Boeing acquisition of Spirit AeroSystems could close as soon as Monday

A New York Stock Exchange notice signaled trading in Spirit AeroSystems may be suspended on December 8, indicating Boeing’s planned takeover could be finalized as early as Monday. The transaction remains subject to closing conditions, and Boeing said teams were working to satisfy the remaining requirements, a move that would reshape aerospace supply chains and draw fresh regulatory scrutiny.

The New York Stock Exchange on Saturday issued a notice saying trading in Spirit AeroSystems may be suspended on December 8, a signal that Boeing’s long planned acquisition of the parts maker could close as soon as Monday. The notice does not confirm a closing, and the transaction remains contingent on customary closing conditions, regulators and the companies said in separate statements earlier this week.

Boeing said teams were working to satisfy outstanding requirements. The companies did not provide a firm closing date in their public comments, but the NYSE advisory raised investor expectations that the deal could clear its final hurdles this week. Suspension of trading ahead of a takeover is a routine step that allows the exchange and regulators to prepare for the transfer of securities and corporate control.

The proposed acquisition has been watched closely by competition authorities and industry participants since it was announced. Regulatory reviews previously imposed conditions and required divestitures intended to preserve competition in aerostructures and related services. That regulatory oversight complicated the timetable for closing, but also clarified the remedies that authorities will expect to be implemented before the transaction is allowed to proceed.

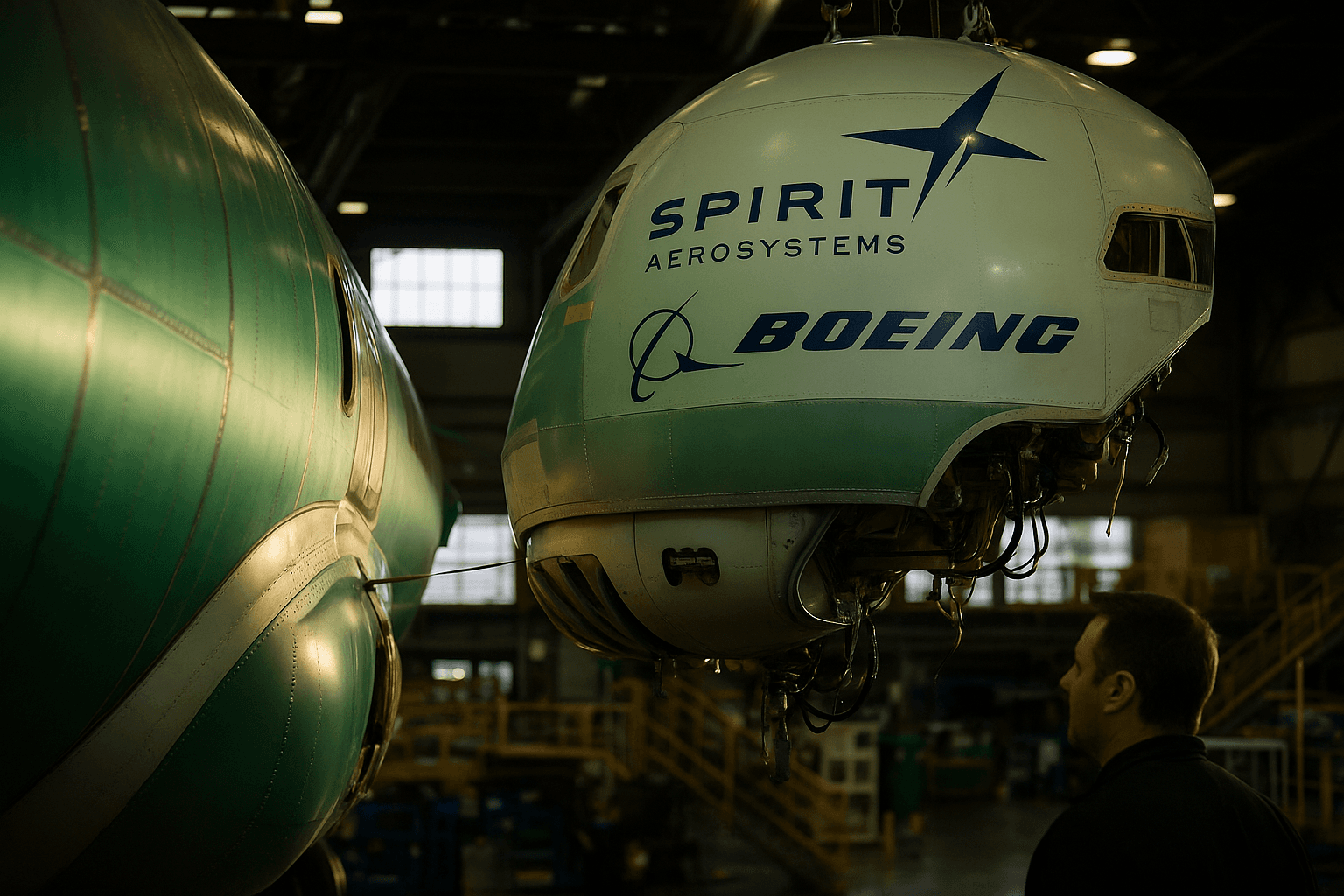

Spirit AeroSystems, a major supplier of fuselage sections and other aerostructures to global airframers, has been central to Boeing’s broader supply chain strategy. For Boeing, bringing the supplier under its corporate umbrella would represent a step toward greater vertical integration at a time when the company has been managing production bottlenecks and rising demand for commercial jets. For Spirit, the deal promises immediate ownership change for investors and potential operational shifts that could follow integration.

Market participants will watch trading in Spirit shares closely if the NYSE follows through with a suspension on Monday. A suspension typically precedes the delisting or removal of a public company’s shares following an acquisition, and it can affect liquidity for existing shareholders. Analysts will also be looking for further disclosures about the divestitures and remedies required by competition authorities, and for any details on how Boeing plans to integrate Spirit operations without disrupting deliveries to airlines.

Regulators imposed conditions earlier in the review process because of concerns that the consolidation of major aerostructure suppliers could reduce competition for a range of components and services across the industry. Those remedies are likely to shape the commercial realities of the combined company and could require further asset sales or contractual changes.

Beyond the immediate corporate consequences, the potential closing highlights longer term trends in aerospace: firms seeking scale to manage volatile production cycles, pressures on suppliers to invest in advanced manufacturing, and the increasing role of regulatory oversight in shaping industry structure. If the deal completes as soon as Monday, attention will quickly turn to the implementation timetable for mandated divestitures, the impact on downstream suppliers and customers, and how the integration will affect Boeing’s production plans in 2026 and beyond.