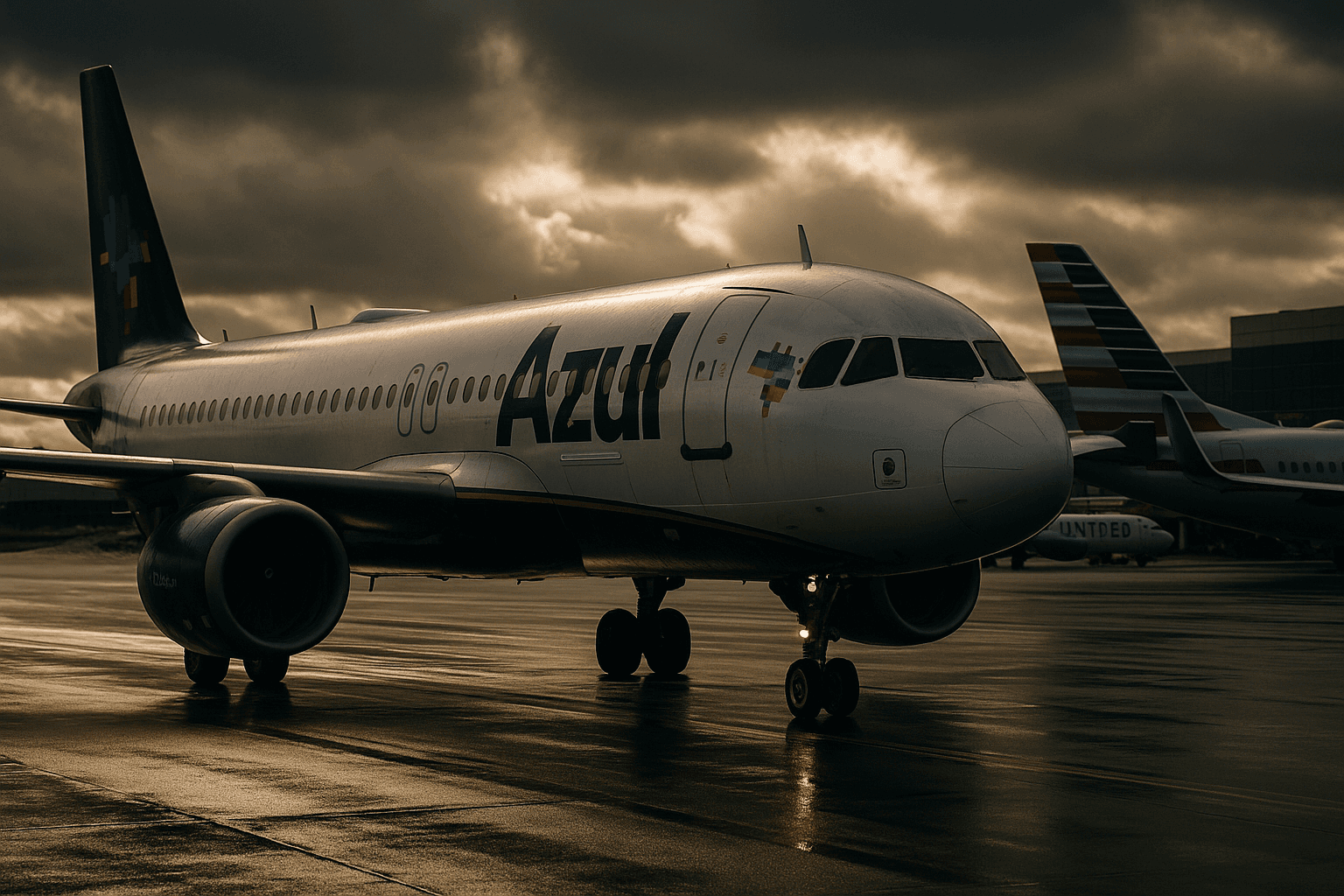

Azul Wins U.S. Court Approval, U.S. Airlines Invest in Rescue

A U.S. bankruptcy judge approved Azul SA’s Chapter 11 restructuring plan after a Dec. 12 and 13 hearing in White Plains, New York, clearing the way for a major conversion of debt into equity and new capital from American and United. The ruling sharpens Azul’s balance sheet, supplies immediate liquidity, and signals deeper strategic ties between Brazilian and U.S. carriers with implications for the region’s aviation market.

A U.S. bankruptcy judge signed off on Azul SA’s Chapter 11 restructuring plan on Dec. 12 and 13, 2025, authorizing the Brazilian carrier to convert a large portion of its existing liabilities into equity and to raise fresh capital from strategic investors. U.S. Bankruptcy Judge Sean Lane approved the plan at a hearing in White Plains, New York, following a case that began when Azul filed for Chapter 11 in New York in May.

The confirmed plan cuts the airline’s liabilities by substantial amounts, although reporting differs on the headline total. Reuters described the reduction as more than $2 billion, while Bloomberg and other market accounts put the figure at roughly $2.6 billion when aircraft lease obligations are included. The plan also authorizes a rights offering and the sale of new shares to replenish capital, and it lays out mechanics to enact the debt conversions and equity placements.

American Airlines Group Inc. and United Airlines Holdings Inc. have agreed to invest in the reorganized company, with several outlets and court papers reporting combined commitments of up to $300 million. Bloomberg cited filings that suggest the restructuring could support as much as $950 million in new equity investment, and some market summaries suggested total U.S. investor capacity could reach $1.2 billion. Aircraft lessors including AerCap are identified among stakeholders who may participate in the equity raising and supportive creditor group.

To sustain operations through the reorganization, the court authorized Azul to access $250 million of an available debtor in possession financing facility. Reports indicate the DIP facility totals $1.6 billion, with the initial draw providing immediate liquidity for fleet and network continuity as the company implements the confirmed plan.

The decision clears key legal hurdles that have constrained Azul since its May filing and positions the carrier to emerge with a materially lighter balance sheet. Company managers and creditors will now move to implement the conversion of existing creditors into shareholders, finalize the rights offering, and close committed investments by strategic partners. Azul has indicated a target to exit Chapter 11 in early 2026, subject to the mechanics of the plan and any regulatory approvals required for the issuance of new equity.

Market implications extend beyond Azul’s balance sheet. The involvement of American and United reflects a strategic embrace of cross border partnerships and could alter competitive dynamics in Brazil and the broader South American market by solidifying network relationships and supply chain ties such as aircraft leasing and maintenance arrangements. For creditors the plan crystallizes recoveries through equity stakes rather than cash payouts, while for lessors and potential equity investors the restructuring offers a pathway to preserve and potentially enhance fleet utilization.

Final implementation will hinge on the detailed plan mechanics in the confirmed court documents, the timing of investor contributions and regulatory clearances, and the airline’s ability to sustain operational momentum as it transitions out of Chapter 11.

Know something we missed? Have a correction or additional information?

Submit a Tip