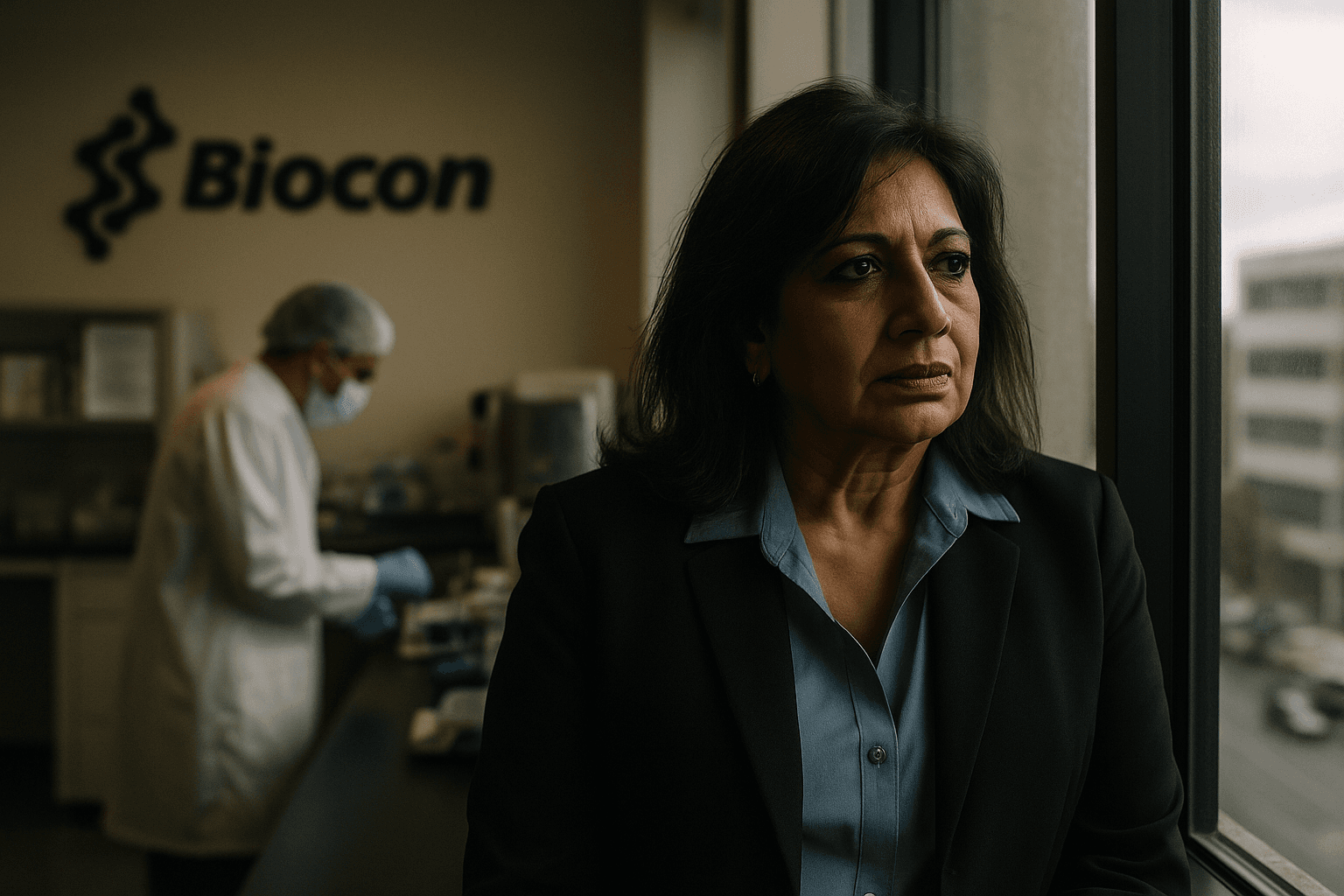

Biocon to Fold Biocon Biologics into Parent Company in $5.5 Billion Deal

Biocon said it would make its biosimilars arm Biocon Biologics a wholly owned subsidiary in a transaction that values the unit at about $5.5 billion, a move that tightens control over a fast growing segment of the firm. The deal includes a cash component to buy Viatris’s residual stake and contemplates raising up to ₹4,500 crore, about $500 million, through a qualified institutional placement, steps that aim to position Biocon for global competition in lower cost biologic therapies.

Biocon announced on December 6 that it would integrate Biocon Biologics as a wholly owned subsidiary, acquiring the remaining stakes held by outside shareholders including Serum Institute Life Sciences and others through a share swap that values Biocon Biologics at roughly $5.5 billion. The transaction also includes a cash element to purchase the residual stake held by Viatris and contemplates a qualified institutional placement to raise up to ₹4,500 crore, approximately $500 million. Biocon Biologics chief executive Shreehas Tambe is slated to become chief executive and managing director of the combined group. The deal is expected to close by the end of March next year.

The move consolidates Biocon’s biosimilars business as the company seeks greater operational control and strategic coherence across development, manufacturing and commercialisation. By folding the listed arm back into the parent, Biocon gains the ability to coordinate investment decisions more quickly, align pricing and market entry strategies, and internalise profits that previously flowed to minority shareholders. The share swap structure reduces the immediate cash burden of the acquisition, while the planned capital raise will provide liquidity to finalise the Viatris transaction and support near term growth initiatives.

Market and industry analysts noted that the consolidation comes at a moment of rising global demand for lower cost biologic therapies, driven by ageing populations, growing incidence of chronic diseases and pressure on healthcare budgets to contain costs. Reuters observed that the deal strengthens a leading Indian player in the biosimilars field, which has become a focal point for cost containment in advanced healthcare systems as originator biologics face patent expiries. For Biocon, scale matters. Larger combined manufacturing capacity and a unified pipeline can accelerate regulatory filings and broaden geographic reach into markets where payers are increasingly willing to substitute expensive branded biologics with lower cost alternatives.

The transaction also carries risks for investors and regulators. The planned qualified institutional placement will dilute existing public shareholders if fully subscribed, and the share swap will alter the ownership mix within the group. Regulatory approvals will be required in India and in jurisdictions where Biocon sells biosimilars, adding execution risk and potential timing delays before the full benefits of integration are realised.

Strategically, the deal underscores a longer term trend of consolidation in the biopharma sector, particularly among companies focused on biosimilars and biomanufacturing. For India’s pharmaceuticals industry, the transaction reinforces the country’s role as a cost competitive producer of biologics and could spur rival firms to pursue similar mergers or capital raises to capture scale advantages. With a closing target in March, stakeholders will be watching funding outcomes and regulatory milestones closely to assess how quickly the combined group can translate scale into market share and sustainable margin improvement.