Former Helena West Helena Mayor Arrested, Faces New Tax Evasion Charges

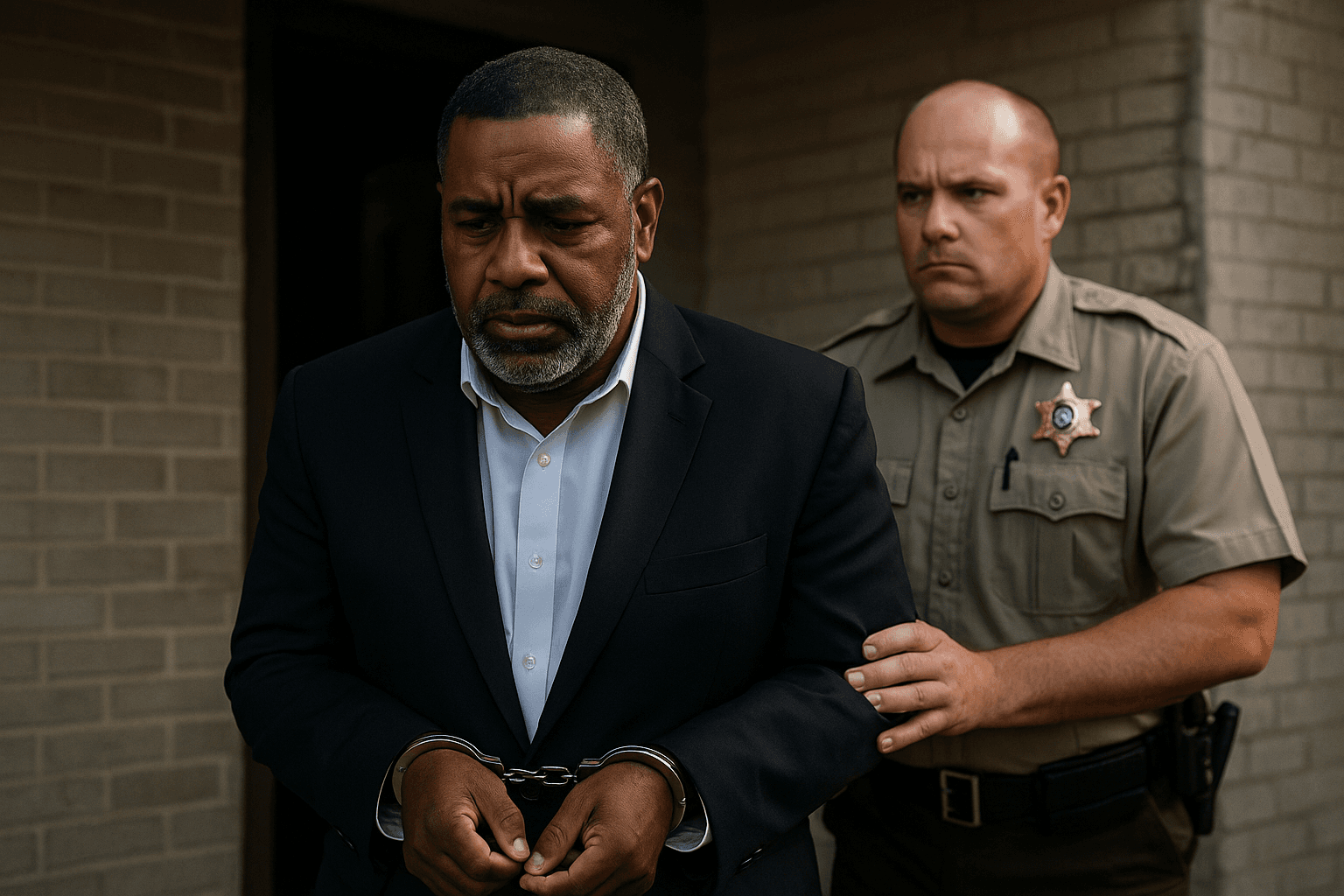

Former Helena West Helena Mayor Christopher Franklin Sr. surrendered to Phillips County authorities after an arrest warrant was obtained for failure to file income taxes, deepening a yearlong probe into his state tax filings. The developments may affect local confidence in municipal governance and will return to court on January 5, 2026.

Arkansas State Police obtained an arrest warrant on December 2, 2025 for former Helena West Helena Mayor Christopher Franklin Sr., 44, charging him with felony Attempt to Evade and Defeat Tax following an investigation by the agency's Special Investigations Unit. Franklin surrendered to the Phillips County Sheriff’s Office on December 5, 2025, was booked on the new charge, and was released on his own recognizance with a court date of January 5, 2026.

The new charge follows Franklin’s earlier arrest on June 24, 2025 when the Special Investigations Unit charged him with four felony counts for Failing to Pay or File a State Tax Return. The investigation began in June of 2024 at the request of First Judicial District Prosecutor Todd Murray after concerns were raised about Franklin’s tax filings. SIU investigators determined that Franklin had not filed state tax returns for four of the past five years.

A second individual, identified as 29 year old Josiah Walker, was also charged by the SIU with felony Attempt to Evade or Defeat Tax. Walker surrendered to the Phillips County Sheriff’s Office on December 10, 2025 to have a warrant served, was processed and released on his own recognizance, and has the same January 5, 2026 court date.

For Phillips County residents the case raises questions about oversight, record keeping, and the integrity of local government finances. Tax compliance by public officials is a matter of public trust, and prosecutions of this kind can trigger additional audits or administrative reviews of municipal records. The legal proceedings will determine whether prosecutors can prove the allegations, and both defendants enter the court process presumed innocent until proven otherwise.

Beyond the local legal consequences, the situation reflects a wider pattern in which state authorities increase scrutiny of public officials to safeguard public funds and maintain confidence in governance. Residents seeking information about the court schedule or case status can follow official Phillips County court postings and announcements as the January 5, 2026 hearing approaches.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip