Brookfield and GIC near binding offer for National Storage

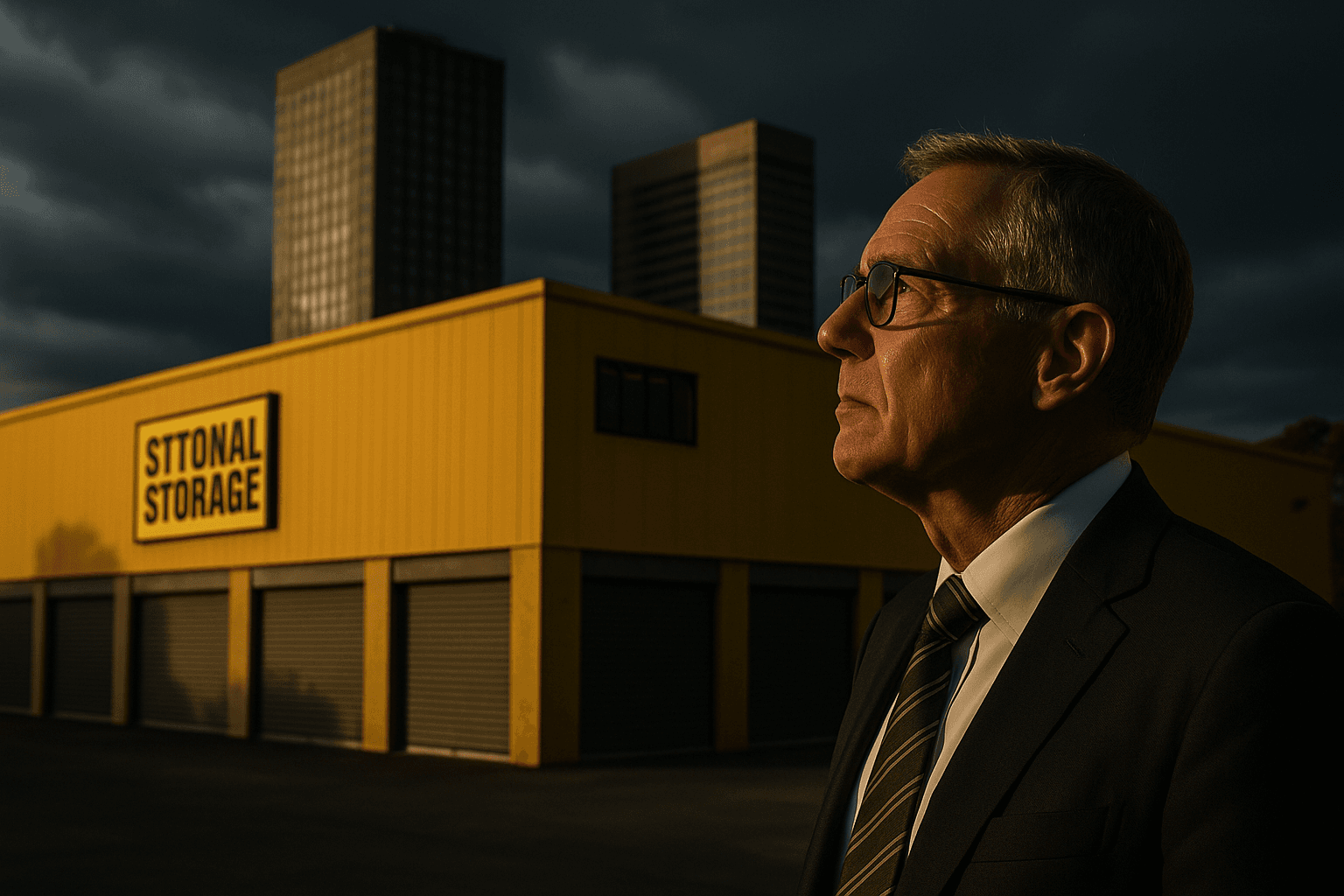

Brookfield Asset Management and Singapore sovereign wealth fund GIC are closing in on a binding offer for National Storage REIT that could value the Sydney listed company at about A$4 billion, Bloomberg reported. The move would mark one of the largest real estate privatisations in Australia and has implications for REIT market structure, investor returns, and regulatory scrutiny.

CIG%2BBroolfield.jpg%3Fwidth%3D700%26fit%3Dcover%26gravity%3Dfaces%26dpr%3D2%26quality%3Dmedium%26source%3Dnar-cms&w=1920&q=75)

Brookfield Asset Management and Singapore’s GIC are finalising a binding offer for National Storage REIT that Bloomberg reported may value the Sydney listed self storage company at about A$4 billion. According to the report the parties have made progress on due diligence and could announce the deal as soon as Monday, with the price for the binding bid likely to match a conditional offer first disclosed in November.

National Storage disclosed last month that it had received a A$4.02 billion buyout proposal from a consortium of Brookfield and GIC. Using the currency rate provided in reporting, one US dollar equals 1.5067 Australian dollars, the A$4.02 billion figure converts to roughly US$2.67 billion. Reuters could not immediately verify Bloomberg’s report.

If completed at the same levels, the transaction would represent one of the largest privatisations of an Australian real estate company in recent history. The deal would remove a sizeable, yield generating asset from public markets and concentrate ownership of around 170 self storage locations under institutional control. For shareholders, a binding bid at the previously reported price implies a firm takeover premium for holders of the listed trust, though the final premium will depend on the company’s recent trading levels and the exact terms of any scheme or takeover offer.

Market implications extend beyond National Storage. A successful privatisation would reduce the free float in Australia’s real estate investment trust sector and may push yield compression for similar assets as private capital competes for stable income streams. For Brookfield the acquisition would deepen its exposure to recurring cash flow real estate in Australia, while GIC would further diversify a sovereign wealth portfolio increasingly tilted toward real assets. Institutional buyers have in recent years shown appetite for assets that deliver predictable rental income amid uncertainty in equities and bond markets.

Regulatory and policy considerations are likely to shape the timeline. A deal of this scale involving significant foreign investment will typically attract scrutiny from Australian authorities, including review by the Foreign Investment Review Board and potential competition assessments depending on portfolio overlaps in specific markets. That process can add weeks to months to the timetable even when commercial terms are agreed.

Strategically the transaction would be consistent with a global trend of private capital recycling into real property that offers stable, serviceable cash flows. For the Australian market it highlights tensions between deep pools of global investment capital and the liquidity needs of domestic retail investors who rely on listed REITs for income exposure. The final structure of the offer, whether as a scheme of arrangement or takeover bid, and the outcome of any regulatory review will determine how quickly the market and shareholders adjust to a privately held National Storage. Reporting is continuing as parties finalise details.

%3Amax_bytes(150000)%3Astrip_icc()%2F100901867_soybeans-60844bfb2b68432a8447f18fa34d28b5.jpg&w=1920&q=75)