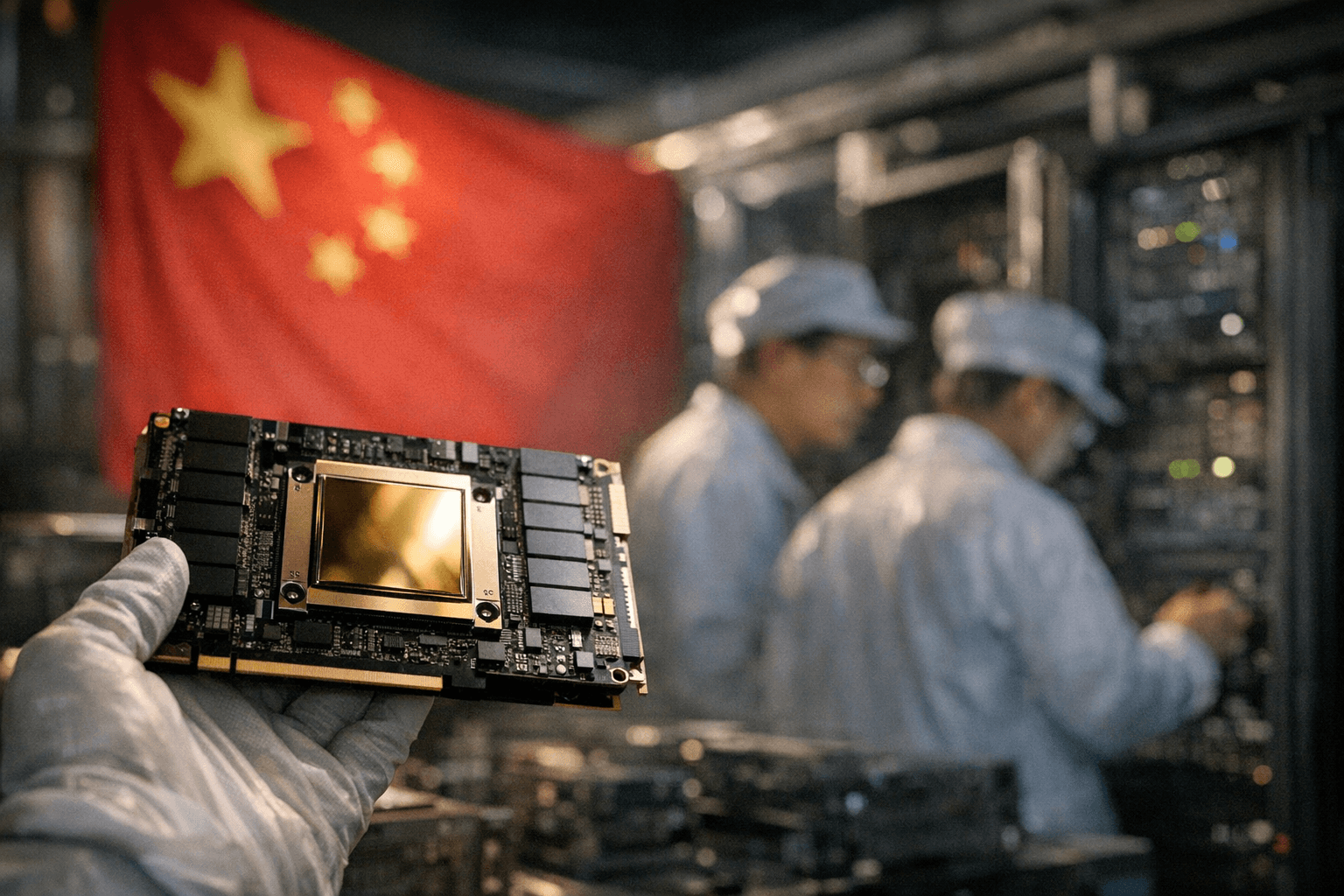

China Signals Limited Approval for Nvidia H200 AI Chip Imports

Chinese authorities are preparing to permit restricted imports of Nvidia’s high-end H200 AI accelerators as soon as this quarter, a move that could relieve immediate cloud and model-training demand while raising tough security and commercial questions. The approvals would be tightly limited, vendors have already tightened payment terms, and the outcome will shape global supply chains and China’s push to nurture domestic semiconductor capacity.

Chinese regulators are preparing to allow select commercial customers to import Nvidia’s H200 artificial intelligence accelerators, potentially as early as this quarter, according to people familiar with private deliberations. Any greenlight would come with strict limits on who may receive the chips and how they may be used, and vendors and buyers are already operating under precautionary commercial terms because formal regulatory permission has not been issued.

The emerging plan, as described by multiple participants in deliberations, would restrict approvals to a narrow subset of commercial firms. Some accounts circulating in industry circles have said the chips would be barred from military use, sensitive government agencies, critical infrastructure and state-owned enterprises, with requests from such entities reviewed on a case-by-case basis. Authorities have not publicly confirmed a formal banned list, and major questions remain about how usage restrictions would be enforced—whether through licensing, end-user certification, customs controls or post-delivery audits.

The commercial backdrop is fractious. Nvidia has reportedly insisted on full up-front payments for H200 orders destined for China, with no options for cancellation, refunds or configuration changes. Those terms are widely understood inside the industry as a hedge against sudden policy reversals or shipment denials. At the same time, Chinese demand has far outstripped available inventory: industry figures circulating privately indicate orders exceeding 2 million H200 units versus about 700,000 units that Nvidia has cited as on hand. Several large Chinese technology firms have privately signaled interest in ordering more than 200,000 units each, and an industry price of roughly $27,000 per H200 has been widely discussed.

The supply-chain ripple effects are significant. Nvidia has sought extra capacity from its main foundry partner, Taiwan Semiconductor Manufacturing Co., to meet demand. Chinese regulators have also reportedly asked some companies to pause new orders in order to shield domestic chip suppliers, underscoring Beijing’s dual objective of satisfying commercial AI demand while fostering local semiconductor development. Beijing has not publicly acknowledged any change in policy; its official posture remains focused on building domestic capability, and authorities are reportedly preparing an incentive program worth up to $70 billion to support that effort.

The international policy interplay adds further uncertainty. An industry LinkedIn post asserted a U.S. condition that the U.S. government would receive 25 percent of sales revenue for exports, a claim that has not been independently verified and requires confirmation from U.S. officials. How U.S. export controls, Chinese approvals and private commercial contracts will be reconciled is unclear and will determine where chips actually land, who pays, and how legal and security risks are managed.

For now, the situation illustrates a high-stakes balancing act: China seeks access to cutting-edge AI compute to remain competitive, while protecting national-security interests and nurturing an ambitious domestic chip industry. Market participants say the next weeks will be critical as formal licenses, enforcement mechanisms and commercial allocations begin to take shape.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip