China’s Q3 Growth Slows to 4.8% as Outlook Signals Slower Momentum

China's third-quarter GDP rose 4.8% year-on-year, matching Reuters poll forecasts but leaving the economy on track to miss Beijing's "around 5%" annual goal. Analysts forecast full-year growth of 4.8% and further deceleration to 4.3% in 2026, raising questions about the balance of policy support and external trade frictions.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

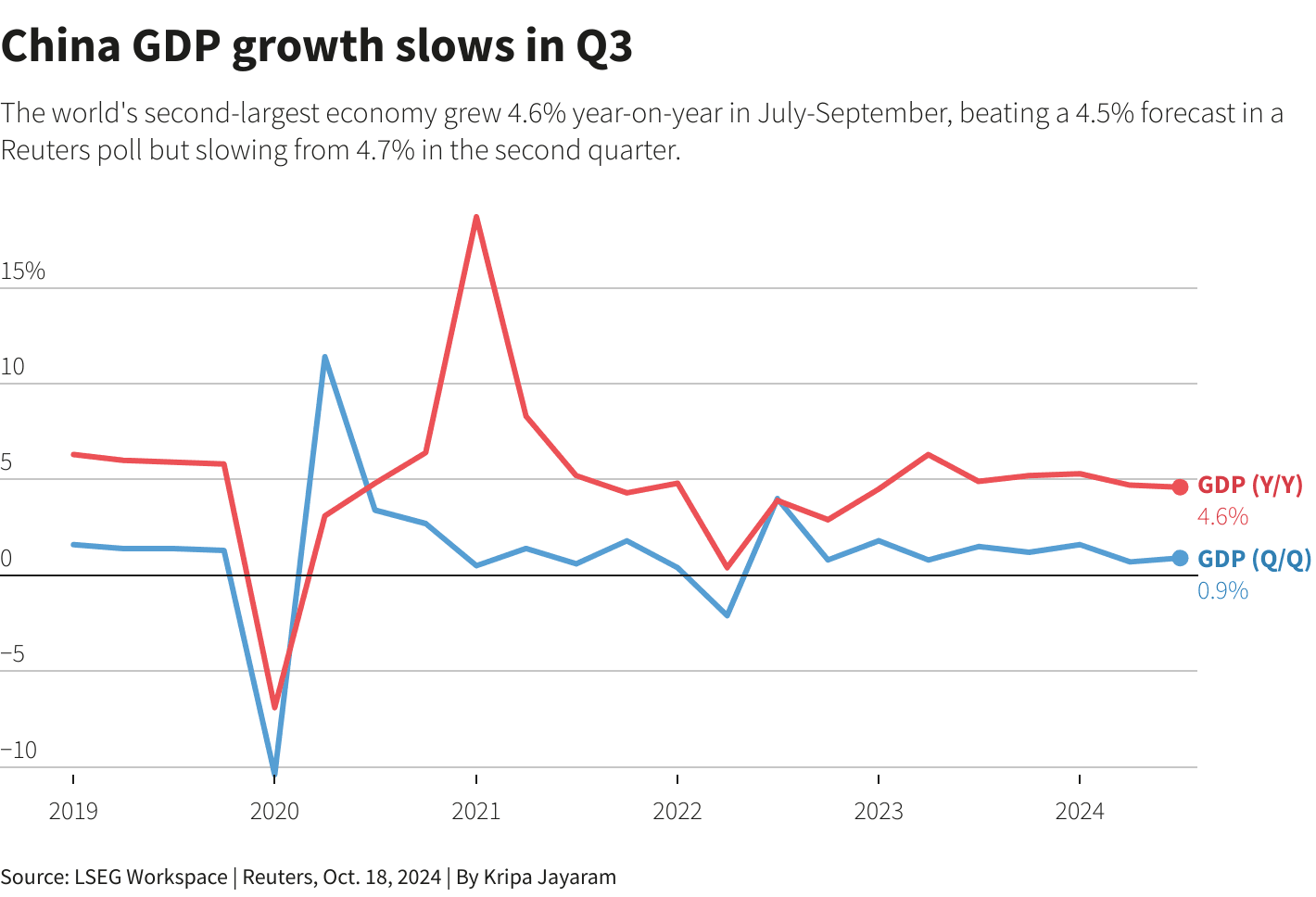

China’s economy expanded 4.8% year-on-year in the third quarter, a pace that Reuters analysts called a slowdown consistent with market expectations and with a Reuters poll projecting 4.8% full-year growth. That poll put the country below Beijing’s official goal of "around 5%" for 2025 and suggested activity will cool to 4.3% in 2026, underscoring a gradual moderation after the post-pandemic rebound.

The figures describe an economy that is growing solidly by global standards but not fast enough to satisfy official targets or to erase longer-term headwinds. Slower population growth, a protracted property-sector correction and uneven consumer demand have combined to reduce the upside in headline GDP, leaving policymakers with less room for big stimulus interventions without risking financial imbalances.

Market commentary in the Reuters coverage underscored those trade-offs. "It is likely that Beijing will meet its growth target for 2025 of 'around 5%'. The impressive growth record year-to-date suggests little need for more fiscal stimulus at this juncture and Beijing would probably take a hard-line stance in pressing the U.S. to roll back its technology curbs in any potential trade deal. As the Fourth Plenum is underway, we expect USD/CNY to stay in a tight range as the People's Bank of China (PBOC) ensures volatility is kept at a minimum during these big [...]"

That view captures a central balancing act for Chinese authorities: with growth close to the official target, the government may opt to conserve fiscal ammunition and rely more on administrative measures and measured monetary management to steady markets. The People's Bank of China’s inclination to limit currency swings, particularly amid high-stakes political gatherings such as the Fourth Plenum, points to an emphasis on stability rather than aggressive stimulus.

For investors and regional markets, the message is one of contained but slowing expansion. A forecasted slide to 4.3% in 2026 signals a longer-term transition toward lower trend growth that could weigh on corporate earnings, demand for imports and capital expenditure. That trajectory also influences Beijing’s negotiating posture on trade and technology disputes: with less immediate need for domestic demand boosts, officials may press harder on external concessions in areas like technology access and restrictions.

Policymakers face a narrow set of options. Large-scale fiscal packages risk reigniting imbalances the last decade has already exposed, while minor targeted measures may be insufficient to materially lift trend growth. Structural reforms — improving productivity, and restoring confidence in the property market and household balance sheets — remain essential but politically and economically complex to execute quickly.

The Reuters poll findings and the Q3 print together suggest China will continue to register robust absolute growth while adjusting to a slower trajectory. That dynamic matters for global markets and trading partners: even a modest deceleration in the world’s second-largest economy can reverberate through commodity markets, multinational earnings and regional capital flows as Beijing calibrates policy to safeguard both growth and financial stability.

Reporting by Reuters Asia bureaus; Compiled and edited by Subhranshu Sahu.