European shares reach records as utilities and health care lead

European equities hit record highs as utilities and health care rally ahead of U.S. inflation data, signaling markets are pricing a possible shift in rate and growth expectations.

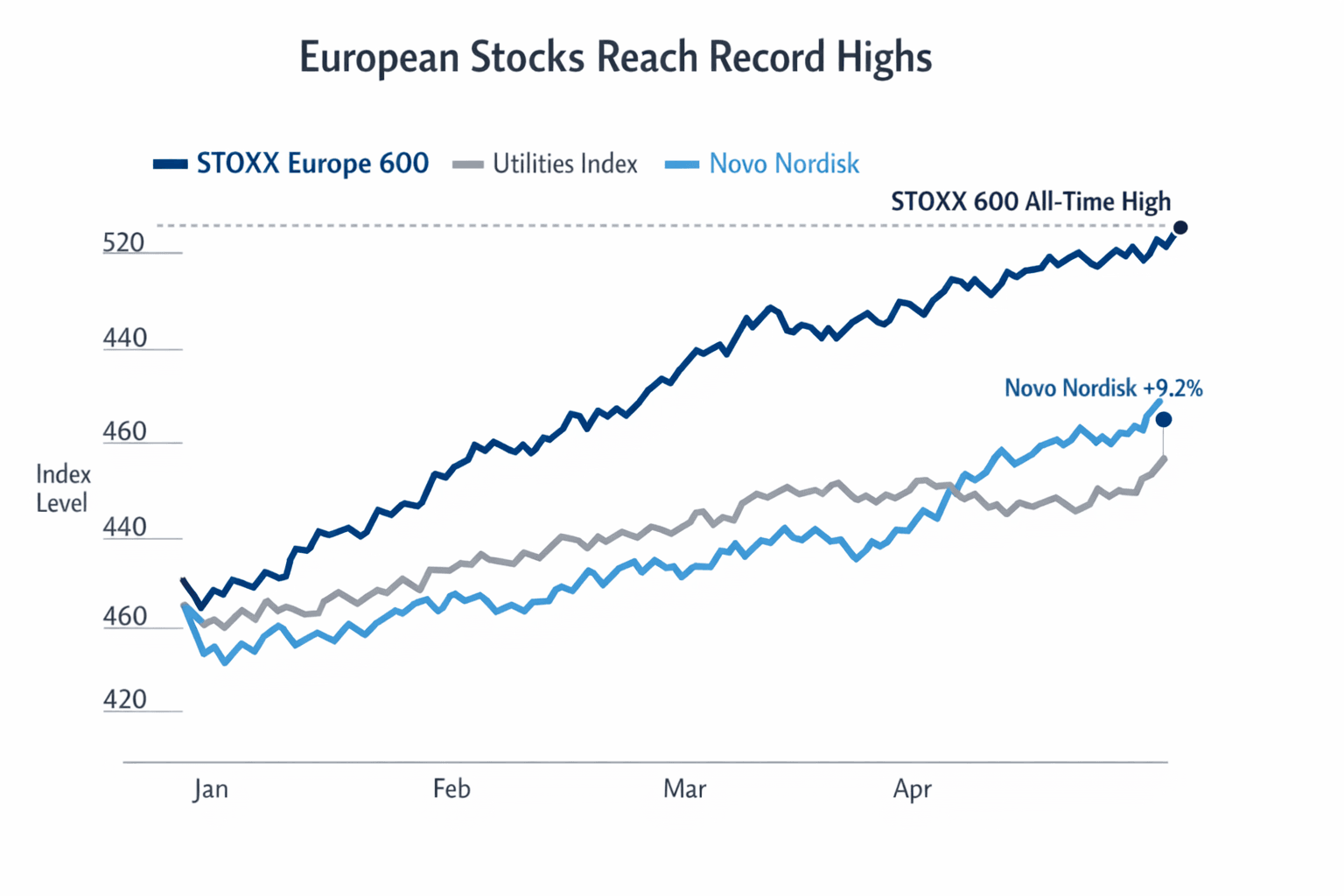

European equities are hitting fresh record highs as gains in defensive sectors such as utilities and health care offset weakness among economy-sensitive names ahead of a key U.S. inflation print. The broad STOXX Europe 600 is trading at all-time highs and is on course for one of its strongest quarters in two years, extending a rally that has pushed regional markets toward a third consecutive year of gains.

The utilities index (.SX6P) rose about 1% and ended a two-day losing streak after energy firms RWE (RWEG.DE) and SSE (SSE.L) were among developers that won guaranteed electricity price contracts in Britain’s latest offshore wind auction. The auction secured a record amount of capacity, lifting sentiment toward power and renewable developers and underpinning the sector’s advance.

Health care was another notable driver. Novo Nordisk jumped 9.2% after the company said it will start selling a pill version of its blockbuster GLP-1 weight-loss drug in the United States in early January. The company’s commercial update and prior indications of U.S. approval for a pill version of Wegovy provided a direct boost to the health-care component of the market and helped lift broader sector sentiment.

Miners, telecoms and banks also outperformed defensive peers, while more cyclical, economy-linked stocks lagged. Travel and leisure companies and automakers were among the biggest underperformers, reflecting investor caution about demand-sensitive sectors even as indices climb to new highs.

Corporate news flow added to selective rallies and rotations. The U.K. offshore wind auction results provided a clear sector-specific catalyst for utilities, while Novo Nordisk’s commercial announcement tightened focus on health-care earnings prospects and product cycles. At the same time investors are parsing corporate governance and policy issues; banking executives are expected to comment publicly on a proposed year-long cap on credit card interest rates, a measure that banks warn could have knock-on effects for lending and consumer costs, and JPMorgan executives have said such a cap would hurt consumers.

Market participants are positioning ahead of U.S. consumer price data, which traders see as potentially market-moving for global rate expectations and equity valuations. A stronger-than-expected inflation print in the United States could prompt a reassessment of interest-rate trajectories and weigh on valuation multiples that have helped propel the STOXX 600 to record levels. Geopolitical and legal risks, including the prospect of a U.S. Supreme Court ruling on the legality of President Donald Trump’s tariffs, are further items on investors’ watch lists.

Asset managers point to a cautiously constructive longer-term picture. Alberto Tocchio, a portfolio manager at Kairos Partners, said the outlook for European stocks in 2026 "appears more constructive." The defensive tilt of the rally suggests investors are balancing optimism about lower borrowing costs and steady growth against the possibility of policy or macro shocks, leaving sector leadership—and the next inflation prints—to determine whether the advance broadens or narrows.

Know something we missed? Have a correction or additional information?

Submit a Tip