EU Climate Agency Says 2025 Likely Among Hottest Years Ever

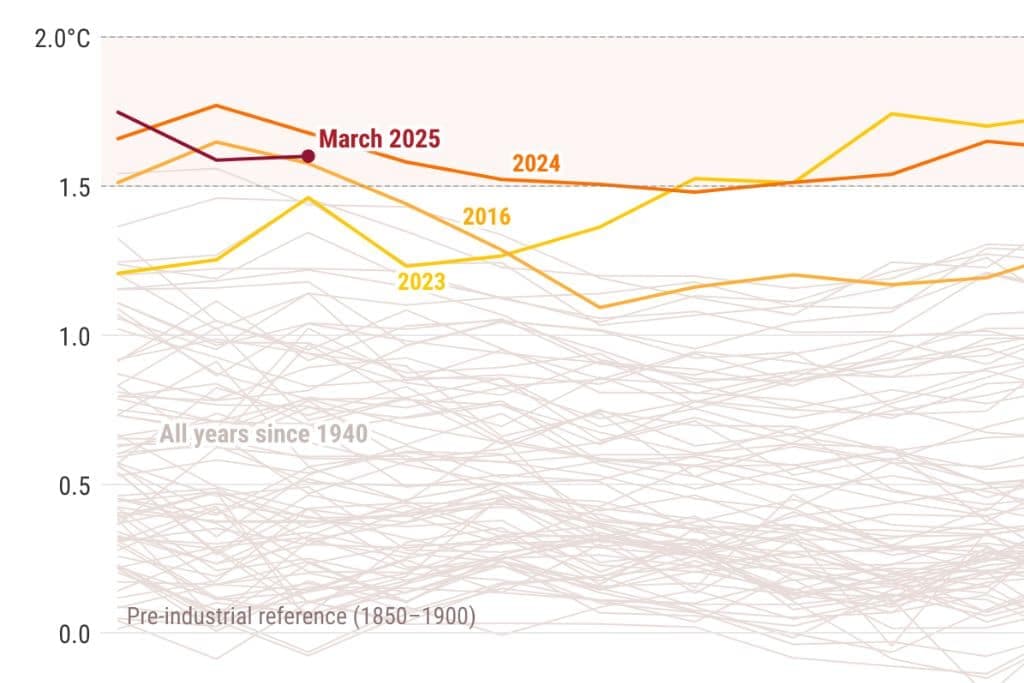

The EU Copernicus Climate Change Service said on December 9 that 2025 will likely rank as the world s second or third warmest year on record, and that a three year period including 2025 may be the first to exceed 1.5 degrees Celsius above the pre industrial baseline. That assessment sharpens the economic stakes for energy, food and insurance markets, and increases pressure on policymakers to accelerate emissions cuts and climate adaptation spending.

The EU s Copernicus Climate Change Service said on Tuesday that 2025 is likely to be the second or third warmest year on record, potentially only behind 2024, and that the three year span now unfolding could mark the first time the global average temperature for a three year period exceeds 1.5 degrees Celsius above the pre industrial baseline of 1850 to 1900. The monthly bulletin highlighted persistent extreme heat across many regions, along with drought and other climate signals that carry direct economic consequences.

Copernicus, which compiles satellite and surface observations to produce global climate statistics, said continued warmth through the year has reinforced long term trends in human driven warming. Scientists and policymakers view the 1.5 degree threshold as a symbolic and practical benchmark because it is enshrined in the Paris Agreement as a limit for avoiding the most severe impacts. Exceeding that benchmark for a sustained multi year interval would mark a new level of climate volatility even if longer term averages remain below the ceiling.

The immediate economic effects are already visible. Higher temperatures raise cooling demand and strain electricity grids during summer peaks, tightening wholesale power markets and elevating prices in regions that rely on thermal generation. Agricultural outputs face mounting risk from heat stress and water shortages, translating into higher food price volatility and increased import bills for vulnerable countries. Insurers and reinsurance firms are recalibrating risk models as the frequency of extreme heat and drought events rises, which can push up premiums and shrink coverage in high risk areas.

Financial markets are responding to rising physical and transition risks. Investors have stepped up allocations to renewable energy and grid resilience projects, while carbon pricing and corporate climate disclosure developments inform asset valuations. At the same time, sectors with heavy exposure to fossil fuel assets confront greater potential for stranded investments if policy tightening accelerates. Governments face a twofold fiscal challenge, needing to reduce emissions while also funding adaptation measures that protect infrastructure, health systems and supply chains.

The Copernicus bulletin comes amid international climate discussions that have struggled to close the gap between current emissions trajectories and the ambition of the Paris goals. Emission trends this decade have not fallen at the pace required to keep warming well below 2 degrees Celsius, and the bulletin s findings are likely to feature prominently in talks over next year s carbon reduction commitments and finance for adaptation.

Longer term, the bulletin reinforces a pattern seen across multiple climate data sets, where each successive decade records higher mean temperatures and more pronounced extremes. For policymakers and markets, the message is that temperature spikes once viewed as anomalies are now part of a new baseline, increasing the urgency of investment in mitigation and adaptation to limit economic disruption and protect livelihoods.