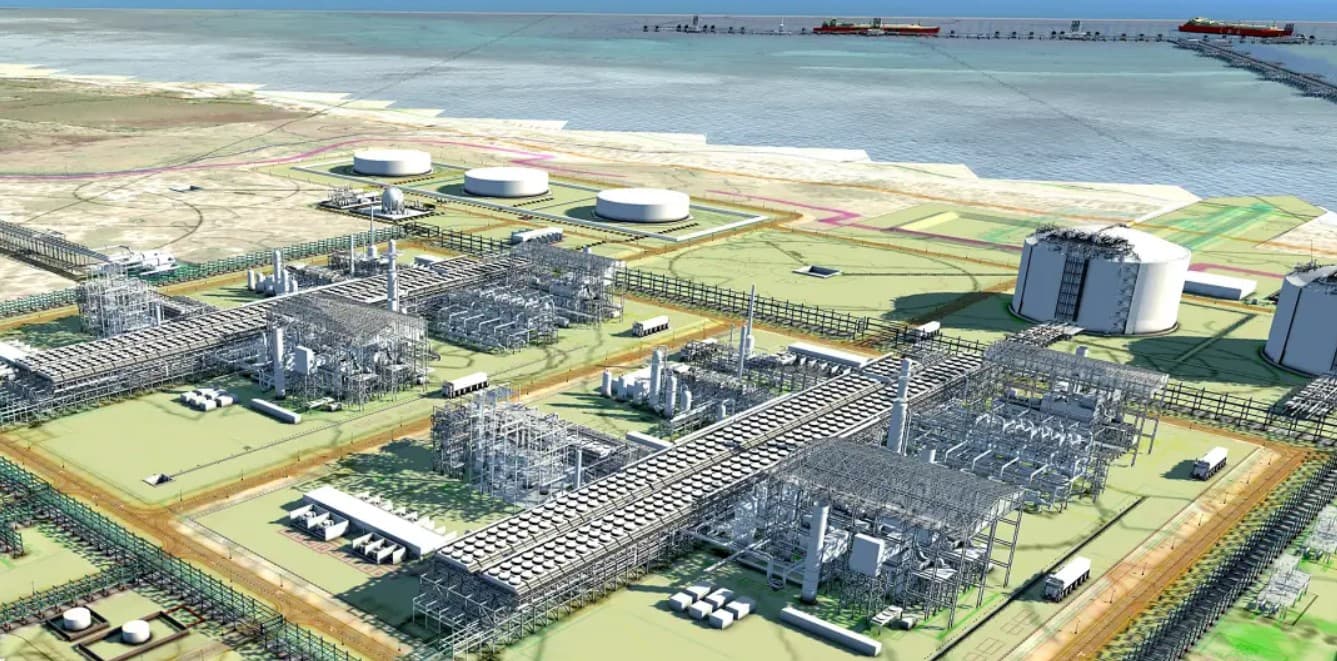

Britain, Netherlands Withdraw $2.2 Billion Support for Mozambique LNG

The United Kingdom and the Netherlands announced they would withdraw about $2.2 billion of export credit and insurance support for the TotalEnergies led Mozambique LNG project, citing rising project risk and reputational concerns. The decisions intensify scrutiny of one of Africa's largest private investments, and they could force partners to reshuffle financing at higher cost even as some lenders remain committed.

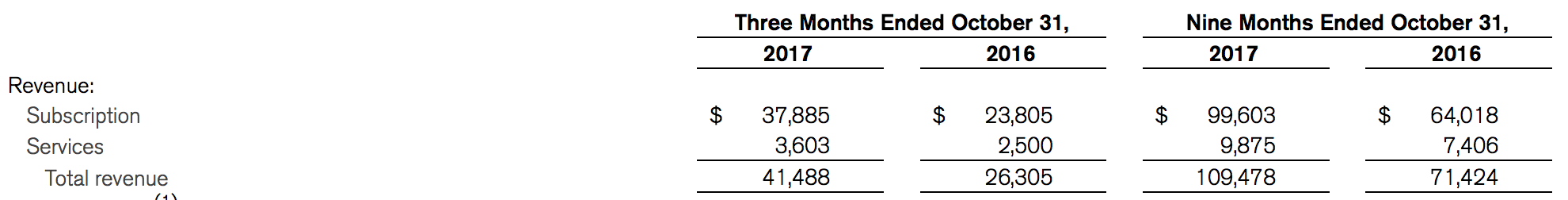

Britain and the Netherlands on December 1 and 2 rescinded roughly $2.2 billion of official backing for the TotalEnergies led Mozambique LNG project, a major setback for a gas development that has been stalled since 2021 amid insurgency and human rights controversy. The U.K. export credit agency, UK Export Finance, rescinded about $1.15 billion of previously pledged support after a review concluded that risks had increased since the original 2020 commitment. The Dutch finance ministry said TotalEnergies had withdrawn an insurance request, prompting Atradius, the Dutch state export insurer, to cancel about $1.1 billion in coverage.

The project, planned in Mozambique's Cabo Delgado province, was halted in 2021 after an Islamist insurgency forced evacuation of workers and disrupted construction. Security risks and allegations of abuses by security forces near project sites have drawn repeated complaints from non governmental organizations and prompted human rights reviews by governments and financiers. More than 70 percent of project financing had reportedly already been secured before the latest withdrawals, and TotalEnergies partners signalled they could replace the lost support with additional equity, according to statements reported to the press.

Export credit and insurance lines play a central role in reducing political and commercial risk for large energy projects. Their withdrawal raises the cost of capital by reducing contingent protections for banks and investors and can force sponsors to increase their cash contributions. Industry executives and analysts say substituting export credit with equity typically dilutes returns for private partners and can slow project timelines as new financing structures are negotiated.

Some financiers in the United States and elsewhere remain committed to the project, and TotalEnergies partners including Mitsui, the Mozambican national company ENH, Bharat Petroleum and Oil India have signalled continued involvement. Project backers indicated that revised financing arrangements could allow the work to proceed, but market participants caution that any gap filled by sponsor equity will tighten balance sheets and could change the investment calculus for other projects in frontier risk jurisdictions.

The decisions by UK Export Finance and Atradius underscore a broader shift in official lending and insurance toward greater scrutiny of security and human rights implications. Governments face domestic political pressure over the reputational risk of supporting projects where state or private security actors are accused of abuses. For export credit agencies, the Mozambique case raises questions about the durability of commitments made years in advance in a fast changing geopolitical and security environment.

For Mozambique, the suspension and reshuffling of support comes at a difficult time for public finances and economic recovery in a region that has seen violence displace tens of thousands of people. For global energy markets, the immediate impact is limited because other financiers remain engaged, but the episode is likely to increase the perceived risk premium for large gas investments in unstable regions and could slow the pace of international capital flows into similar projects.