ASML surges past $500 billion as TSMC lifts 2026 capex target

ASML tops $500 billion after TSMC raises 2026 capex, signaling stronger AI chip investment but elevating valuation and policy risks.

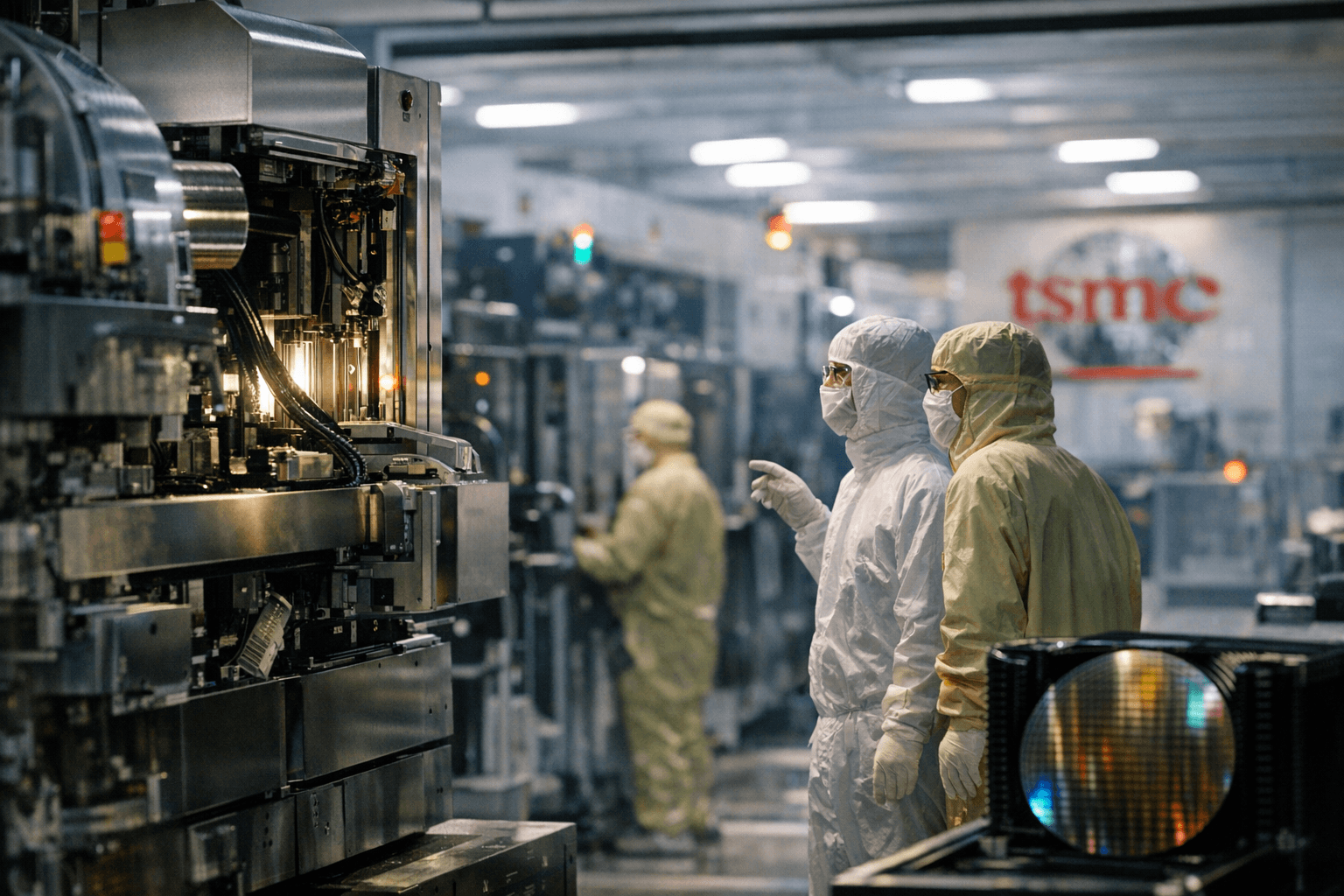

Shares of ASML Holding NV surged about 7.6% in Amsterdam on Thursday, driving the Dutch lithography specialist to an all-time high and pushing its market capitalisation past the $500 billion mark after Taiwan Semiconductor Manufacturing Co. raised its 2026 capital expenditure outlook. The move reflects renewed investor conviction that AI-driven demand for cutting-edge chips will sustain an elevated round of factory investment.

TSMC’s fourth-quarter results and guidance were the immediate catalyst. The foundry reported roughly $33.7 billion in fourth-quarter revenue and net profit for Oct.–Dec. of about NT$506 billion (roughly $16 billion), with year‑over‑year profit and revenue increases widely cited. Management raised planned 2026 capex to a range of $52 billion–$56 billion, with market attention gravitating to the top end of that range. TSMC also signalled strong full-year revenue growth expectations tied to continued demand for advanced nodes in AI accelerators.

The linkage to ASML is direct. ASML is the primary supplier of extreme-ultraviolet lithography systems required for the most advanced process nodes that TSMC is expanding, with an estimated market share in lithography of roughly 90%. Investors read TSMC’s higher capex as a near-term guarantee of order flow for ASML, which supplies the EUV machines essential to 3nm-class and successor production. The rally extended into U.S. premarket trading, where ASML saw gains in the order of 5%–7% on Nasdaq venues.

Market snapshots from the session varied by venue and currency conversion. One intraday peak for ASML shares reached €1,167, translating to an approximate market value of €443 billion (about $515 billion) at that moment; other data snapshots recorded valuations near $490.5 billion, reflecting intraday and cross-market variance. Analysts and market commentators noted the stock’s sharp run-up—about a 74% climb over the prior 120 days in some measures—and flagged a pronounced valuation premium, with one assessment pointing to a $47.5 P/E premium relative to peers.

The milestone underscores both opportunity and risk. On the upside, a sustained AI investment cycle could lengthen semiconductor expansion and lift suppliers across the capital goods chain. Higher capex tends to have a multiplier effect: more fabs, more tools, and more recurring service revenue for equipment vendors. On the downside, several near-term vulnerabilities could curtail upside. Market watchers pointed to the potential for slower-than-expected end-market demand, delays in customers’ node roadmaps such as timing around TSMC’s N2P node, and new policy levers including proposed 25% semiconductor tariffs that could reshape investment economics. Geopolitical and China-related frictions remain an overarching risk that could affect both order timing and supply-chain access.

Investors will also be watching ASML’s own disclosures: the company is scheduled to publish full 2025 results on Jan. 28, when management commentary on order books, lead times and regional exposure will test whether the recent sentiment-driven rally has underlying operational momentum. For now, the market has priced in a large slice of the AI‑led capex narrative; the next two weeks of earnings and guidance will determine whether that optimism is rewarded or reassessed.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip