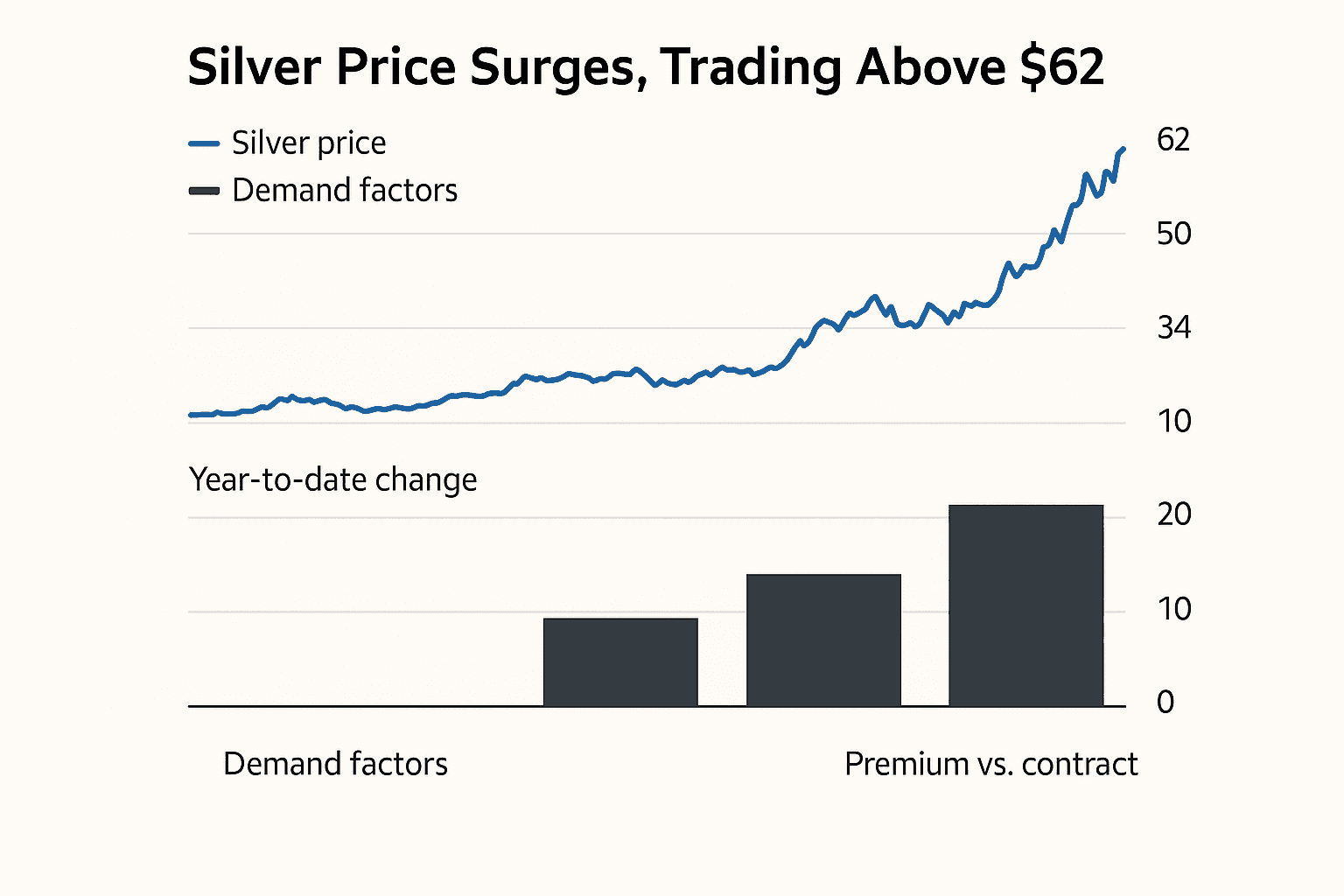

China silver fund manager warns retail investors as premiums surge

The manager of China’s only pure play silver fund is warning retail investors after silver more than doubled year to date and climbed above $62 an ounce, a rally that has pushed the fund to a record premium over Shanghai Futures Exchange contracts. The move raises concerns about elevated volatility, speculative participation and the potential for abrupt reversals that could ripple through futures markets and industrial users.

The manager of China’s sole pure play silver fund is issuing a rare public caution as silver prices have exploded higher, more than doubling year to date and briefly trading above $62 an ounce on December 11, 2025. Bloomberg via Moneycontrol reported that the fund was trading at a record premium to contracts on the Shanghai Futures Exchange, a gap that managers say reflects heavy retail demand and speculative positioning rather than underlying spot liquidity.

The rally has been driven by a confluence of factors. Short squeezes in futures markets tightened available metal and forced covering by short sellers, compressing inventory and lifting prices. Rising industrial demand has added structural support, with silver used extensively in solar panels, electronics and other clean energy applications. The metal has also benefited from spillover inflows from gold as investors seeking protection and yield alternatives broaden their exposure to precious metals.

Market participants say the combination of rapid gains and a large retail presence creates elevated volatility. A significant premium between fund shares and Shanghai futures can signal an imbalance where paper claims on metal outstrip deliverable supplies. That makes the market vulnerable to sharp reversals if buying momentum fades or if leveraged positions are unwound, which would amplify price moves through margin calls and forced liquidations.

The backdrop has implications beyond traders and speculators. Manufacturers dependent on silver for industrial production face higher input costs when prices spike. Conversely, sustained high prices typically prompt higher recycling rates and incentivize mining investment, but new mined supply comes with long lead times. For investors, silver’s dual role as an industrial commodity and a monetary metal means returns can be more volatile than those of gold or base metals.

From a market structure perspective, the record premium raises questions about the interaction between retail demand, exchange settlement mechanisms and fund management practices. Funds trading at large premiums may be forced to alter subscription and redemption terms, or to increase inventories to anchor net asset value, each of which can affect liquidity and investor outcomes. Regulators in China have in the past reacted to rapid, credit fueled rallies in speculative assets, and the current episode is likely to attract scrutiny given the retail concentration.

The warning from the fund manager underscores a broader lesson for investors: rapid past performance does not guarantee future returns and high concentration of retail participation can exacerbate downdrafts. For policymakers and market operators, the episode highlights the need to ensure that derivative markets and physical delivery systems are resilient to surges in demand. Over the longer term, structural drivers such as growing demand from clean energy technologies and shifts in recycling and mining investment will shape silver’s supply and demand balance, but those dynamics will play out against the nearer term risk of episodic speculative swings.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip