TSMC posts record profit as AI demand fuels chip boom

Taiwan Semiconductor posts a record quarterly profit, driven by AI and advanced-node chips, and signals a major capex ramp for 2026.

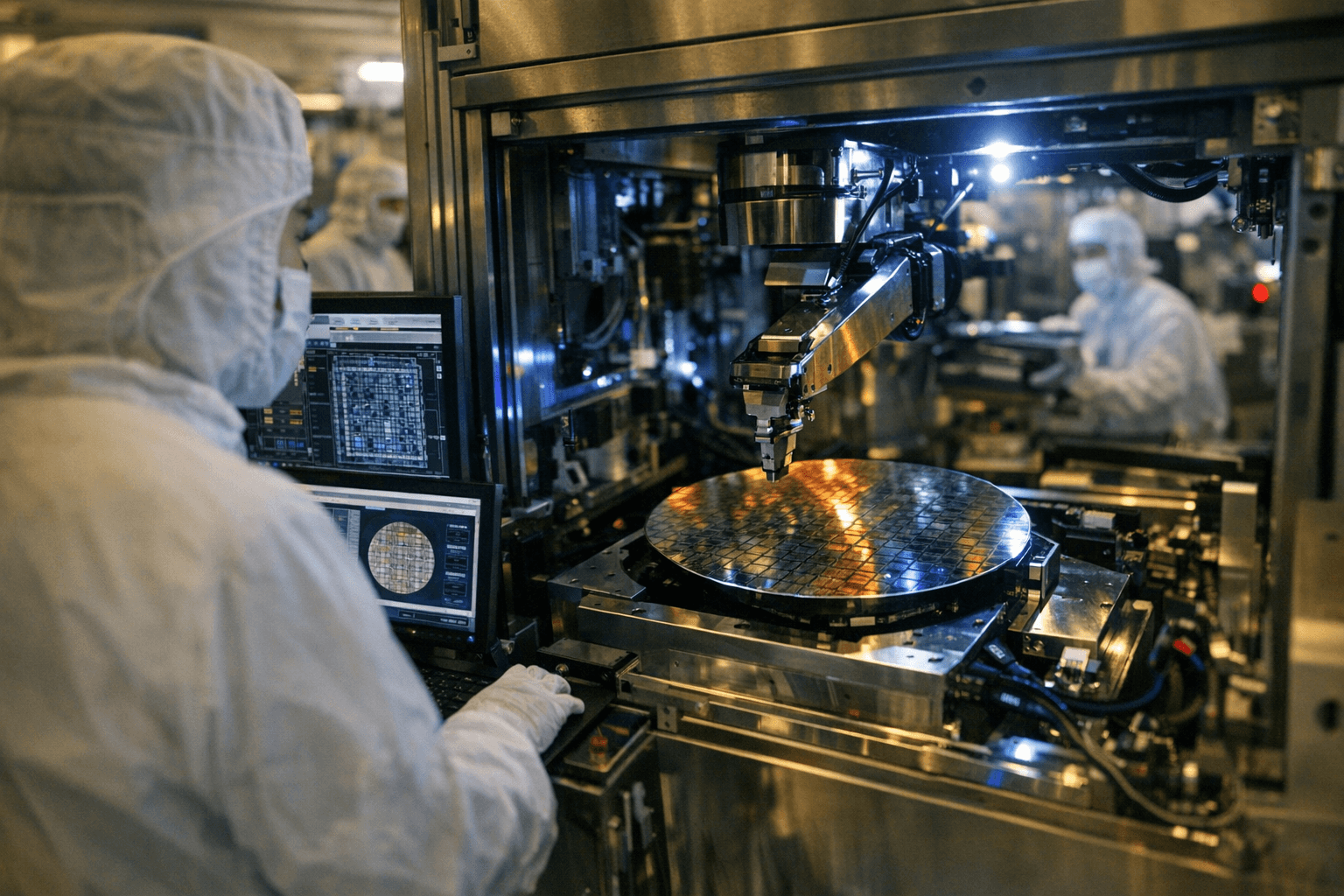

Taiwan Semiconductor Manufacturing Co. reports a 35% year-on-year jump in fourth-quarter net profit to NT$505.7 billion, a record for the world’s largest contract chipmaker and roughly $16.0–$16.01 billion using an exchange rate of $1 = NT$31.5920. The October–December results, announced from Taipei, also show revenue rising about 20.5% to roughly NT$1.05 trillion, underscoring accelerating demand for high-performance semiconductors.

The profit exceeded market expectations across multiple measures. LSEG SmartEstimate had forecast NT$478.4 billion, a Tech Buzz consensus was NT$478.37 billion, and a Bloomberg survey of analysts had projected NT$466.69 billion. TSMC’s actual net income surpassed all three forecasts, marking the eighth consecutive quarter of year-on-year profit growth.

Company executives and market observers attribute the strength to surging orders tied to artificial intelligence and high-performance computing. Industry reporting indicates AI and HPC now account for about 55% of sales, while chips manufactured at 7-nanometer or smaller made up approximately 77% of wafer revenue in the quarter, up from 69% a year earlier. Those shifts reflect customers’ growing appetite for advanced nodes to power data centers, AI accelerators and next-generation servers.

TSMC chairperson CC Wei underscored the strategic thrust in a company statement: “Our conviction in the multiyear AI mega trend remains strong, and we believe the demand for semiconductors will continue to be very fundamental.” Management also signaled plans to scale production at the most advanced process nodes, including 2-nanometer technology, to meet the pipeline of AI-related demand.

The company is preparing a substantial capital expenditure increase for 2026, with guidance pointing to a range of $52–$56 billion versus about $40.9 billion spent in 2025. That planned capex ramp reflects factory builds, equipment for leading-edge nodes and investments tied to a widened global manufacturing footprint. Higher capital intensity will reinforce TSMC’s role at the center of the semiconductor supply chain but raises questions about capacity timing and returns on projects that typically span several years.

Market reaction to the results was mixed. U.S.-listed TSMC shares (TSM) closed at $327.11 on Jan. 14, down $4.10 or 1.24% in the latest snapshot, suggesting investors weighed the beat against already-elevated expectations and the sizable near-term investment plan.

TSMC’s results carry broad implications. Statistically, the rising share of advanced-node wafer revenue and the majority contribution from AI/HPC signal a structural shift in product mix toward high-margin, capital-intensive segments. For technology companies and data-center operators, sustained access to TSMC capacity will be a critical constraint for deploying next-generation AI systems. On the policy front, Taiwan’s centrality to global chip manufacturing and rising U.S.-China strategic tensions add a geopolitical overlay to the company’s expansion decisions and to governments’ supply-chain strategies.

Looking ahead, TSMC’s combination of record profits and heavy investment suggests the company expects the AI-driven demand cycle to be durable, but the execution challenge of converting capex into timely wafer capacity will determine how quickly the market balances supply and demand and how global semiconductor competition evolves.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip