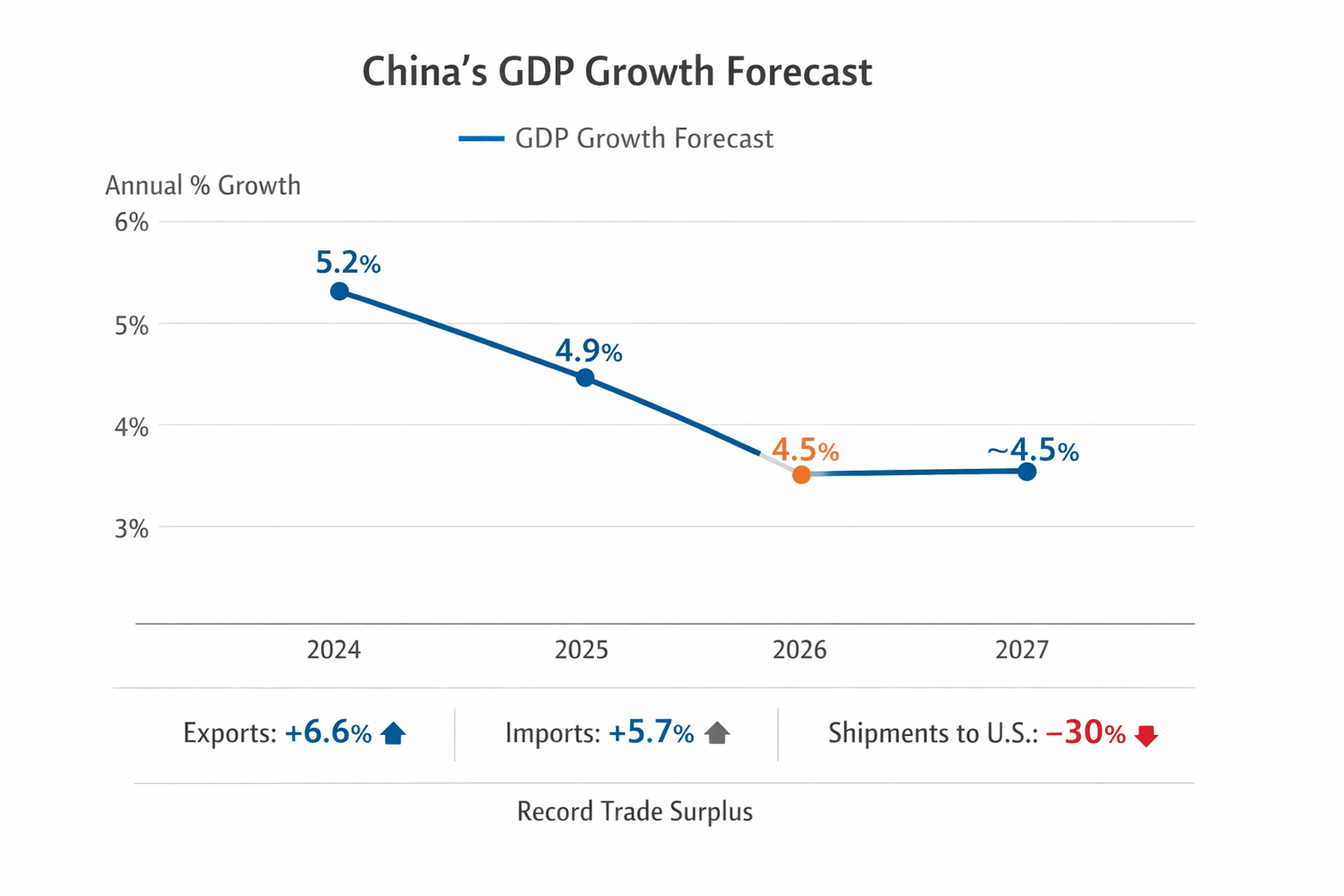

China growth to slow to 4.5% in 2026, economists say

A poll and surveys point to growth slowing to about 4.5% in 2026 as exports buoy the economy while weak domestic demand and a property slump persist.

A Jan. 15 poll of 73 economists and a separate December survey point to China’s gross domestic product expanding about 4.5% in 2026, a deceleration from an estimated 4.9% in 2025 and roughly on par with a similar pace expected in 2027. The consensus frames the outlook as one in which vigorous external demand and limited policy easing prop up headline growth even as private consumption and services activity remain subdued.

The poll’s median forecast gave a "median forecast of 4.5% in 2026" and noted that "strong exports and modest policy support" are the primary near‑term supports for the economy. That external strength was clear in December trade data, which showed exports rising 6.6% in U.S. dollar terms year‑on‑year and imports up 5.7%, lifting the annual trade surplus to a record high. Yet the same trade snapshot contained anomalies, including a steep 30% plunge in shipments to the United States in December, underlining volatile demand patterns across markets.

Domestic activity paints a contrasting picture. Private‑sector services data compiled by RatingDog and S&P Global showed the services PMI edging down to 52.0 in December from 52.1 in November, the weakest services reading since June. The composite output index, which combines manufacturing and services, was 51.3 in December versus 51.2 in November. The PMI detail highlighted slowing new business for services, new export business slipping into contraction, shrinking employment, a tenth consecutive month of rising input costs and firms cutting selling prices amid fiercer competition. Still, business sentiment ticked up, with the expectations sub‑index reaching a nine‑month high; as Yao Yu, founder of RatingDog, summarized the sector as ending 2025 with "modest growth, high expectations."

Analysts and forecasters warn the expansion remains unbalanced. A December survey warned that "tariff headwinds easing" has helped exports but cautioned that "weak domestic demand stemming from the prolonged property market slump" is a persistent drag. The property correction continues to weigh on household wealth, mortgage demand and local government revenues that normally support infrastructure spending, constraining a consumption‑led recovery.

Policy officials have set a growth target around 5% for 2025, a level that the consensus suggests China will undershoot slightly if private demand fails to firm. Economists interpreting the forecasts say the reference to modest policy support implies limited fiscal or monetary easing rather than a large stimulus push, reflecting authorities’ caution about reigniting asset bubbles and accumulating debt.

For markets and global trade, the pattern of export‑led growth with soft domestic demand carries mixed implications. Strong shipments help sustain commodity exporters and manufacturing supply chains, but a sluggish consumer sector in China will cap growth in services‑intensive industries and blunt secondary spillovers to economies reliant on Chinese tourist and retail spending.

Longer term, the convergence of slower potential growth, a drawn‑out property adjustment and the transition toward more services and household consumption points to an era of lower headline growth rates for China. Policymakers face a choice between stepping up targeted support to revive consumption and managing financial risks that could worsen if a more aggressive stimulus is pursued. The immediate picture for 2026, however, is one of subdued expansion — carried on exports but constrained at home.

Know something we missed? Have a correction or additional information?

Submit a Tip