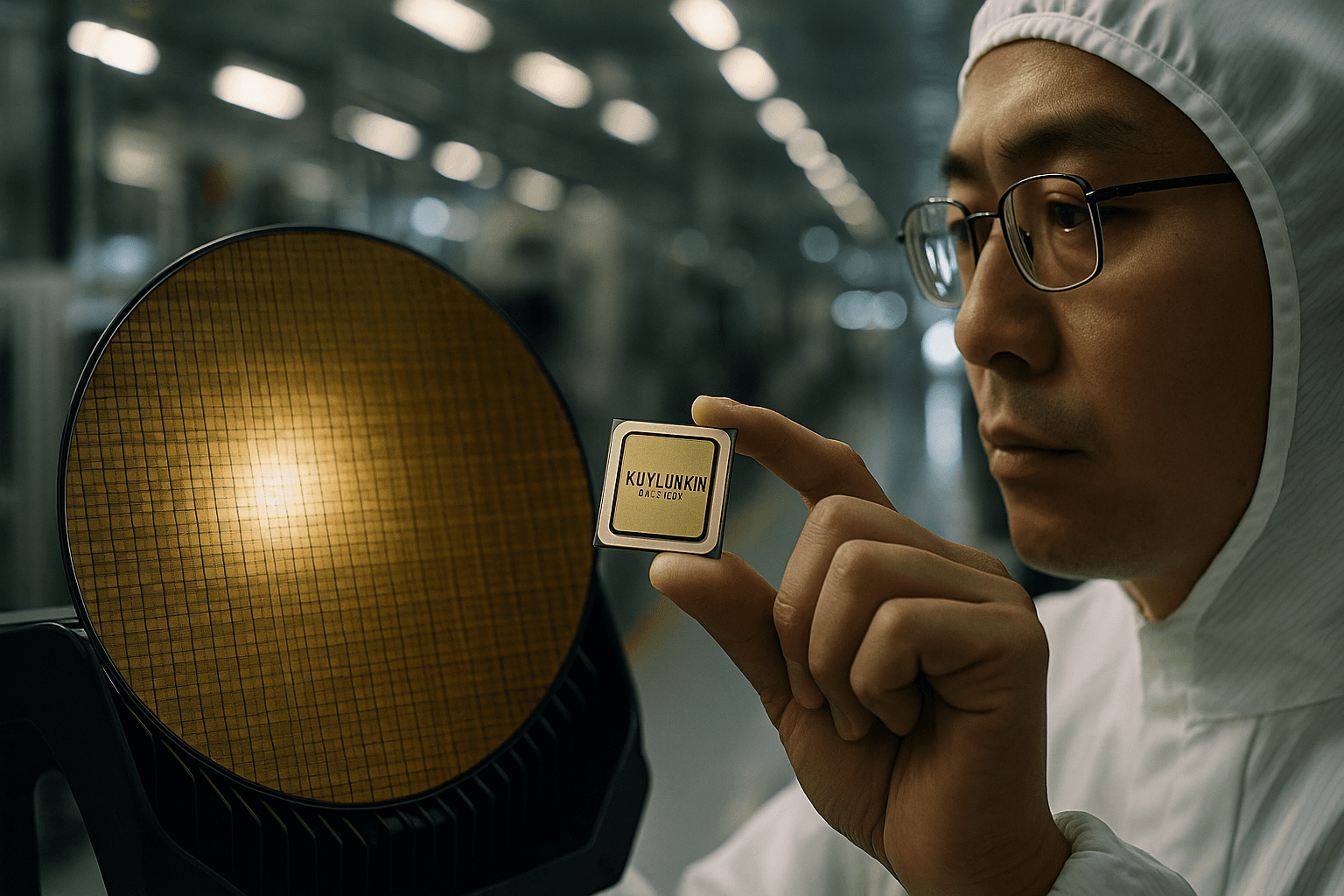

Kunlunxin, Baidu’s artificial intelligence chip unit, is moving toward a Hong Kong initial public offering after securing over 2 billion yuan in new funding that values the company at about 21 billion yuan. The push highlights Beijing’s drive to cultivate domestic semiconductor champions as U.S. export curbs squeeze access to advanced chips, and could accelerate commercial sales of Kunlunxin’s P800 processor.

Kunlunxin, the chip division of Chinese internet giant Baidu, is planning an initial public offering in Hong Kong after completing a new funding round that valued the company at roughly 21 billion yuan, people familiar with the matter told Reuters on Friday. The unit has raised more than 2 billion yuan from investors including a China Mobile fund, and is considering filing for a Hong Kong listing possibly in early 2026, with a target IPO by early 2027.

The financing and proposed listing come as Kunlunxin expands external sales beyond Baidu and its P800 chip gains traction in state backed data centre projects. The P800 is being positioned as a domestically developed AI processor that can support large language models and other compute intensive workloads, a strategic advantage as access to some foreign advanced semiconductors becomes more restricted by U.S. export controls.

For Baidu, spinning out and eventually listing Kunlunxin would create a clearer commercial pathway for its chip business while attracting outside capital and corporate partners. Investors such as a China Mobile fund taking part in the latest round signal interest from major domestic telecom and infrastructure players, which could translate into steady enterprise demand for Kunlunxin silicon and systems.

The timing fits a broader government and industry push to build sovereign capabilities in semiconductors and AI hardware. Beijing has prioritized reducing reliance on foreign suppliers for critical technologies, and Chinese chipmakers have benefited from state backed procurement and investment programs. A successful Hong Kong IPO would provide Kunlunxin with both capital for research and development and public market validation for its business model.

Market reaction to the proposed float will hinge on several factors. Global macroeconomic conditions and sentiment toward Chinese technology listings in Hong Kong will influence appetite for shares. Equally important will be Kunlunxin’s ability to sustain sales growth outside its parent company and to compete technically with established foreign chipmakers in areas where centuries of investment have created lead times in process technology and tooling.

Kunlunxin’s plan also underscores how corporate strategies are adapting to a tougher geopolitical environment for semiconductors. With U.S. export curbs tightening access to some advanced chips and manufacturing equipment, Chinese firms are accelerating development of indigenous designs and securing domestic supply chains.

The unit’s pursuit of an overseas listing in Hong Kong rather than a mainland exchange reflects the appeal of the city as a capital raising venue capable of drawing international investors, while keeping the company under Chinese regulatory oversight. If Kunlunxin proceeds on the timeline outlined, its progress will be watched closely by competitors, state planners and investors as a litmus test for the commercial viability of China’s AI hardware ambitions.