MongoDB Posts Stronger Than Expected Quarter, Raises Full Year Guidance

MongoDB reported sharper revenue growth and robust cash generation for its third quarter, sending shares higher after hours. The results signal accelerating enterprise demand for managed databases and reinforce a longer term shift to cloud native infrastructure that has implications for margins and cloud provider economics.

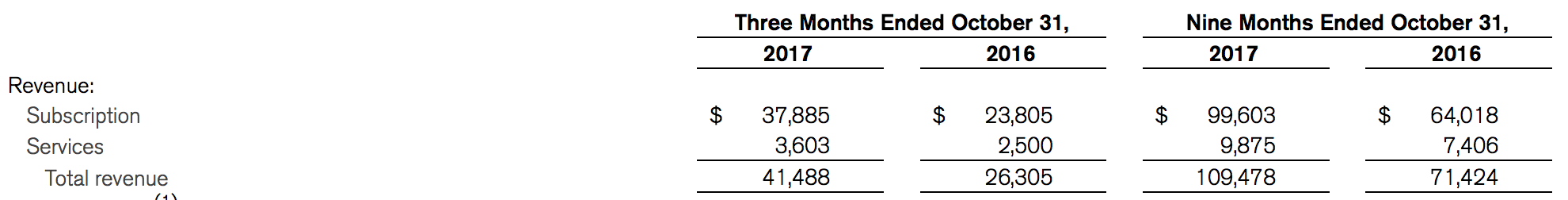

MongoDB, Inc. delivered a stronger than expected third quarter in fiscal 2026, reporting total revenue of $628.3 million for the period ended October 31, 2025, an increase of about 19 percent compared with the same period a year earlier. The company said growth in Atlas, its managed cloud database, accelerated to roughly 30 percent year over year and contributed about three quarters of total revenue, underscoring the firm s shift toward recurring, cloud based services.

Customer additions were robust, with roughly 2,600 net new customers in the quarter bringing the installed base to more than 62,500. Management highlighted improving profitability metrics, noting material gains in Non GAAP net income and a significant rise in free cash flow to around $140.1 million for the quarter. Those cash flow gains, the company said in a press release, reflected operating leverage as Atlas scaled and as subscription economics improved.

Management raised the company s guidance for the remainder of fiscal 2026, citing stronger demand for Atlas and improving margin performance. The firm provided full financial tables in the release and scheduled a conference call for analysts to discuss the quarter. Investors responded quickly, pushing the stock higher in after hours trading following the announcement.

The report contains a portfolio of mixed signals for investors and for the cloud market more broadly. On one hand the Atlas business is demonstrating the high growth, high retention profile that investors prize in enterprise software. Atlas accounting for roughly 75 percent of revenue points to a business now dominated by managed cloud services, and a 30 percent year over year expansion at that scale is consistent with companies transitioning critical workloads away from self managed databases.

On the other hand GAAP gross margins were reported as compressed relative to a year ago, a result management attributed to rising cloud infrastructure costs. That tension is central to the cloud era. Providers such as MongoDB gain scale and recurring revenue but remain exposed to variable costs charged by hyperscale cloud vendors for compute and storage. The short term squeeze on GAAP margins can mask underlying operating leverage in subscription economics, but it also highlights a structural cost risk that enterprise customers and regulators are watching as cloud market concentration persists.

From a market perspective the stronger quarter and raised guidance will likely pressure analysts to lift estimates and could broaden investor confidence in a narrative of sustained enterprise IT spending. For policy makers and corporate strategists the results reinforce the importance of cloud competition, pricing transparency, and data governance as determinants of total cost for cloud native applications.

Long term the quarter reinforces a secular trend toward managed services and consumption based pricing in enterprise software. MongoDB s ability to convert that revenue into free cash flow near $140 million gives the company greater optionality to invest in product development and international expansion while continuing to navigate the margin dynamics of the public cloud. The analyst call scheduled by the company will provide more detail on guidance specifics and on how management plans to balance growth with margin recovery.