Wall Street Inches Higher as PCE Keeps Fed Cut Odds Intact

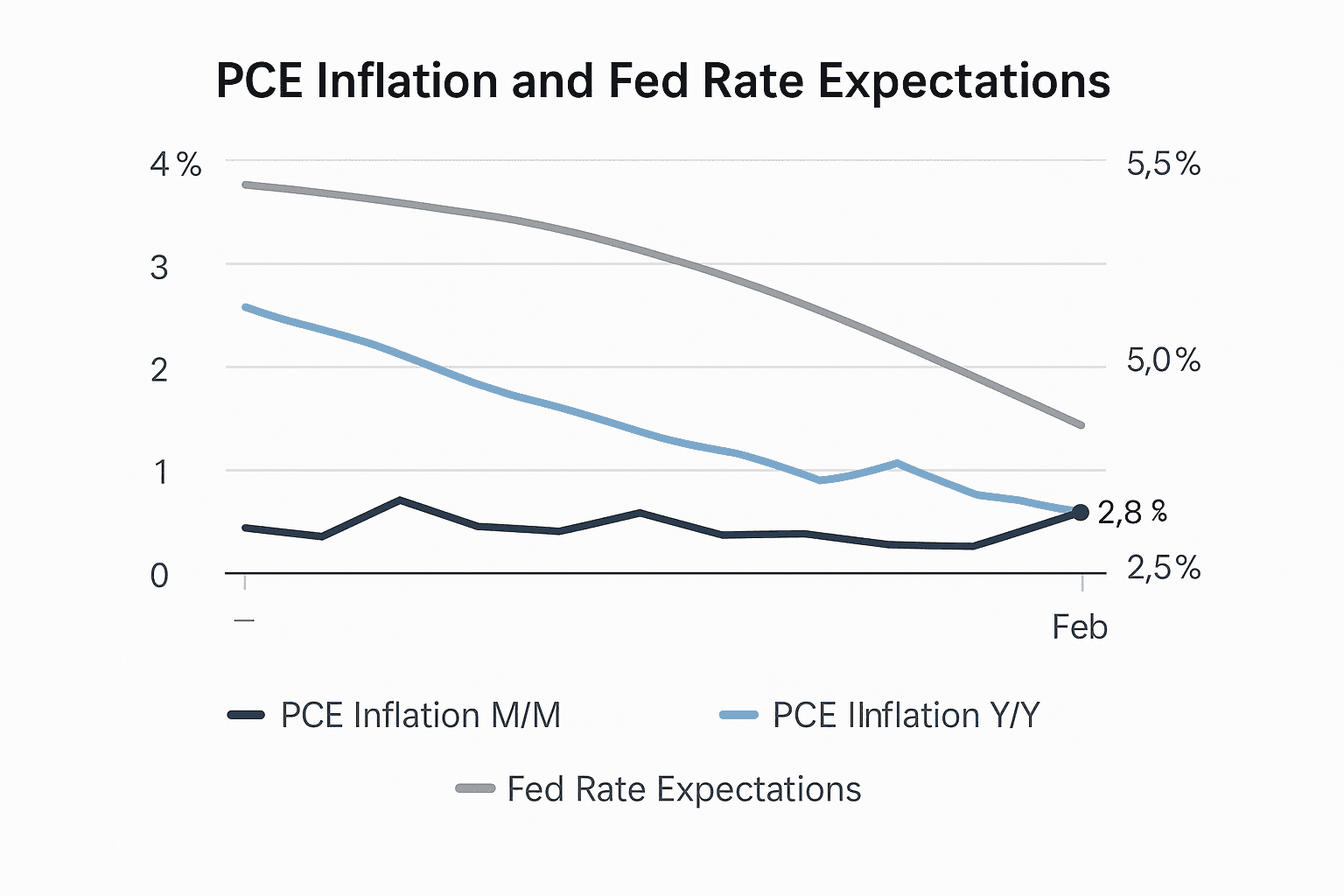

U.S. stocks closed with modest gains as a delayed Personal Consumption Expenditures inflation report matched forecasts, reinforcing market expectations for a Federal Reserve rate cut next week. The reading underscored continuing inflation above the Fed target, leaving investors focused on the tone from policymakers and the size of any internal dissent.

U.S. equity benchmarks closed slightly higher on Friday after the delayed release of the Personal Consumption Expenditures Price Index offered investors a fresh snapshot of inflation ahead of the Federal Reserve meeting next week. The PCE index rose 0.3 percent in September and was up 2.8 percent year on year, matching consensus forecasts and reinforcing the view that inflation has cooled but remains above the Fed's 2 percent target.

The data came after a 43 day government shutdown delayed a tranche of economic releases, creating an unusually concentrated information flow as markets recalibrated expectations for central bank policy. Traders priced in a high likelihood of a quarter point cut at the upcoming Fed meeting, reflecting a belief that policymakers can justify easing while inflation shows signs of moderation.

Equities were led by sector specific moves rather than a broad risk rally. Warner Bros Discovery climbed after Netflix agreed to buy its television, film studios and streaming division for $72 billion, a blockbuster media consolidation that reshaped expectations for content ownership and distribution. Ulta Beauty surged after the cosmetics retailer raised its forecasts, underscoring the resilience of consumer discretionary spending despite mixed macro signals.

The Dow rose 104.05 points, or 0.22 percent, to 47,954.99. The S&P 500 gained 13.28 points, or 0.19 percent, to 6,870.40, and the Nasdaq added 72.99 points, or 0.31 percent, to 23,578.13. The muted gains reflected a market that is finely balanced between optimism for easier policy and caution about persistent inflation above target.

For policymakers, the PCE reading presents a familiar conundrum. A 2.8 percent annual increase is substantially lower than the peaks seen in recent years, and it supports arguments for easing that hinge on continued disinflation. At the same time, the figure remains materially above the Fed's stated target, providing ammunition to officials who worry that premature easing could reignite price pressures. Investors will be watching the language from Fed Chair Jerome Powell and the number of officials who dissent from any decision, as recent public comments revealed a range of views inside the Federal Reserve.

Market pricing of a quarter point cut next week indicates that traders expect a cautious approach, with the Fed likely to signal scope to move if incoming data continue to show cooling. The delayed data release served as a reminder that policy decisions are being made in an environment of uneven information, where single data points can have outsized influence on expectations.

As the Fed meeting approaches, the interplay between inflation statistics, central bank communication and high profile corporate news will continue to shape market direction. Investors will parse both the decision itself and the projections and minutes that follow for signals about the timing and scale of future easing.